The US dollar is poised to make big gains this week and there is very little in the way to stop the move. The worlds reserve currency is supported by a wave of positive economic data that points to one thing; more interest rate hikes from the FOMC. This week’s economic calendar is full, for the US at least, and is expected to reveal more strength within the expanding US economy.

Because the week is shortened for holiday much of the data will come out on Thursday, but the all-important non-farm payrolls report is due on Friday. Thursday should see the release of the Challenger report on lay-offs, the ADP report on private sector payrolls and the weekly jobless claims figures, all of which are expected to show low levels of job losses and high levels of job retention and hiring.

Friday’s non-farm payrolls report is expected to show strong gains in the range of 200,000 new jobs. Even more important will be the revisions and how they affect the twelve-month average, an average that has been trending at or above 200K for several years. Within the report unemployment is expected to fall to 3.8% and wages to rise by 0.2% Wage growth is the key figure this month and, if it continues to trend above 2.5%, will affirm the need for two more rate hikes this year.

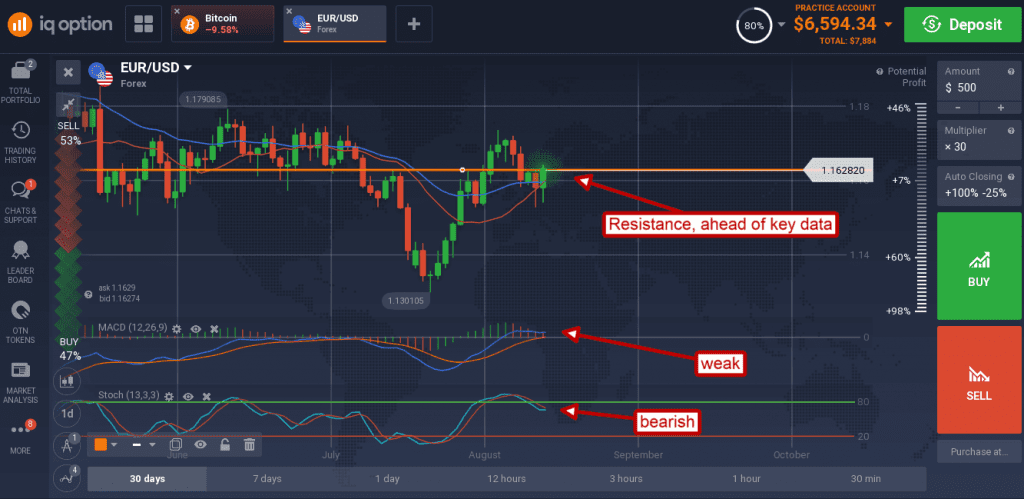

The bad news for the euro and euro bulls is that there is very little EU data left to come out this week. So far, PMI and PPI data have been strong enough to offset some of the dollar’s strength, but retail sales were weak and all that’s left is a GDP revision on Friday. The 2nd quarter revision could spark strength in the euro if it’s hot but, since its rear looking, isn’t expected to produce much movement.

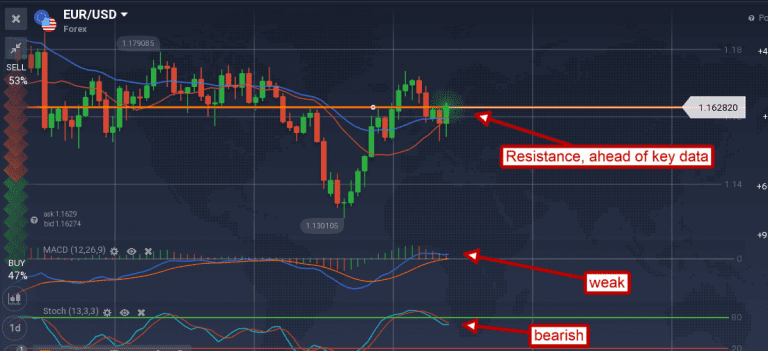

The EUR/USD is now trading at the short-term moving average but below the 1.6255 resistance target with bearish indications. A move lower would confirm resistance and could take the pair down to 1.1400, a move up would face additional resistance targets near 1.16700 and 1.1725.

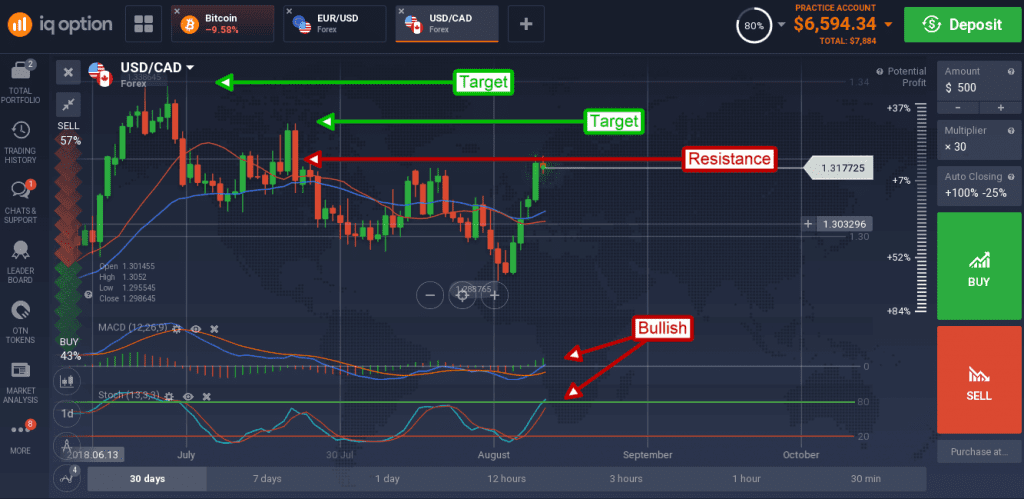

In North American trade negotiations between the US and Canada has the two dollars moving higher.

The USD/CAD has been trending up from a recent low but now facing resistance at 1.3200. The indicators are bullish and pointing higher in support of rising prices so a more up is expected. The labor data is a likely catalyst and could send the pair up to 1.3300 and 1.3400 in the near-term.