The Fed… Before The Meeting

Expectations for a rate hike had been firming ahead of the FOMC meeting but not enough to significantly lift the dollar. Employment trends and longer term views on inflation had, at the least, halted the decline in forward rate hike expectations if not move them up. The committee was not expected to raise interest rates but it was expected to do a number of other potentially dollar moving things to include announcing the start balance sheet unwinding and perhaps signal a rate hike by the end of the year.

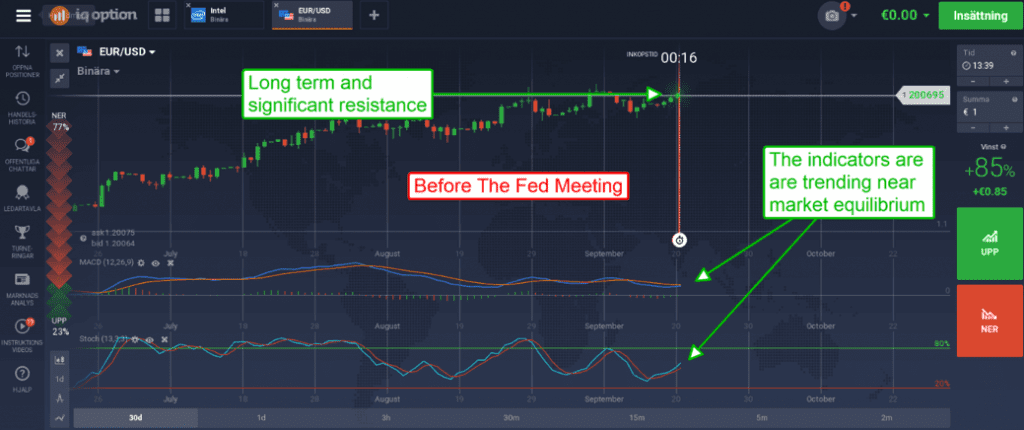

The CME’s Fed Watch Tool had been indicating a less than 50% chance for rate hike by next June with a greater chance of rate cut at the September meeting than an increase. Since the release of CPI, PPI, median household income, housing starts and building permits those odds sharpened to 1.2% in September and 53.2% by December 2017.

The change in outlook did not move the dollar substantially but it did halt a long term down trend caused by slowly eroding FOMC outlook. The EUR/USD, which had been in a long term up trend, was testing and consolidating at a major resistance line with mixed outlook. Both the Fed and the ECB are expected to increase/begin tightening activities in the near future, the question was who would be first and who would be strongest. If the Fed won out the pair would likely confirm resistance and fall; if the ECB the pair would likely complete the break through 1.2000 and continue moving higher.

The Fed… After The Meeting

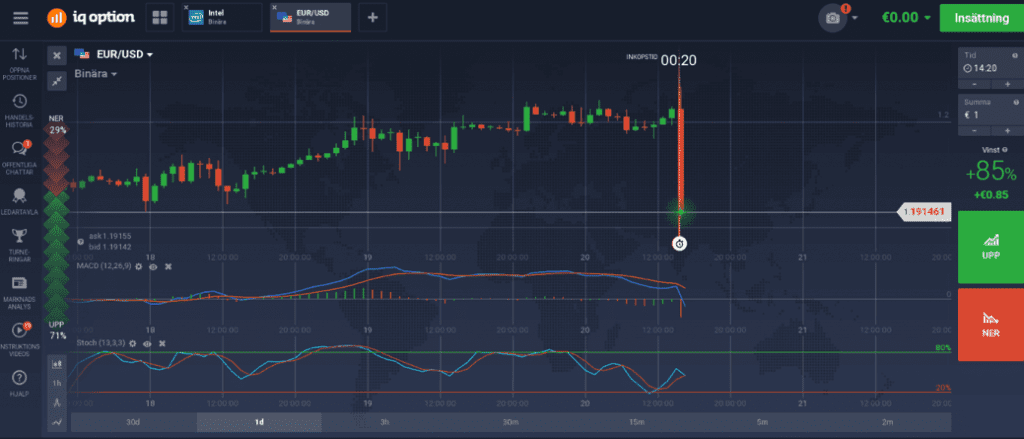

And the results are… The FOMC did indeed hold rates steady. They also did indeed announce the beginning of balance sheet unwind and have sparked a rally in the dollar. They will begin selling bonds at a rate of $10 billion per month with a $10 billion per month increase each quarter. Sales will begin in October and continue into late next year when the action is expected to come to a close. On top of this they indicated that long term inflation targets may be too high with an expectation for near term inflation to remain tame. The recent Hurricanes are expected to impact near term economic growth but have no material affect on longer term outlook. The committee expects to see modest growth in the short to long term with continued labor market tightening.

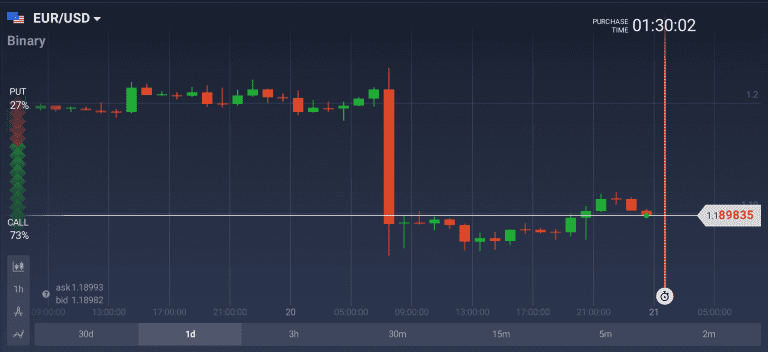

The news that moved the market was a 12/16 count in favor of hiking in December and an expectation for an average 3 hikes next year. Within the minutes the dollar caught a bid confirming resistance at the 1.2000 level. The EUR/USD shed nearly a handle in the first 20 minutes following the release and was falling even as I wrote this.

Outlook is bearish for the euro in the near to short term. Up to and until the next round of economic data and/or central bank meetings. Looking forward it seems as if this pair will remain in consolidation. Yes, the FOMC indicated the next phase of tightening and yes, it was a bit above market expectations but there is a caveat. The ECB is following right in the FOMC’s footsteps and set on tightening soon as well. With this in mind anything the Fed does to strengthen the dollar will likely be offset by the ECB.