The Bank of England kept interest rates unchanged yesterday but at the same time it lowered GDP growth forecast for 2017, plus several readings showed weakness for the strength of UK economy.

British Pound

As anticipated the Bank of England did not make any surprise yesterday leaving the interest rate unchanged at 0.25%:

![]()

But it was the mention to the GDP growth forecast for 2017 which was downgraded plus a series of readings that showed that UK economy is having severe impact from the Brexit.

Mark Carney, the Governor of the Bank of England said that “the decision reflected the impact that slowing wage growth and rising inflation has had on near-term household spending and gross domestic product growth forecasts” and “The Committee judges that consumption growth will be slower in the near-term than previously anticipated, before recovering in the latter part of the forecast as real incomes pick up”.

Economy growth

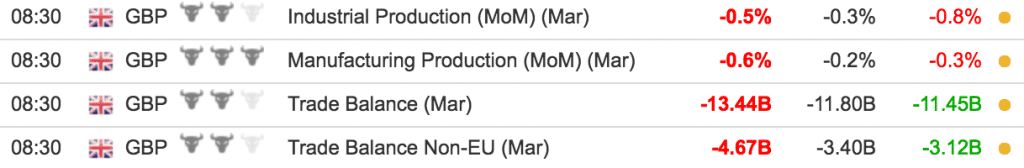

The Bank of England lowered its outlook for GDP forecast for 2017 to 1.9% from 2.0% and made the forecast that Inflation on 3-year period will peak at 2.8% in 2017 and then it will be 2.4% and 2.2% for years 2028 and 2019 respectively. But it was also the readings of several important economic indicators such as Industrial Production, Manufacturing Production, and Construction Output, which all came lower than expectations meaning that the UK economy is showing signs of slowing growth:

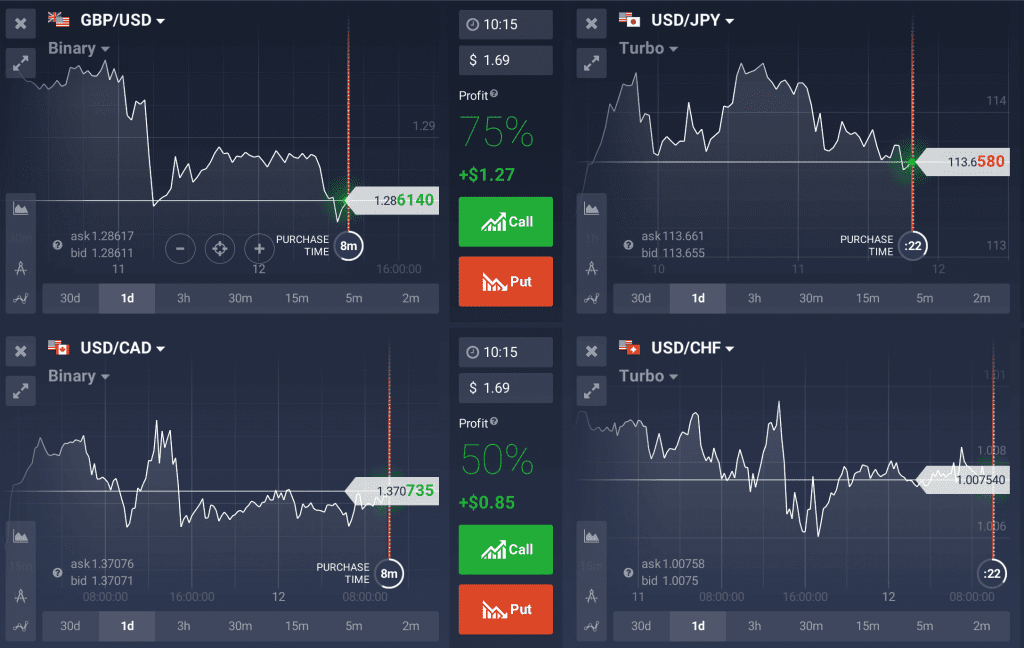

Furthermore the Trade Balance showed a further widening in the total deficit, which can be interpreted as negative for the British Pound, as more outflows mean a possible depreciation for the Pound. As a result the GBP/USD fell from high price of 1.2953 to 1.2847:

Furthermore the Trade Balance showed a further widening in the total deficit, which can be interpreted as negative for the British Pound, as more outflows mean a possible depreciation for the Pound. As a result the GBP/USD fell from high price of 1.2953 to 1.2847:

Overall negative fundamental news for the British Pound which pose a potentially reversal to its current strength.

US Dollar

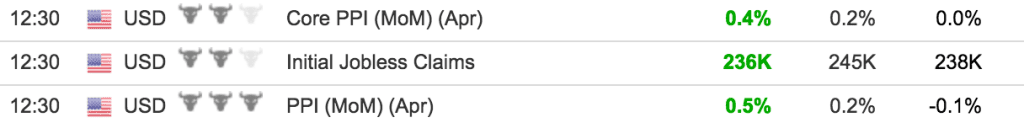

Some inflationary signs again from several Producer Price Index readings but also very important news about lower than expected weekly Initial Jobless Claims, meaning that fewer people filed for unemployment insurance for the first time, and lower Continuing Claims for unemployment continues to show a strength in US labor market.

These can be considered positive news for the US Dollar but the market did not react much to that.

A mixed day for the US Dollar and we can attribute its weakness related to Canadian Dollar and the Swiss Franc to rising oil prices and gold price respectively.

Important news to watch for today which can move the FX market:

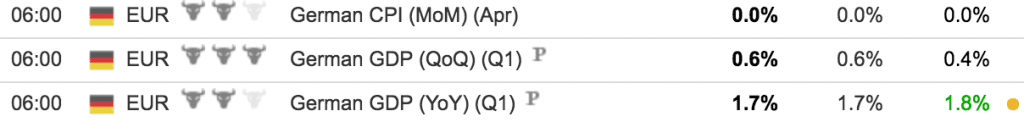

Early in the morning there was a release of news about the German Gross Domestic Product and also the Euro-Zone Industrial Production, important numbers about the growth of Eurozone:

The reports have appeared around the forecast levels.

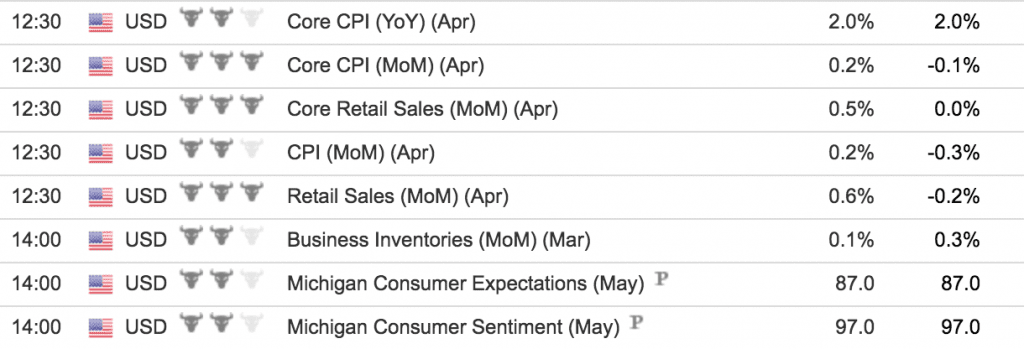

But later on today again important news from the US economy such as Consumer Price Index readings, Retail Sales and the University of Michigan Survey.

The signs of an economic downturn can cause volatility for US Dollar currency pairs in case of any significant surprises from expectations.