The minutes for the ECB’s last policy meeting were just released and confirm what the governing council has been saying all along, they are optimistic for growth in the EU but not quite ready to end their easy money policy. This news is contrary to expectations the bank was turning hawkish and put a damper on ECB rate hike expectations.

In the minutes council members revealed a near unanimous agreement all on points. Global growth continues to gain momentum although inflation within the OECD countries remains weak. Despite the weakness the council sees sustained economic expansion within the EU consistent with the recently upgraded growth outlook.

The council does not expect recent volatility in global financial markets to impact growth longer term although economic tailwinds are projected to diminish. Growth in the EU is still expected to peak in 2018 and taper off to about 1.8% in 2020. Inflation pressures have been subdued but are expected to continue building until reaching the 2% target over the next 12 to 24 months. These pressures are supported by robust labor markets and growing demand within the corporate and consumer segments.

The council also discussed the policy statement and the change removing the accommodative stance. The council wished to prepare the market for the possibility of tightening even though they do not yet see the need for it. For the time being they remain on track to end asset purchases this fall but will wait for inflation pressures to build up before making any change to interest rates.

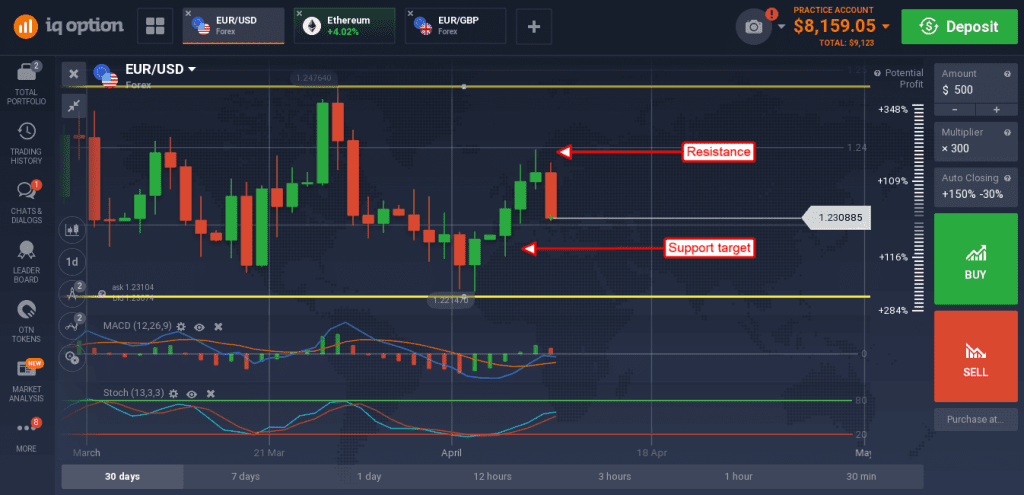

The EUR/USD fell on the news. The minutes confirm the ECB’s positive stance but take away any expectation the bank will be raising rates, or even talking about it in a serious way, any time soon. The EUR/USD fell more than 50 pips confirming resistance within its narrowing trading range. The pair fell to support at the short term 30 bar EMA where it may find support. The indicators are no help at this time, price action is in too narrow a range for them to show any kind of strong move, so I would expect the range to continue in the near to short term, up to and until the next ECB and FOMC meetings in June. A break below the EMA, near the 1.2316 level, would be bearish with target near 1.2250.

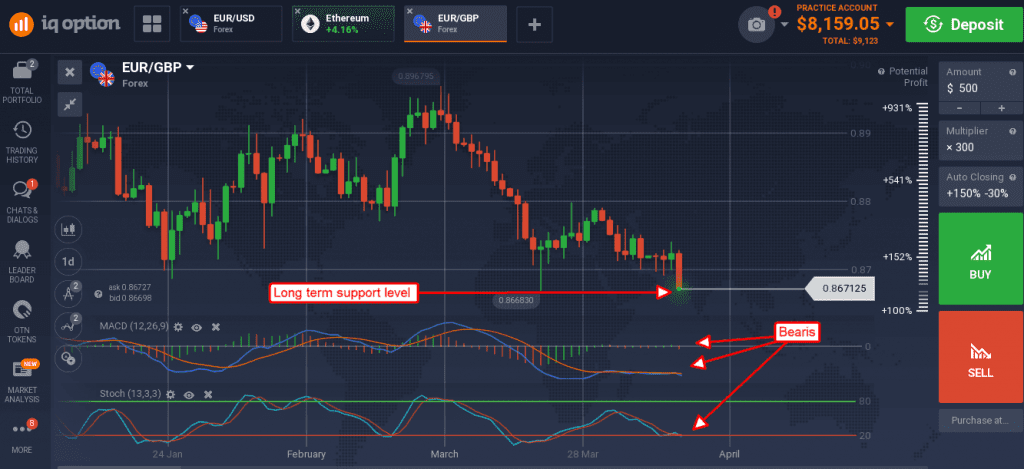

The Euro also fell hard against the pound as signs within the EU, industrial production, suggest economic growth slowed more than expected in the first quarter. February industrial production fell -0.80% versus an expected gain bringing the YoY total to 2.9% and nearly a full percent below expectations. The EUR/GBP shed close to 50 pips creating a medium sized red candle moving down to touch support at a long-term low.

The indicators are bearish and pointing lower, so I would expect to see the 0.8670 level tested if not broke. A break would be bearish with targets at 0.8600 and 0.8400.