Traders who don’t shy away from fundamental analysis know that IQ Option provides an economic calendar, which is available directly on the website. The economic calendar reflects events of major importance in the financial world, which may affect certain assets and cause movements in their price. How to read the economic calendar and make sense of the numerous events, which often have complicated descriptions?

The truth is, understanding the economic calendar may substantially enhance many traders’ technique. However, the calendar might seem quite complicated at the first glance. Here is a thorough explanation of what exactly the economic calendar events mean.

How to read the economic calendar?

Firstly, let’s look at the structure of the economic calendar to know what information is at our disposal. For this, let’s break the economic calendar page into several parts and look at each of them individually.

Filters: type, date, impact and more

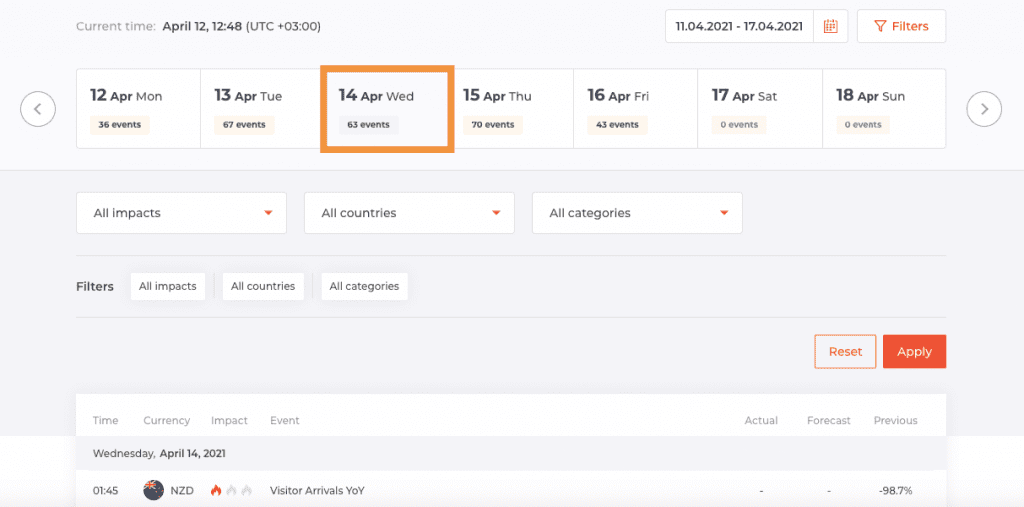

The first part of the calendar is the settings which allow you to adjust the calendar to your personal needs. Here you can choose, whether you wish to check the economic news, for instance, reports on unemployment, budget statements and inflation rates or whether you are interested in earnings reports for certain companies. If it is the latter, you can switch to the “Earnings” tab.

Another setting you can change is the date — check the current, previous or next week or even month, depending on what you are interested in.

By clicking on the “Filters” button, you will be able to expand the menu and choose specific countries, choose the categories of the economic events and filter them by importance (“low”, “medium” and “high” impact).

To view events for a certain day, simply click on the date and scroll down. For instance, let’s have a look at the events of Wednesday, April 14th.

Events & forecasts

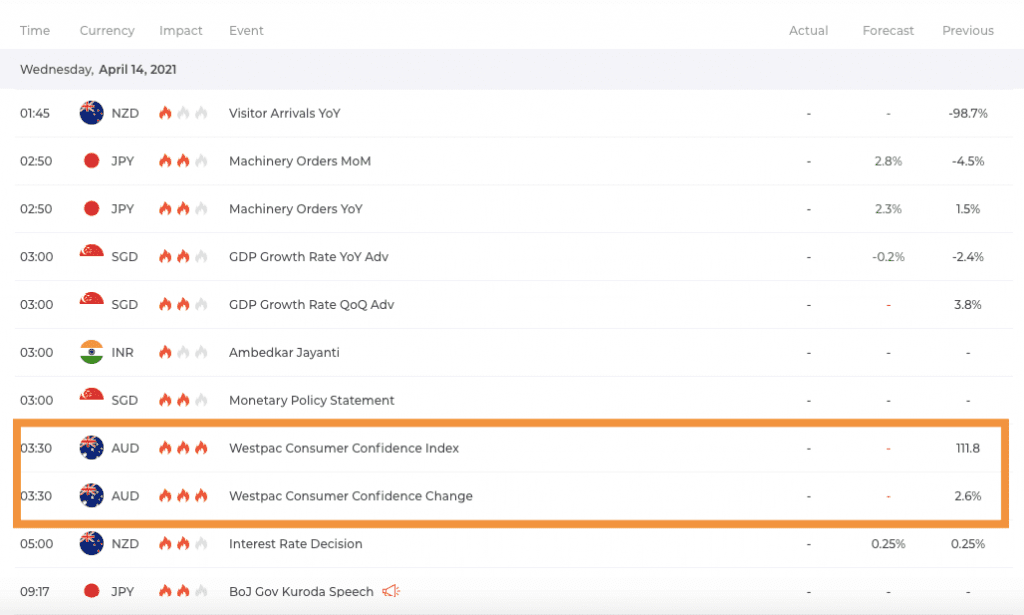

After choosing Wednesday, April 14th in the schedule, we are presented with a calendar of economic events which take place on this particular date. The list may show different types of events that are expected to influence the market. It may be a report on unemployment, a budget statement as it was mentioned before, or even a political speech of high importance.

As was described, it is possible to filter the events according to the country, category or impact. In the list below we can see two events of the highest impact, which are marked with the corresponding sign of three fire emojis. Impact reflects the degree in which the event might increase the volatility of the market for the specified assets.

Each event shows its time, the currency that it is expected to affect, the impact degree, its name and three result columns: actual, forecast, previous. These three columns show us the change in the asset price.

“Forecast” shows the expected result for the particular piece of news (for example, the interest rate percentage change). “Previous” shows the previously issued result for the particular piece of news. “Actual” shows the result, once the news has been released.

How to understand economic news?

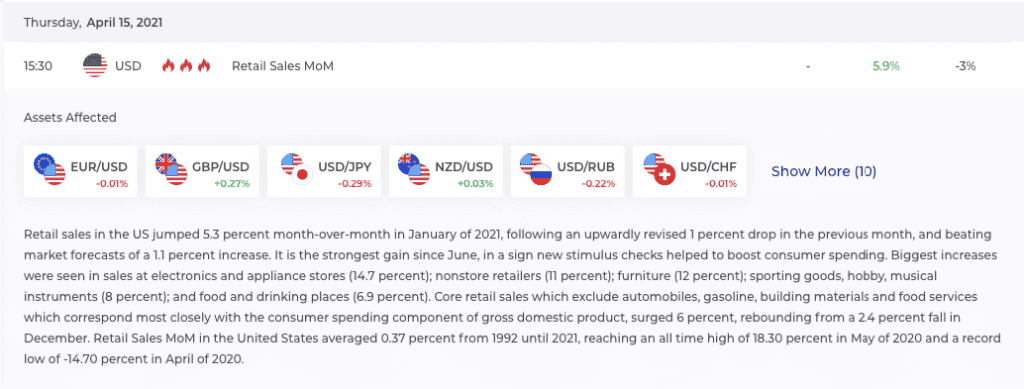

An example of one news might help explain the mechanics of working with the economic calendar. Let’s focus on a high impact news scheduled for Thursday, April 15 — Retail Sales MoM. To understand how it might affect the market, let’s look at the details below.

When you click on a news, you can find detailed information regarding the assets it might affect. In this case, it includes Forex pairs with USD. Retail Sales MoM is an indicator of consumer spending, which defines the majority of the general economic activity in the United States.

As you can see, the forecasted value is 5.9% while the previous is -3%. How to understand this information?

A higher than expected result (over 5.9%) might be a prerequisite for a bullish trend for the USD, while a lower than forecasted reading might result in a negative (bearish) trend for the USD.

This does not mean that the news will affect the asset in the exact described way. Certain news may have less impact and not reflect on the market movement as much as the higher impact ones. However, in general following the economic calendar is important and might be highly useful for traders that want to catch the moments of increased volatility and understand whether a bullish or bearish movement is expected.

Introducing the economic calendar to your trading approach

To start using the economic calendar, first, decide on the trading approach you will be exercising.

- If you are trading Forex, you may pick the currency pairs you are most interested in and find the time intervals when you are ready to give your full attention to trading.

- In case you prefer trading stocks, you may pay attention to the “Earnings” tab.

- Find the news that will potentially have an impact on the trading asset of your choice. Compare the previous result with the forecast and decide on your strategy accordingly.

- You may also consider keeping a trading journal to record your trades and track your results.

- Combine your trading with money management tools in order to possibly reduce the risks associated with trading.

- Always keep in mind that past performance is not an indicator of future performance.