Last week’s forecasts were mostly winners. I had advised closing the long EUR/USD positions at 1.1640, go long USD and avoid taking a GBP position. Further, closing the long EUR/JPY positions and entering short at 129.94 is already gaining 97pips. Only my long 0.7300AUD/USD trade is 120pips in the red.

Major last week’s events:

- Tariffs’ front: An additional round of tariffs of $200bn worth of Chinese products is under way, but markets seem indifferent. Trump has confirmed, in a Bloomberg interview on Friday, that he could withdraw the USA from the WTO (World Trade Organization).

- NAFTA: USA reached a preliminary agreement with Mexico that included a $16/hour minimum wage for a least 40% of the workforce in Mexican automobile plants. The Canadian Foreign Minister, Chystia Freeland, has started negotiations with US Trade Representative, Robert Lighthizer.

- US Transformation: Starting Wednesday, Wilbur Ross (the US Secretary of Commerce) was authorized to allow à la carte exemptions from tariffs on steel, as long as it is requested by US companies and as long as the steel is imported from S. Korea, Argentina or Brazil. On Tuesday we learned that $4.7bn are set to be distributed to US farmers hit by tariffs.

- Turkey: TRY dropped once more. The downtrend once again stopped when Turkey showed a pro-European facade. On Thursday the Turkish defense minister participated in the EU defense ministers’ summit in Vienna.

- Russia: 1-year US sanctions on Russia started on Monday (end of foreign assistance, end of arms sales, and of financing)

- China, India, Iran, Pakistan, Afghanistan: Peace talks to happen in Moscow, scheduled for Tuesday 4 September, were postponed

- Cryptos: Total market cap at 231B$, +7% w/w, -71% from the 800B$ peak.

Major next week’s events:

- Tuesday’s Monetary meeting or Central Bank of Australia (RBA)

- Wednesday’s Monetary meeting of Central Bank of Canada (BOC)

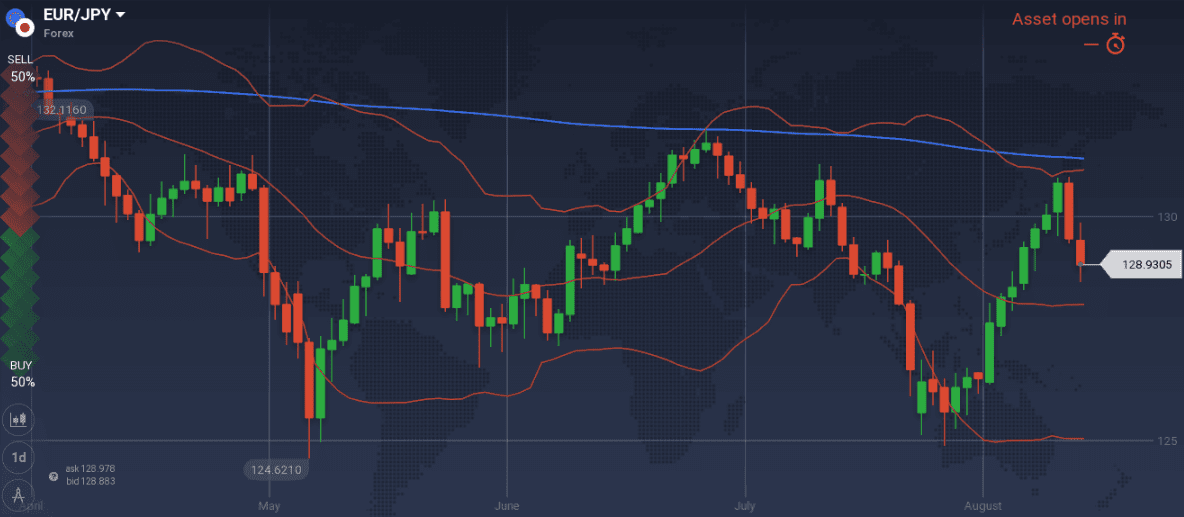

JPY

I keep my short EUR/JPY bias and would re-enter short at 130.23 and 131.32 levels.

Snapshot with mixed indications:

- Core CPI (=BOJ’s compass) at 0.8% (vs 2.0% target and BOJ’s members’ expectation of 1.2~1.3% within 2018), BOJ rate at -0.1%

- GDP at 1.00% annual, 0.5% q/q, 10Y Government bonds yield at 0.11% (+1bps w/w) vs BOJ’s target of 0.00±20% level

- Unemployment increase to 2.5%

Strengths of JPY:

- US equities dropping is not happening, but it is still a possibility

- New $27.15bn swap line between Japan and China was signed.

- QQE will stay, up until core CPI reads 2.0% in a stable manner. The scheduled VAT hike in Oct’19, rules out any possible monetary policy change, before 2020.

- increasing retail sales, improved GDP reading, increased Manufacturing PMI

Weaknesses of JPY:

- decreased readings of Services PMI, monetary base, household spending, bank lending, machine orders and trade balance

- latest increased unemployment reading

Watch:

- Monday’s Capital Spending and Manufacturing PMI. Increasing numbers favor JPY

- Wednesday’s 10y Government Bond Auction. A yield below 0.11% favors JPY

- Friday’s Average Cash Earning. Anything above 2.8% favors JPY. Note that Mr. Kuroda (Governor of BOJ) would love a 3% y/y wage growth.

- Next Monetary Meeting on 19 September

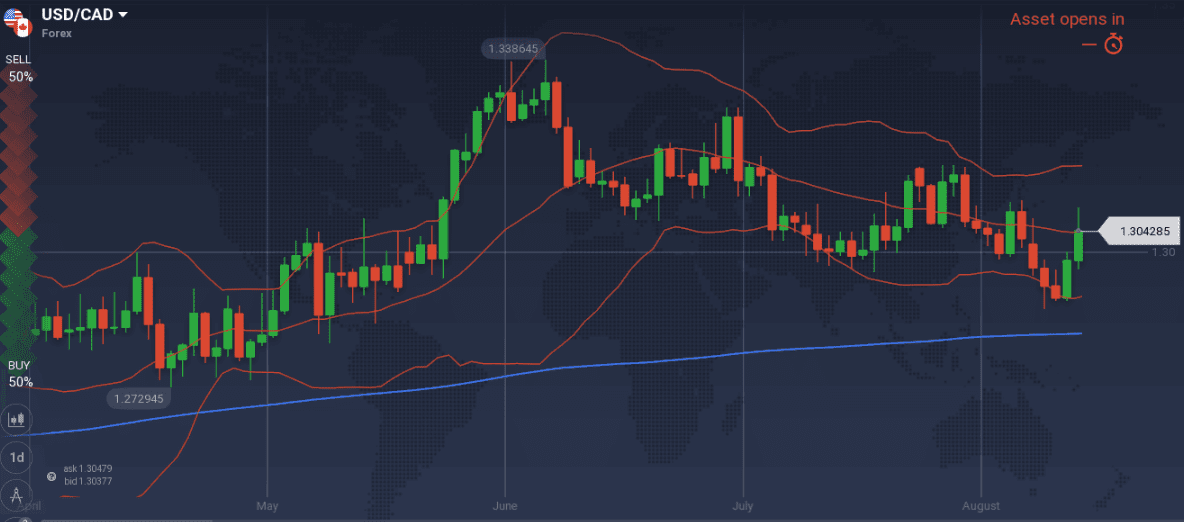

CAD

I will short USD/CAD in the event 1.3156 level is triggered.

Snapshot deteriorated and expected to deteriorate further.

- Inflation at 3.0% (vs 2.5% target), BOC rate at 1.50% (4 hikes so far, neutral rate according to BOC within 2.5%~3.5% range).

- GDP at 1.9% (vs. BOC expectations of 2.0% in 2018 and long-term potential of 1.8%), 10Y Government bonds yield at 2.23% (-3bps w/w).

- Unemployment at 5.8%

Strengths of USD/CAD, weakness of CAD:

- latest disappointing GDP m/m reading

- housing market, wholesale sales and retail sales readings

Weaknesses of USD/CAD, strengths of CAD:

- Since the last OPEC’s report where the oil market was presented as balanced, oil prices are in a 2 weeks’ rally.

- Canada re-entered NAFTA negotiations. I am expecting a CAD rally once a deal is reached

Watch:

- Monday is a holiday

- Tuesday’s Manufacturing PMI

- Wednesday’s Trade Balance and Monetary Meeting. Markets do not expect a hike.

- Friday’s unemployment that is expected to increase

AUD

Turnbull’s (former PM) resignation from the Parliament is a fact. Current government is enjoying a 1-seat majority so the October’s snap election for his seat at Wentworth are crucial.

I have no view for AUD/USD given my last week’s blunder to go long the pair

Snapshot unchanged but expected to deteriorate:

- Inflation at 2.1% (vs 2.0~3.0% target, and expected to decline during 3Q18), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 3.1% (RBA expects more than 3.0% within 2018 and 2019), 10y Bond yields at 2.52% (-3 bps w/w)

- Unemployment at 5.3% (expected to reach 5.0% by 2020)

Strengths:

- I believe that the political drama is over and no government change will happen at the scheduled snap elections. Polls are showing the Liberals at 37%, Independent at 32%, Labor at 20% and Greens at 17.7%. The irony is that PM change was demanded by people opposing tax cuts and National Energy Guarantee policies, and at the end the new PM and Deputy were the architects of both.

Weaknesses:

- market participants expect the RBA’s rate to remain unchanged for a considerable period

- an increased trade balance is not expected soon

- decreasing capital expenditure, building approvals and home sales

- scheduled macro releases (GDP, profits, trade balance) are not expected weak.

Watch:

- Monday’s retail sales and company operating profits. Decreasing numbers that do not help AUD are expected.

- Tuesday’s Monetary Meeting. My focus is on the remarks on wage growth and any other comment on politics, as no reason to adjust rates in the near term is expected.

- Wednesday’s GDP and Thursday’s Trade Balance are expected lower, and do not favor AUD.

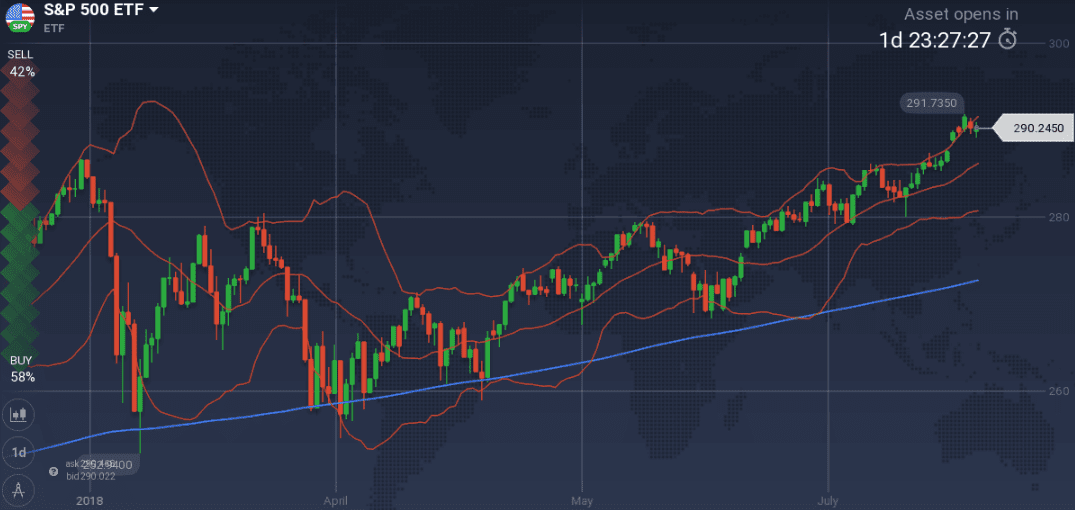

USD

I keep my long USD bias, but I would avoid shorting US equities.

Snapshot improved:

- Core PCE (=FED’s inflation compass) increased to 2.0%, FED ‘s rate at 1.95% (IOER) and expected to reach 3.1% within the cycle. FED’s view of long run rate at 2.9%

- GDP increased to 2.9%y/y (reached OPEC expectations for 2018), 4.2% q/q, 10y Bond yields at 2.85% (+2 bps w/w)

- Unemployment at 3.9% (vs natural rate of unemployment of 4.5%), FED expects 3.6% unemployment in 4Q18 and 3.5% for 2019 and 2020.

Strengths of USD:

- a possible equity downtrend from current highs would help USD but has not happened. The increased wholesale inventories were very alarming reading.

- inflation is contained (labor cost data decreased & Trump canceled a 2.1% wage raise for federal employees) and at the same time the Fed cannot postpone the rate hiking, given its forward guidance is described as a policy tool and given that markets are currently pricing 98% probability of a rate hike on September and 71% probability of an additional rate hike on December.

- strong macros

- two new narratives capable of boosting US markets for another semester are in the making (a) indexing inflation so that long term capital gains are taxed lower (b) publishing earnings every 6 months instead of every 3 months can bring creative accounting.

Weaknesses of USD:

- 10y Government Bond yields remain below 3.0%.

- low industrial production reading and durable goods orders.

Watch:

- Monday is a holiday

- Tuesday’s Manufacturing PMI number, Wednesday’s Trade balance, Thursday’s Non-Manufacturing PMI and Friday’s Unemployment rate. Although, no sign of weakness is expected in these readings, they need to be noted down.

- Next Monetary Meeting on 26 September, when a new hike is expected.

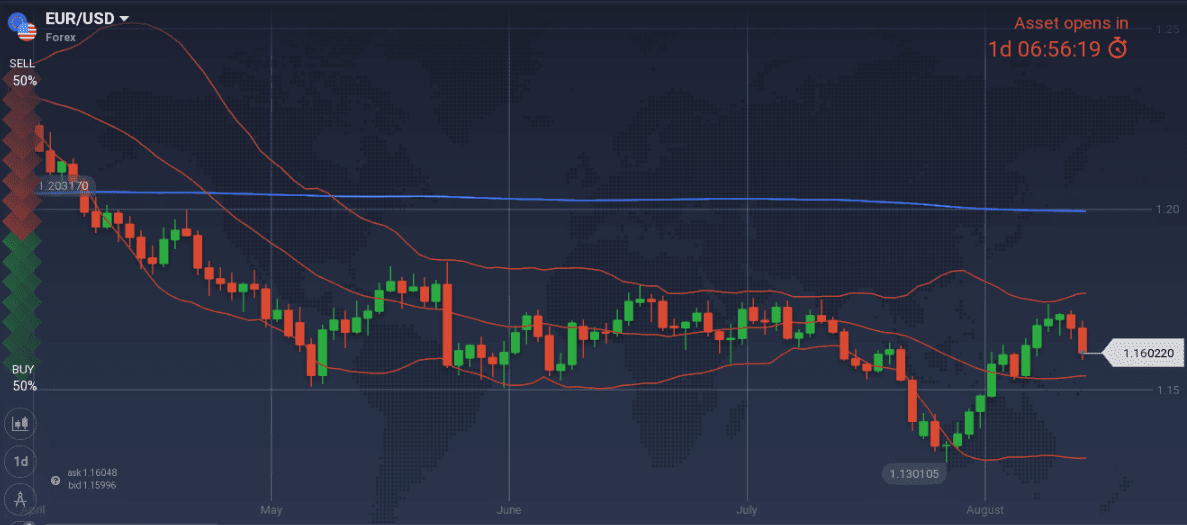

EUR

I am shorting EUR/USD at 1.1720

Snapshot improved further:

- Annual CPI decreased to 2.0%, core CPI (=ECB’s compass) decreased to 1.0%, ECB ‘s rate at 0.00%

- GDP at 2.2% growth (OPEC reduced expectations to 2.0%), 10y Bond yields of EFSF at -0.41% (-1bps w/w), 10y German Bond yields at 0.33% (-1bps w/w), 10y Italian Bond yield at 3.24% (+9bps w/w), 10y Greek Bonds yields at 4.40 (-20bps w/w, at the second week following bailout protection)

- Unemployment decreased to 8.2%

Strengths of EUR/USD:

- increased GDP, decreasing unemployment

- service and manufacturing PMI levels are still above the 50 thresholds, but decreasing

Weaknesses of EUR/USD:

- the different stages of monetary policy between EU and US, can only be simulated with two expected dips of EUR/USD, in late September and mid-December

- a possible decline of US equities would fuel a risk off environment, where EUR is generally falling

- Italy

- decreased last week’s M3 reading coupled with weak macro releases expected next week

Watch:

- Monday’s Manufacturing PMI, Wednesday’s Services PMI and Retail Sales. All three numbers are expected weaker and would favor a short EUR/USD trade.

- Thursday’s German Factory orders at 07.00 GMT are expected higher.

- Next Monetary Meeting of ECB on 13th of September.

GBP

I am offering no forecast for GBP as we are approaching to November’s Brexit deadline.

Last week’s note, that any comment from UK or EU politicians is able to move the market, proved correct and, under such circumstances, it is not wise to trade with a week’s long time horizon. “Brexit deal within our sights Minister Raab said” was a Wednesday’s headline that moved GBP/USD by 100pips within 3 minutes.

Snapshot unchanged:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.75%

- GDP at 1.3% growth (vs 1.75% BOE’s expectations and 1.3% decreased OPEC’s expectations), 10y Bond yields at 1.43% (+16bps w/w)

- Unemployment at 4.0%

Strengths:

- the bad weather narrative for the abnormally low GDP number of Q1 still makes sense.

- Macro picture is improving (GDP, unemployment, construction activity and housing market). On top, inflation increased proving that BOE was correct to hike.

- Last week’s macro releases were positive. Consumer Confidence increased, M4 increased.

Weaknesses:

- a no deal with EU is possible. In this case UK would be able to be competitive to EU regulatory wise but would lose tax revenues from the decrease of financial activity in the City.

- decreased average earnings and industrial order expectations

- Manufacturing and Services PMI decreasing. New readings are expected this week

Watch:

- UK politics

- Monday’s Manufacturing PMI, Tuesday’s Construction PMI and Wednesday’s Services PMI

- Next Monetary Meeting on 13th of September.