Blockchain technology nowadays comes up in the articles of financial newspapers and magazines regularly. The world of the decentralized financial system (cryptocurrency) is frequently bombarded with the news of a new crypto coin or about the rocket high market cap of these digital currencies.

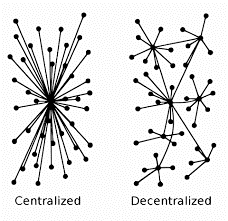

Blockchain technology basically is the platform that allows the cryptocurrency software developers to create shared digital databases of entries. Coming back to the concept of decentralization, today it has become extremely rare to find an organization which is completely centralized.

Decentralization, in fact, involves a systematic allocation of power at all levels of management throughout the organization. Thus, the distribution of the decision making power reduces the burden on the higher positions in the management.

Some obvious advantages of decentralization are as follows:

- Decentralization of a financial institution allows the employees to take some decisions on behalf of their company.

- It is a great opportunity to hone their skills by contributing to the organization.

- The company can take on diverse projects at the same time and can give the same emphasis to the projects.

- Delegation of authority to the regional units to a certain extent ensures that quality, price, novelty and execution—all are handled equally.

- Last but not the least is the effective decision-making process.

Worldwide application of the decentralised blockchain technology

“The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value.” – Don & Alex Tapscott: Blockchain Revolution.

The peer-to-peer system permits the participants to log into the system of records. This has had an immense effect on the banking sector. The shared ledger will provide accordance and provenance around the transfer of assets within the company, reducing project costs and execution time in the process. Although blockchain is still in its cradle, the technology has initiated a large number of projects in the financial sector.

According to a study by IBM, one-third of C-level executives are in the process of incorporating blockchain technology in their organizations. They believe that in the future, a secure system will be developed with the help of this technology which will not only strengthen the company but also establish trust.

- Deutsche Bank

Deutsche Bank is currently experimenting with blockchain technology regarding the transactions of money. Instead of settlements being done in fiat currencies, be it through physical contact or internet banking, they would be transferred through the blockchain platform. The developers are exploring these issues in the labs of Berlin, London and Silicon Valley. - Nasdaq

Blockchain technology is already playing a pivotal role in the zone of cryptocurrency and trading. Nasdaq is determined to improve the Nasdaq Private Market Platform with the help of this peer-to-peer system. The digital ledger technology called the Nasdaq Line enhances the process of cataloguing, issuance and recording of the shares of their clients. The technology harmonizes with Exact Equity, a cloud-based stock plan administration solution. Their clients can easily check the records as everything is laid out on a transparent platform which also offers increased audibility. - DBS Bank

The DBS Bank went a step ahead by organizing the first blockchain Hackathon of Singapore in 2015. 16 teams of developers participated to find ways to introduce the technology in the banking sector to make it more accessible and competent. Omnichain, Nubank and BlockIntel found their winning streak. - US Federal Reserve

The US Federal Reserve has an on-going project with IBM which involves the development of a new digital payment system. - Santander

Santander has an in-house team called the “Crypto 2.0” which uses the blockchain technology to improve the daily banking processes. Till now, it has cut down the infrastructure significantly. - Wall Street

Wall Street believes that blockchain technology will be a “game changer” and has recently launched a trial project to process transactions. - ASX

The Australian stock exchange is in the process of creating a private blockchain with Digital Asset.

Other notable projects on blockchain and finance are being conducted by BNP Paribus and Standard Chartered Bank.

Reasons behind the popularity of Blockchain technology in the financial sector

Smart Contracts

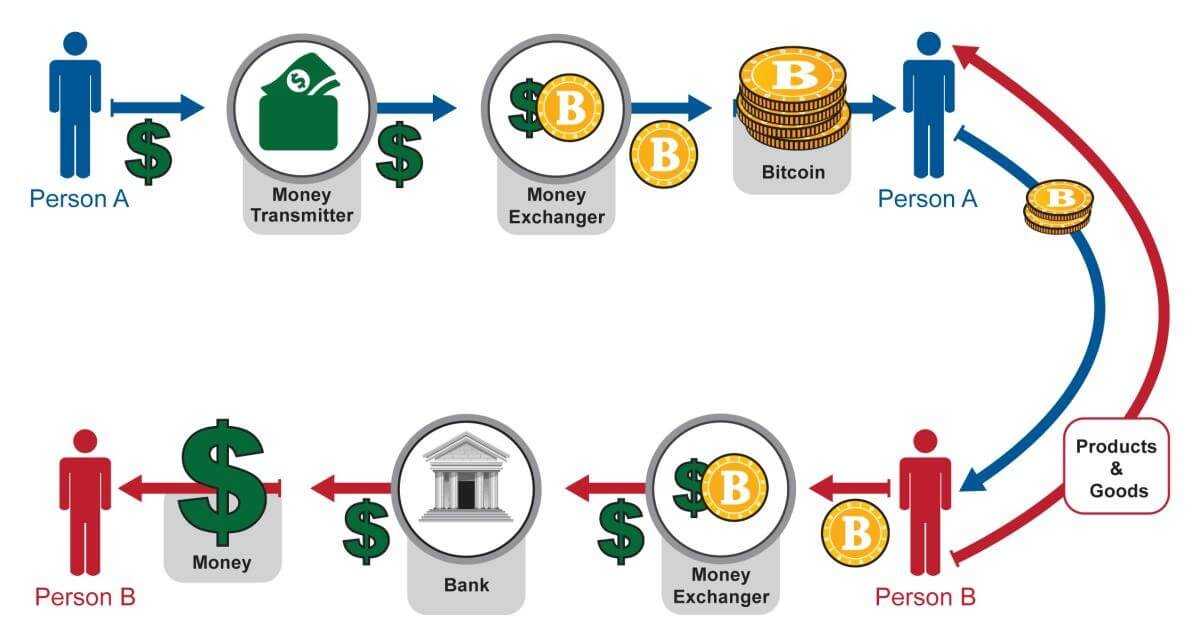

The blockchain platform can be used to store digital contracts. The fact that the system is transparent says that when connected to GPS data the logistics section will receive remarkable benefits. The payments would be transferred automatically to both the supplier and the shipper. The retail market will also be benefited in the same way. The invoice will be directly sent to their clients as per the regulations. The process, in short, eliminates the need for middlemen.

Cross-border Payments

Often the overseas transaction process requires 2-3 business days to complete. Moreover, it is an expensive procedure. The blockchain technology will reduce the time period and also the costs due to simplification of the process. A study conducted by Deloitte reveals that the transaction costs were reduced by 2-3% when real-time transactions took place across borders.

Digital Identity

Once the bio-data of a person have been uploaded to the blockchain platform, they do not need to provide the details again and again. The relevant financial sectors can access the data from the platform itself, reducing the time taken for verification and authorization. Furthermore, the users will be able to choose with whom they will share their bio-data.

Share Trading

The application of blockchain technology in the world of trading is creating new headlines every day. Bitcoin, Etherium and other cryptocurrencies are just some instances of the decentralized and secure ledger system. New digital currencies like Iota, Bitcoin Cash, Bitcoin Gold, Ion and Dash are constantly challenging the fiat currencies.

Distributed Cloud Storage

The decentralized system has enabled distributed cloud storage. Moreover, the users can rent out the extra storage space. Ensuring security involves keeping data in multiple locations with the help of blockchain technology.

The property of the blockchain technology to keep a record of all the transactions makes it so popular in the financial sector. Thus, with time the need for decentralized system increases.