When exploring any new field, it is important to first cover the basic concepts. Trading is no exception. One of the biggest mistakes novice traders can make is skipping this step and plunging right into the action. So let us go over the main terms to make sure you are ready to set out on your trading journey.

Ask and Bid prices

An Ask is a price someone is ready to accept for an asset he or she is selling. A bid is a price that someone is ready to pay for an asset. These prices may change frequently, as new trades are made on the market. The Bid price is almost always lower than the Ask. By looking at these figures, traders can monitor the demand and supply levels for an asset.

The average price of an asset on the IQ Option Platform is calculated using the formula (Ask+Bid)/2. This is the price traders may see on the charts in the traderoom.

Binary and Digital Options

One of the most popular trading instruments is binary options. This tool enables you to predict the direction of an asset’s value — whether it will increase or decrease within a specified expiration period. If your prediction is accurate, you earn a profit based on the predetermined profitability at the entry point. If your prediction is incorrect, you lose the amount invested.

Similar to binary options, digital options operate on a “yes or no” principle. If your prediction about the asset’s price direction is correct, you gain a profit; if it is wrong, you incur a loss. However, digital trading includes a unique element: the strike price.

The strike price is the value that the trader predicts the asset will reach by the expiration time. If the asset hits the strike price, the trade is profitable. If it does not, the trade is out of the money.

Digital options offer potential profitability of up to 900%, making them quite thrilling. They not only allow you to predict the direction of the price change but also estimate the extent of the price movement.

CFDs

Contract for Difference (CFD) refers to a financial agreement that pays the price difference between the open and closing trades. Traders try to predict whether the price will go up or down without purchasing the asset itself. Their outcome depends on the difference between the opening and closing prices.

IQ Option offers CFD trading with a variety of instruments: Forex, Stocks, Cryptocurrencies, Commodities and ETFs.

Margin

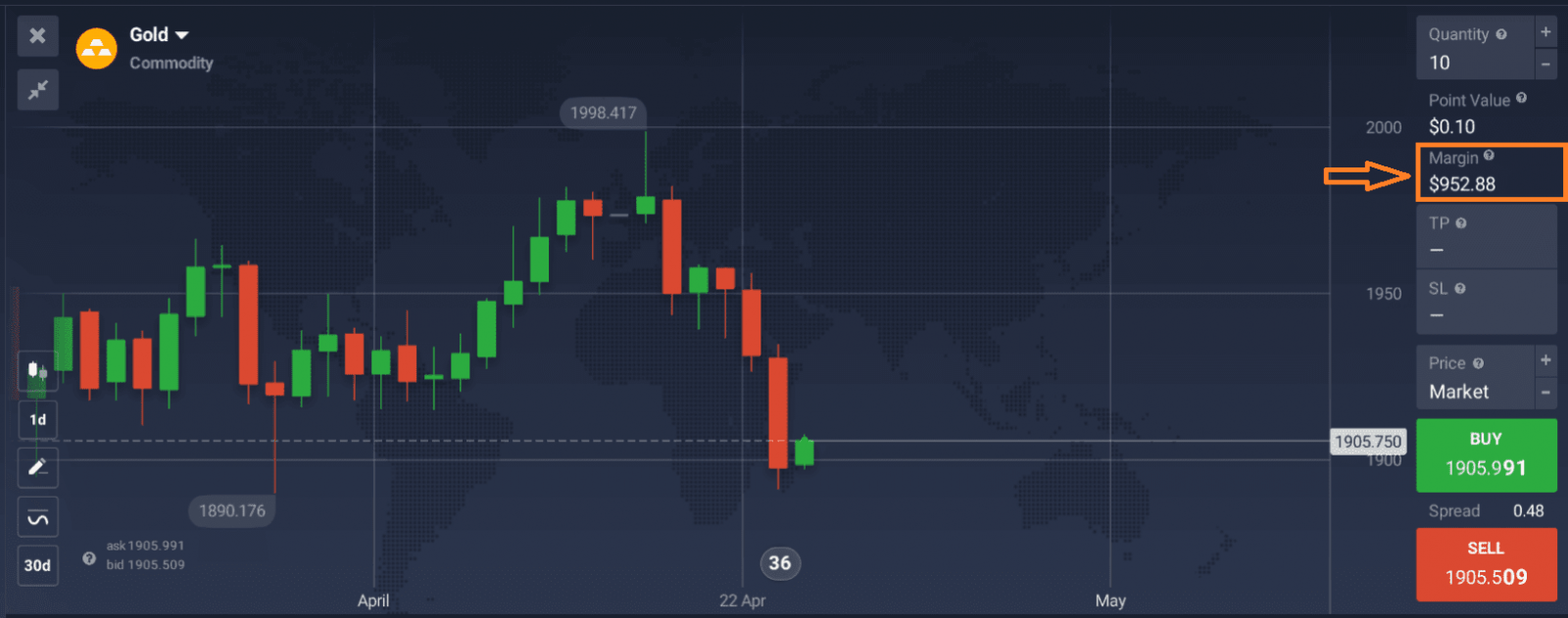

Margin trading involves borrowing money from the broker. By doing so, traders may be able to make larger trades, which might increase their outcome. But the risks increase as well: if a trade was unsuccessful, the losses would be bigger than just the initial deposit.

A Margin itself is the collateral – a certain amount of money that is deposited with the broker before the trade. It ensures that the trader has enough money to manage potential losses. The exact amount required for a trade is indicated in the traderoom beforehand, so it is important to consider the risks before entering any deal.

This method might seem complicated for novice traders, as it requires careful consideration of the risks involved. To get more practical information on margin trading, take a look at this article with examples referring to Forex trading: Margin Trading: How Does It Work.

Pip

This is an important concept of the Forex market: it reflects the shifts in value between currencies. Pip stands for “percentage in point” and refers to the smallest change in value in a currency pair. In most cases, a pip is 1/100th of one percent, or the fourth decimal place – 0.0001.

The success of Forex trades depends on the price movements of currency pairs. For example, when a trader buys the EUR/GBP pair, he or she might make a profit if the value of the Euro increases relative to the British pound. Imagine that you bought 1 lot of EUR/GBP for 0.84081 and then sold it for 0.84100. The profit would be 1.9 pips, the amount is then automatically converted into the currency of the trader’s account.

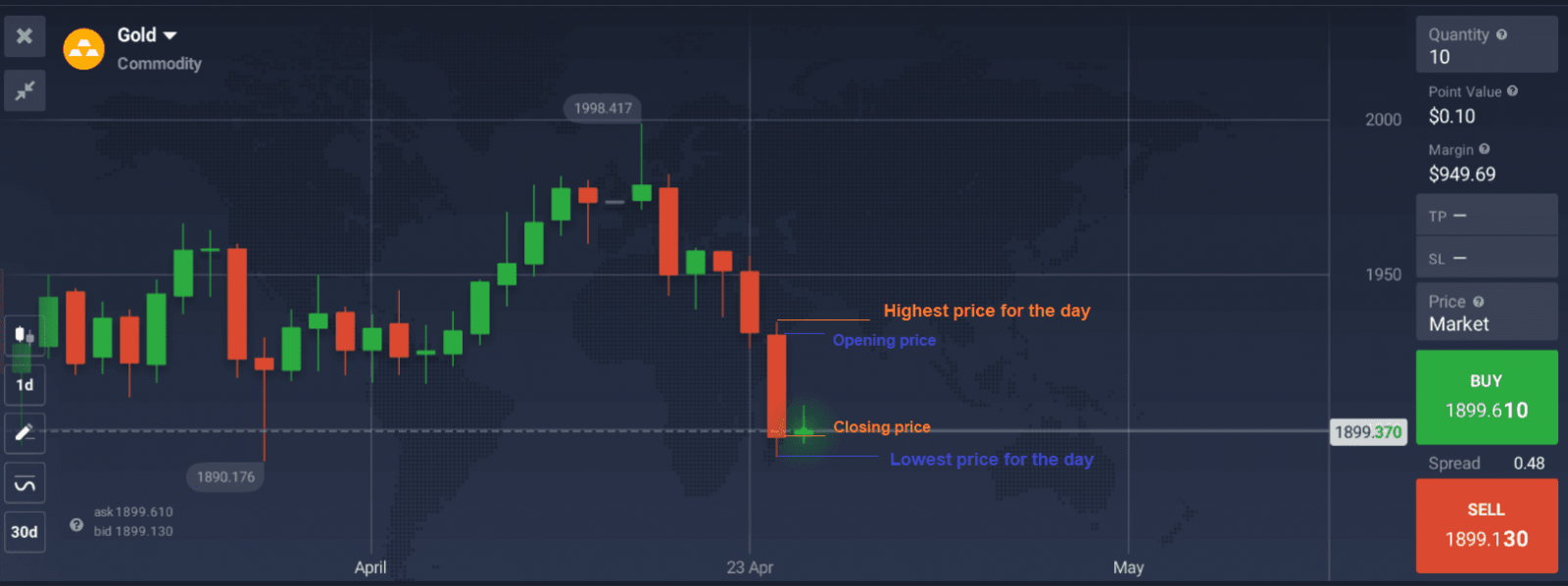

Candlestick chart

There are a variety of charts available in the IQ Option traderoom, so you may try out different ones for technical analysis. The main advantage of the candlestick chart is that it allows you to see the difference between opening and closing prices. If a candle is green, it means that the opening price was lower than the closing one, if red – higher.

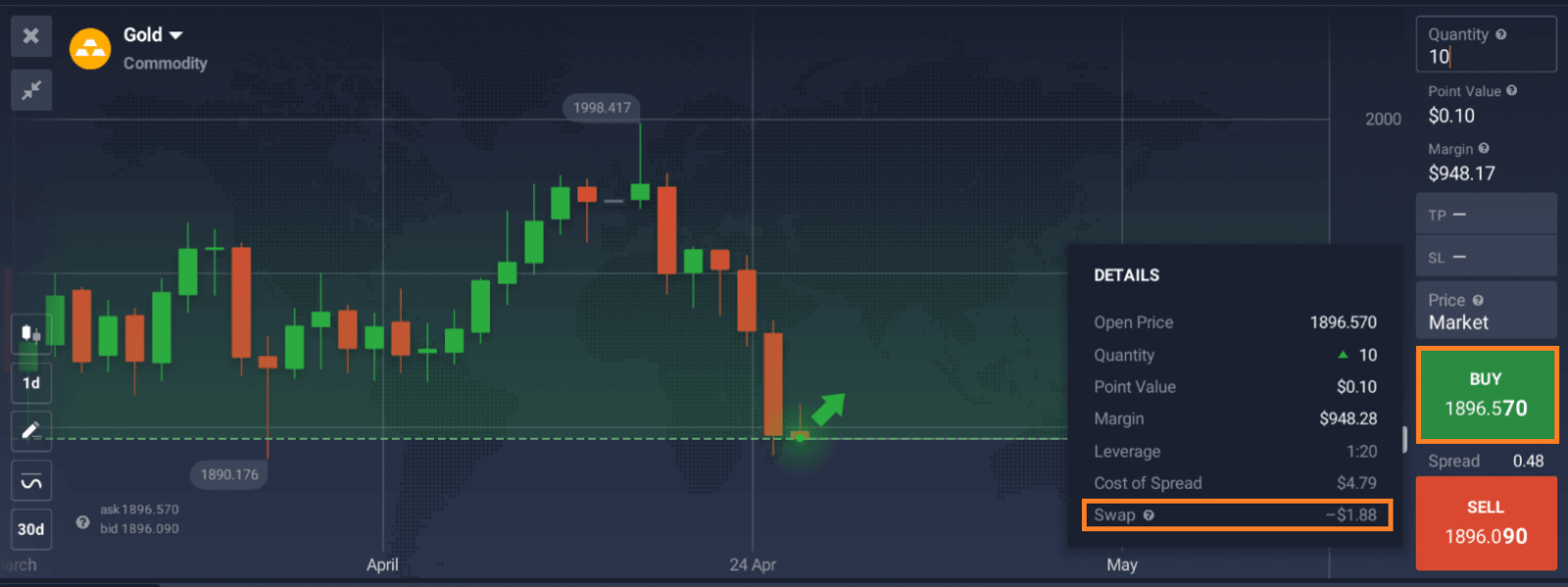

Swap

Swap refers to an overnight charge for open positions. It can be either credited to or debited from the trader’s account depending on the trading conditions of a particular asset. The swap is indicated in the traderoom, so take it into account before making a trade.

Technical Indicators

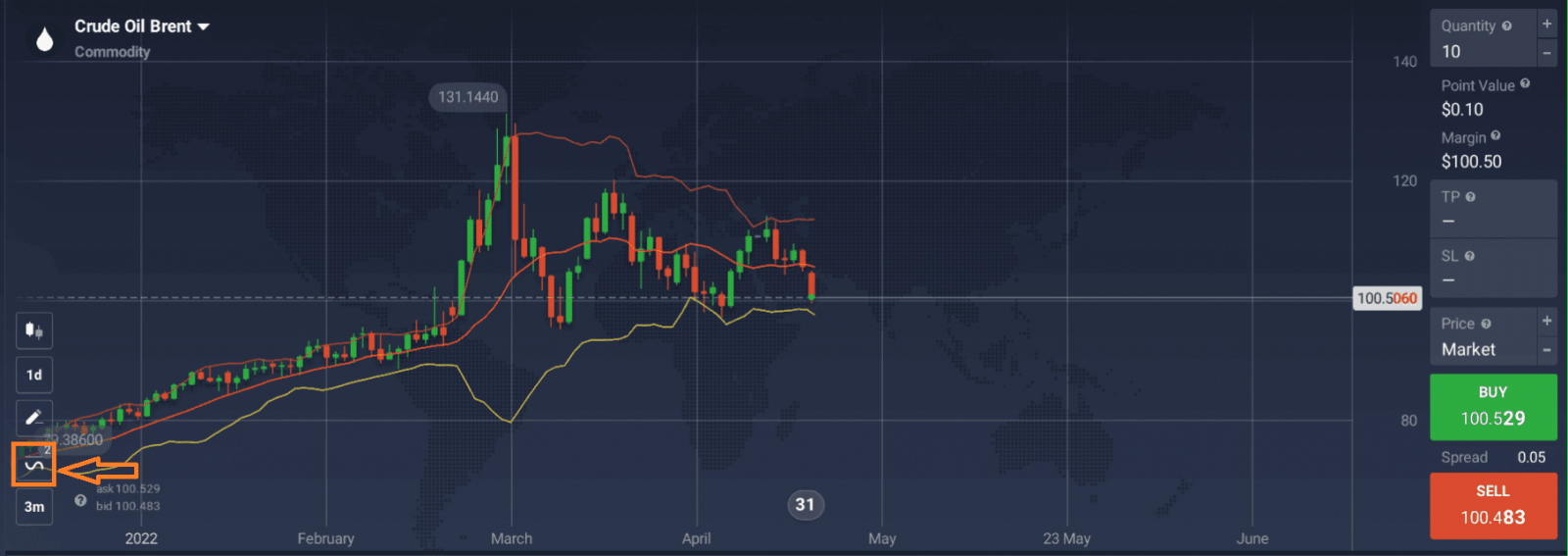

Indicators are tools, commonly used for the technical analysis of assets. They usually show patterns in price fluctuations, which might provide ideas on future price changes. Traders use these patterns to look for potential deals, but making the right decisions often requires practice and experience. So take time analyzing these indicators and make sure you understand the risks before entering any trades.

Different indicators can be applied in the traderoom. Some of the most common are the Relative Strength Index (RSI), Bollinger Bands, and Moving Average. To learn more about them, read our articles with step-by-step guides on their application: How to Choose Indicator Settings and 5 Most Popular Indicators Explained in 5 Minutes. These indicators may be used separately or in combination to achieve the best results.

These are just some trading basics for novice traders to understand before venturing into the market. You might soon need to go deeper and do more research to make good trades. But having a grasp of the most basic concepts is necessary at the beginning: it might give you the confidence to make the first steps and avoid mistakes that are common for novice traders. To learn more about potential errors that may be awaiting on the trading path, check out this article: 3 Top Trading Mistakes Novice Traders Make.

You can also test your trading skills and gain experience by using the Practice Account on the IQ Option platform. It allows novice traders to get acquainted with the trading basics and get some practice before making real trades.