US Dollar sell-off continues driven by negative political sentiment in the USA, Japanese Yen rallies both as a safe-haven currency but also due to positive economic data from Japan.

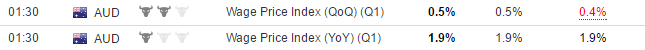

Australian Dollar

The Australian Dollar continues its gains versus the US and the Wage Cost Index reading measuring quarterly changes in Australian wages was exactly as the forecast, signaling no current inflation pressures.

The Australian Dollar continues its gains versus the US and the Wage Cost Index reading measuring quarterly changes in Australian wages was exactly as the forecast, signaling no current inflation pressures.

With a neutral reading the rally in the commodities helped the AUD/USD move higher from 0.7391 to 0.7438:

Japanese Yen

Several important economic data about the economy of Japan with an increase in Industrial Production on a yearly basis for the month of March 2017, lower than expected Private Consumption and Business Spending for the 1st quarter of 2017, but mainly a very positive surprise of better than expected Gross Domestic product growth annualized for 1st quarter of 2017.

Several important economic data about the economy of Japan with an increase in Industrial Production on a yearly basis for the month of March 2017, lower than expected Private Consumption and Business Spending for the 1st quarter of 2017, but mainly a very positive surprise of better than expected Gross Domestic product growth annualized for 1st quarter of 2017.

![]()

With these positive news and the increased concerns about any potential political instability in the USA, the USD/JPY moved significantly lower from 112.72 to 110.514:

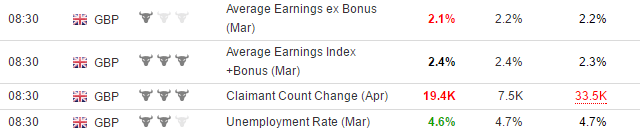

British Pound

The UK economy continues to shows strong readings of economic growth with lower than expected unemployment rate for the month of March 2017, but also significant positive growth in Employment Change, a very strong positive surprise while Average Weekly Earnings showed no surprises and not any inflationary pressures:

The UK economy continues to shows strong readings of economic growth with lower than expected unemployment rate for the month of March 2017, but also significant positive growth in Employment Change, a very strong positive surprise while Average Weekly Earnings showed no surprises and not any inflationary pressures:

As a result the GBP/USD pair moved higher from 1.29049 to 1.2989:

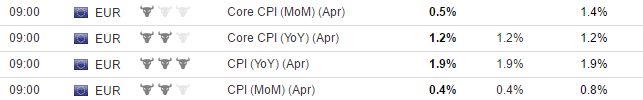

Euro

The Euro-Zone Construction Output reading was weak compared not to the forecast but to the previous reading and Euro-Zone Consumer Price Index was exactly as expected for the month of April 2017 and on a yearly basis the reading was 1.9%.

The Euro-Zone Construction Output reading was weak compared not to the forecast but to the previous reading and Euro-Zone Consumer Price Index was exactly as expected for the month of April 2017 and on a yearly basis the reading was 1.9%.

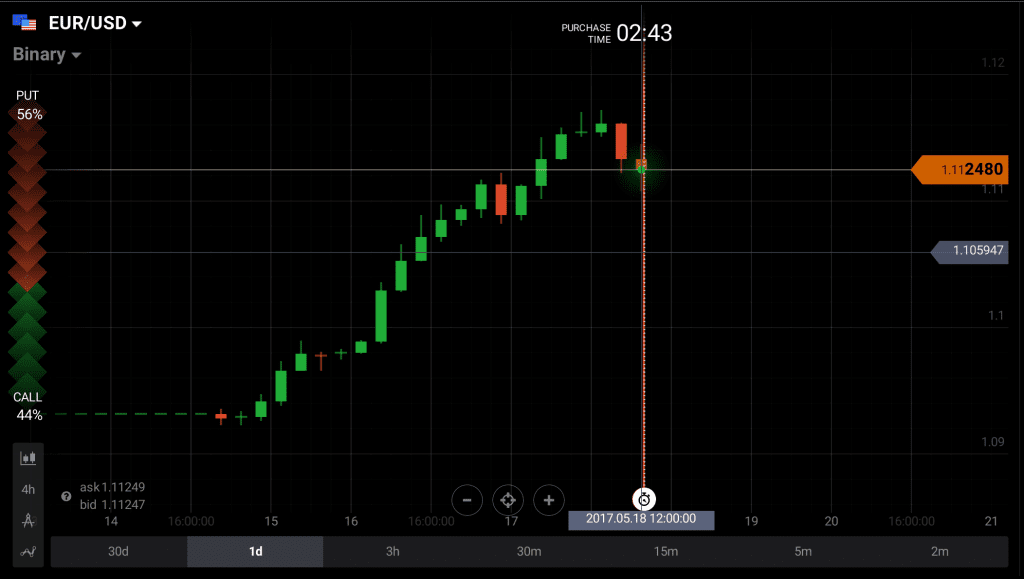

This neutral reading may not urge ECB to increase interest rates soon. But as the negative sentiment of the US Dollar was dominant the EUR/USD managed to move to new yearly highs as it moved to 1.169 from 1.1086:

Key important economic news to watch on Tuesday 18th May 2017

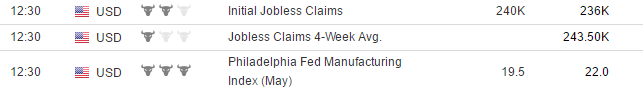

The intense sell-off of the US Dollar which is mainly attributed to political concerns may pause or reverse if the investor sentiment is perceived to have moved in extremes. Weekly Initial Jobless Claims and Continuing Claims plus the Philadelphia Fed survey can turn positive and supportive for the US Dollar if their readings are better than expected.

The Unemployment Rate for the Australian economy, Retail Sales for the UK and a speech of Mario Draghi, President of the European Central Bank will all be important. And the commodities prices such as oil and gold can cause price action to pairs such as the USD/CAD and the USD/CHF.