According to the official definition of the Ethereum website, “Ethereum is a decentralized platform that runs smart contracts.” But that doesn’t say much. By now, many people, investors and traders in particular, have familiarized themselves with bitcoin. Therefore, it would be easier to understand what Ethereum stands for by simply comparing it to the world’s first cryptocurrency.

| BTC | ETH | |

| Concept | Digital money | Smart contracts |

| Market capitalization | $71 billion | $27 billion |

| Release date | Jan 2009 | July 2015 |

| Release method | Early mining | Presale ($18 million raised) |

Bitcoin is the first and by far the largest cryptocurrency by market capitalization. It is used for financial transactions and as a store of value. Ethereum is all that but glazed with the so-called ‘smart contracts’ feature. Say, when you want your money transferred automatically under a set of certain conditions.

Smart Contracts

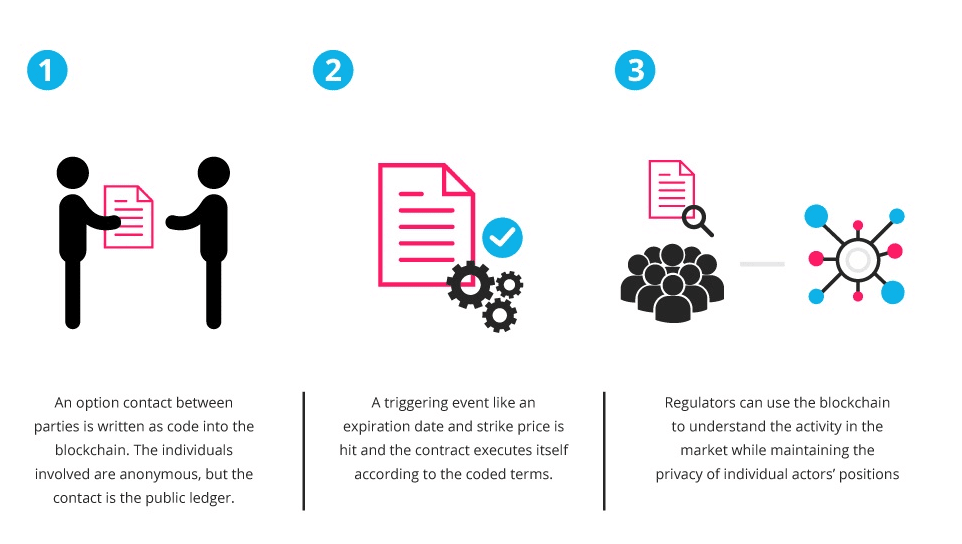

The feature can be used to avoid the involvement of third-party mediators. Several global companies with established names that operate as intermediaries may be gone should the smart contracts catch up. Decentralized platforms can, therefore, drive down transaction costs and eliminate single points of failure/control.

But wait, there is more. With smart contracts, there is no need to rely on social media — centralized and biased — to store your personal information. Systems like uPort do not use centralized servers, and therefore cannot be hacked or manipulated. Decentralized rating-based lending agencies provide disadvantaged categories of citizens with access to peer-to-peer credit. Imagine being rewarded for lending your spare computing capacity to other people. Smart contracts make it possible, too.

More Opportunities

Decentralized social media services can benefit from smart contracts, as well. No centralized servers means there is no chance of a single party overtaking the network. Twitter and Facebook has recently been criticized for politically-motivated censorship, which would never be possible should these social media networks be based on Ethereum.

Managing company’s capital (issuance and distribution of shares), decentralized fundraising and even distribution of funds among several parties are the tasks Ethereum network is also very well capable of.

Conclusion

It is hard to believe there are so many things smart contracts will enable or make considerably easier/cheaper to use. Ethereum network is bringing all of them to life. This is definitely one of the market is crazy about Ethereum creating enough buying pressure to drive the ETH price from $10 to $292 in less than seven months.