February started with a big equity sell off, in fact the steepest 2 week decline in history.

From the beginning (published articles on the 6th of Feb) commentators were attributing the sell-off to leveraged volatility products (SVXY and VIX) that were busted. They used to be a nice bet during 2017, while volatility was low. And volatility was low because Central Banks were intervening in all market corrections and were keeping it low.

Now that Central Banks have changed mode, on the first market correction they did not provide support, volatility crossed a threshold, long volatility products were busted, and the selloff became even greater due to forced liquidation. On the technical significant level of 200-Day Moving Average of S&P500, equities found support and bounced back. Now there are commentators arguing that we are back to normal.

We are not back to normal.

S&P500 rallied on the week 12~16Feb, reached the 50-Day Moving Average but during the last week 19~23Feb it only managed to cross the 50-Day Moving Average and 20-Day Moving Average at the last hour of Friday’s trading.

Let me clarify myself by saying that during 2018, I am a bear on equities. Back to normal does not mean that we are back to a low volatility environment safeguarded by Central Bank’s asset purchases, or that we are back to an anemic inflation – modest growth environment with very low interest rates and low bond yields. That was the environment of 2017 and, in such environment, long positions on equities was the only way to yield returns.

We are transitioning into a new environment. US Government Bonds are already yielding higher (due to increased supply to fund the new fiscal policy and the decrease demand from FED and China) and inflation will (I strongly believe it) grow. A worth noting remark, that was also made by Governor Lowe (Central Bank of Australia) at his 16th Feb speech, in favor of the expected rising inflation is that on the 1st of February the Preliminary release for the US Unit Labor cost was for 2.0% annualized increase versus the previews -0.2% reading.

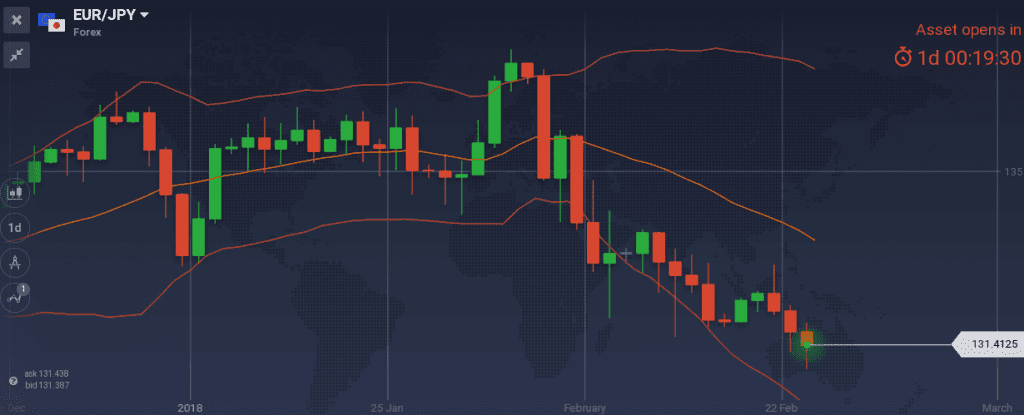

JPY

In such a global environment JPY is usually getting stronger, and that is also happening now. I am biased in favor of JPY.

Snapshot:

- 7% GDP growth in 2017 compared with 0.9% expected at the start of the year.

- 09% 10y Bond yields. BOJ is pressing them to 0.00%

Strengths:

- last reading of trade balance at 0.37T on 19 Feb

- announcement that Kuroda will serve for another 5 years

Weaknesses:

- the technical significant level of 131.00~131.20 may trigger a bounce up until 132.80. I believe that the bounce will be short lived

Watch:

- Thursday’s early in the morning (03:45)10-year Bond Auction and the unemployment release at 23:45. Things will only get complicated if the reading is above 0.09% which is something I do not expect.

- Next monetary meeting is scheduled for next Friday 9 March, and my interpretation of the BOJ’s communication is that no change is expected up until the second half of 2019.

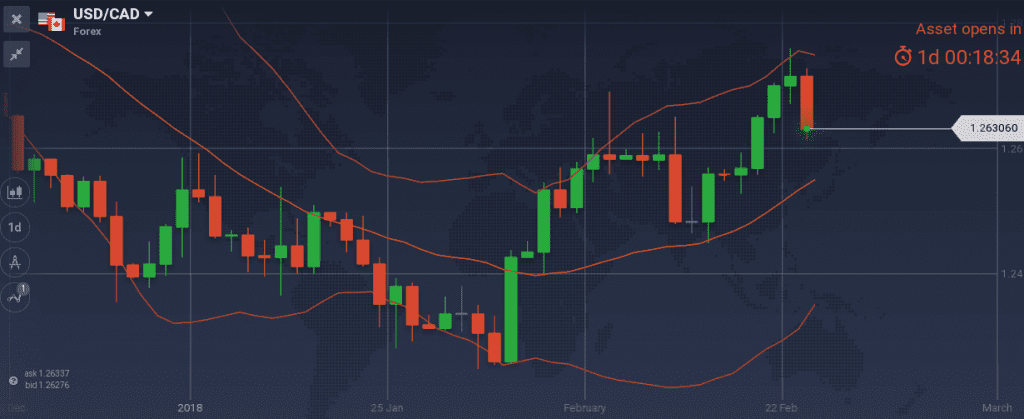

CAD

The rosy picture seems to have already been priced in USD/CAD long before February’s equity sells off, as the pair was at 1.2400 level and heading south and as the rates increased to 1.25% on17 January (as anticipated). Since then, CAD is experiencing pressure and USD/CAD pair is heading north. Now it is consolidating.

Snapshot:

- Desired level of inflation. Inflation stands at 1.9%

- GDP growth is acknowledged by the Central Bank to be higher than long term average.

Arguments for consolidation:

- I believe in a move within the 200-Day Moving Average and the 50-Day Moving Average range

- The opening 1.2630 level is a nice equilibrium in my analysis

Watch:

- Wednesday’s (15:30 GMT) US Crude oil inventories release, which impacts CAD

- Thursday’s 13:30 Current Account reading.

- Next monetary decision is scheduled for the 7th of March.

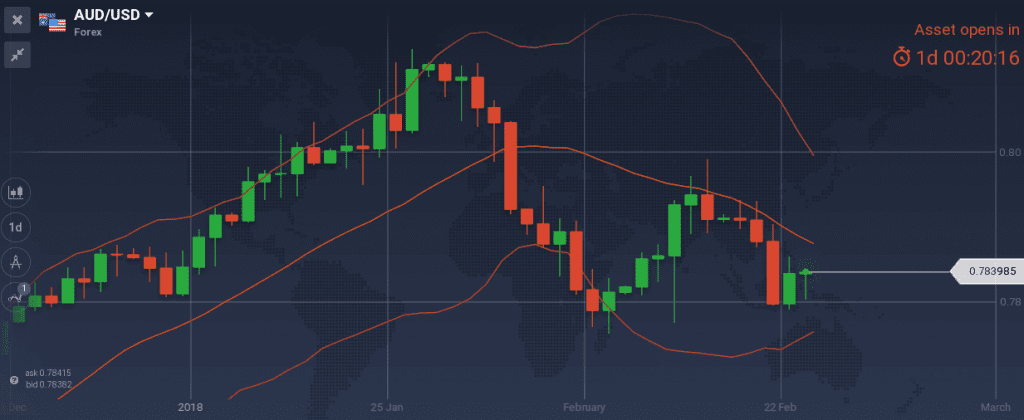

AUD

February’s equity sell-off, found AUD/USD heading south from 0.80 all the way down to the 200 Days Moving Average. The 200-MA has not been crossed or tested yet and is behaving as support.

Snapshot:

- Central bank ‘s interest rate is at 1.50% with no hike yet in this cycle.

- Inflation is at 1.9% (expected to be above 2.00% in 2018, reach 2.25% on mid-2020, target is 2.0~3.0%)

- GDP expected at 3% growth, (2.8% was 2017 reading)

- My interpretation is that Central Bank is avoiding a hike, due to the high levels of household debt and would remain at the current 1.50% rate unless we see significant increases on wages. Next release on Australian wages expected on the 16th of May.

Arguments for consolidation:

- Given that we will not experience a new equity sell-off, I believe that the 0.7810 level will act again as support (nice level to go long) and that we would need some more good news for the pair to cross north the 0.7950 level (nice level to exit any long positions).

Watch:

- No major macro-announcements for the coming week.

- Next monetary policy meeting is scheduled for the 6th of March and no rate change is expected.

USD

I am maintaining my long bias on USD.

Snapshot:

- US economy is growing at a healthy rate of 2.5%, unemployment is at 4.1%, the biggest tax reform is already a reality (expected to add 0.2% growth to World’s 2018 GDP according to IMF)

- Tightening cycle has begun with a very gradual pace of rate hikes since Dec 15. We are counting 5 hikes of 25bps so far, resulting to a current FED rate of 1.50% which Ι expect to reach the peak of 2.75% ~3.00%

Watch:

- Second release of the annualized GDP (Wednesday 13:30GMT) expected at 2.5%

- New FED Governor’s testimony (Tuesday 13.30 GMT)

- Next FOMC meeting is scheduled for the 21st of March

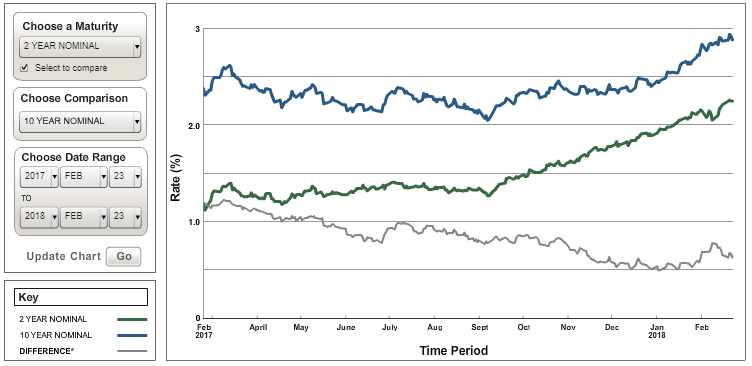

For your archive, bellow is a snapshot of the yields of US Government bonds and a comparison of 2-Year (blue) and 10-Year(green) T-Bond yields that shows the alarming decrease of their spread (grey):

EUR

EUR/USD managed to come all the way up to 1.2500 but retreated during the February’s equity sell-off and failed to cross it when it retested it. Technically the EUR/USD chart could be interpreted both ways. I would wait and would try to minimize my open positions on EUR/USD especially at the end of the week, as we are heading to the 4th of March Italian elections.

Snapshot:

- European’s Economy great 2017 run took everyone by surprise. Actual GDP growth at 2.4% vs beginning of year consensus for 1.3%~1.8%

Strengths:

- The uptrend from October’s 2017 is not broken and that 1.2260 is the perfect level to enter long.

Weaknesses:

- Decreased European current account, economic sentiment found it’s ceiling, decreased PMI readings, double top formation at the 1.2500 level. A catalyst for a big downtrend could well be the Italian elections that are expected to head for a deadlock.

Watch:

- Italian Elections on Sunday

- German, France and Italian 10year bond auctions on Wednesday and Thursday

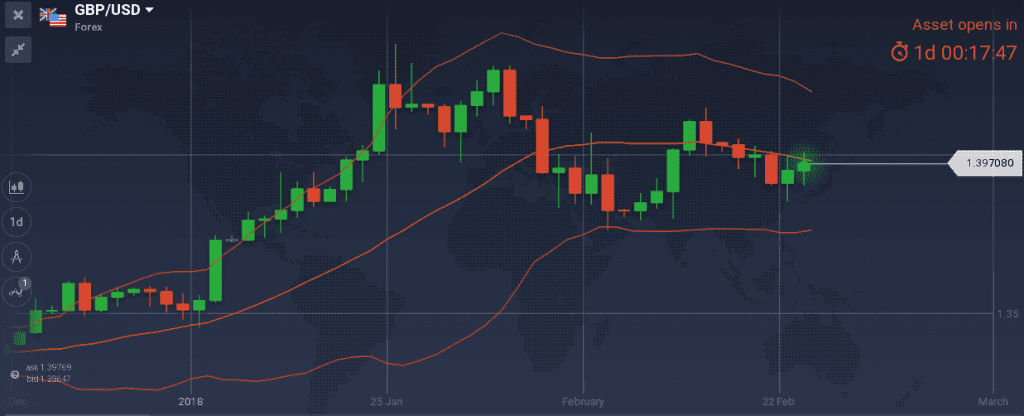

GBP

Snapshot:

- UK’s economy at a glance stands at 1.5% GDP growth, 4.4% unemployment and 3.00% inflation

- Note that UK is the only major economy that experiences higher inflation than the targeted 2%.

- Second rate hike on the 10th of May is probable.

Strengths:

- The CPI reading released on the 13th Feb at 9:30GMT indicated that the 3.00% inflation is not declining as expected, and thus a rate hike becomes even more probable

- I am expecting the GBP/USD to consolidate at current levels before moving higher and I am searching to build a long position if the pair approaches the 1.3700-1.3750 territory.

Weaknesses:

- Brexit negotiations and their outcome

- Thursday’s 9:30GMT Manufacturing PMI reading. I want to see an above 55.0 reading that would emphasize the growing economy scenario, so that I try to build a long position.