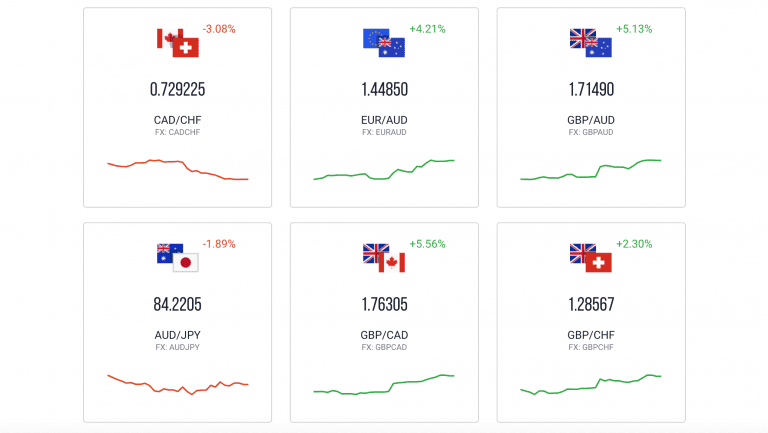

USD

US dollar will get a busy and probably volatile week as the Federal Reserve monetary policy announcement on Wednesday 3rd May 2017 is very important (time – GMT):

![]()

The expectations are to keep the FED funds rate unchanged at range 0.75%-1.00%. On Friday 5th May 2017 we have the very important non-farm payrolls number which is estimated at 175k.

![]()

This combined with unemployment rate expected to rise slightly at 4.6% from 4.5% last month will set the tone for the US dollar.

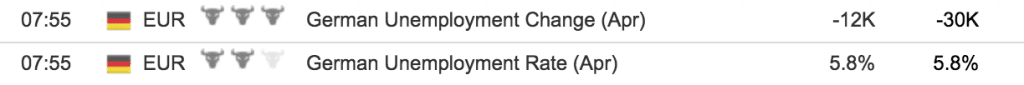

EUR

Euro has gained last week versus US Dollar, British Pound and Yen as a result of the first round of French elections. On Wednesday 3rd May 2017 we have the important releases of German unemployment rate for the month of April 2017 and Euro-Zone Gross Domestic Product 1st quarter annualized growth.

Both these numbers if better than expectations, especially the Euro-Zone Gross Domestic Product can move the Euro higher.

GBP

The British Pound had a huge boost last week due to the unexpected announcement about general election on 8th June 2017. We have not any very important announcements about British Pound this week, other than some reports related to manufacturing, construction and services economic indicators. The main driver of the British Pound this week will be economic news from other pairs, especially the US dollar. Nevertheless the rally of British Pound last week may have reached extreme levels and a correction is possible this week.

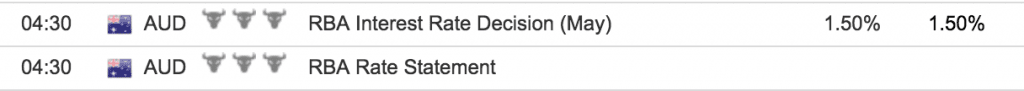

AUD

The Australian Dollar has been weakening past week but this could change as on Tuesday 2nd May 201y we have the very important decision from Reserve Bank of Australia and its monetary policy.

The key interest rate is expected to remain unchanged at 1.50% but often it is the language spoken from officials which can increase volatility for the currency. The Australian Dollar could gain this week versus The US Dollar and mainly the Euro, as there is a big difference in interest rates spread in favor of the Australian Dollar.

CAD

The Canadian dollar has also weakened this week versus major other currencies mainly due to falling oil prices. The big day for the Canadian dollar is on Friday 5th May 2017 with the releases of Net Change in Employment and Unemployment Rate for the month of April 2017.

If there is an increase in oil prices this week this could also help the Canadian dollar rise significantly.

JPY

The Yen has not any important fundamental news this new week. Again it will strengthen or weaken versus other currencies depending on the outcome of important news such as the non-farms payrolls for the US dollar on Friday 5th May 2017. A possible correction could be for the GBP/JPY pair as it has moved to extreme levels past week.

CHF

The CHF has not any important fundamental news this week and gold prices will play a key role either for a weakening or strengthening of the currency. The USD/CHF pair could move higher this week, especially on Friday 5th May if the numbers for US non-farm payrolls are strong enough.