Blockchain-based startup Tezos, which raised $232 million during an ICO in July 2017, seems to be falling apart, as the founders of the code declared war on the fund manager, who raised funds to support the development of the startup.

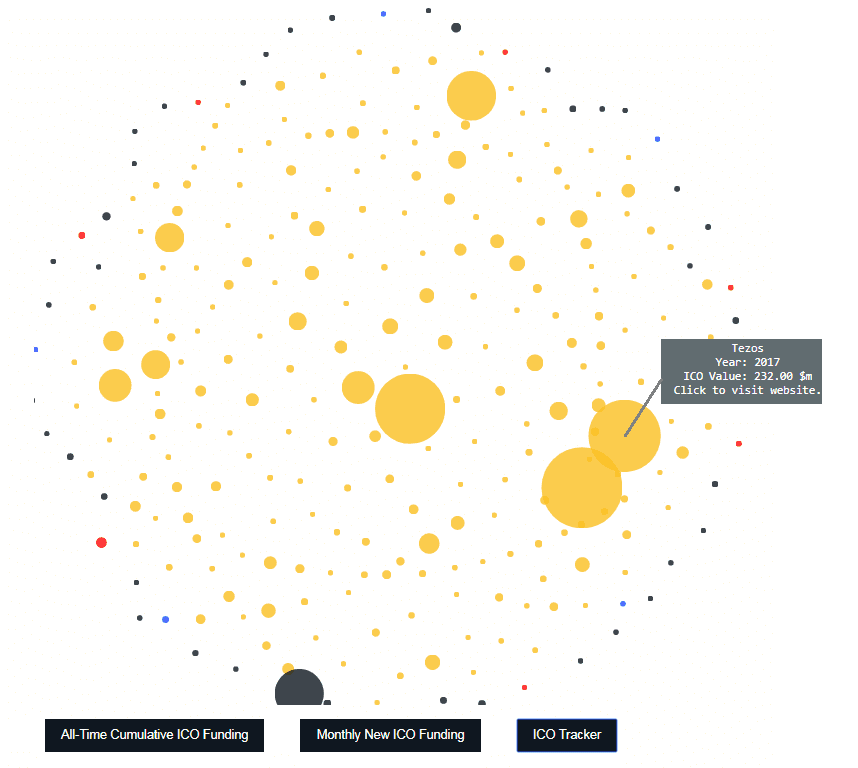

If you check this picture below, you will see that Tezos, which is part of Dynamic Ledger Solutions, still remains among the largest ICOs in history:

Tezos has proprietary blockchain system, which is a rare achievement today, as most of the startups develop blockchain technologies based on Ethereum or Bitcoin. Its distributed ledger technology (DLT) resembles a platform for banks and other corporations, which helps create smart contracts. Interestingly, the system was built so that it couldn’t go through hard forks. Tezos has been in development since 2014 and is the brainchild of the team of husband and wife Arthur and Kathleen Breitman, former employees of Morgan Stanley and Accenture respectively.

Besides the couple, Johann Gevers has also participated in the management of the company. He is the president of the Swiss-based Tezos Foundation, the body established to launch the ICO, as well as the promotion and development of the computer network.

The Conflict Between the Founders

According to several sources, Arthur Breitman sent a letter to the board of the fund, demanding that Gevers be removed from the position of the president of the Foundation because of “self-promotion, the realization of personal goals and conflicts of interest.” The couple says Gevers has granted a bonus to himself.

In a report on Medium, Arthur Breitman expanded his allegations, saying that the development of Tezos had slowed significantly due to Gevers’s inaction as the head of the Fund.

But despite Breitman’s allegations that Gevars should be removed from office during the investigation, the latter stated that he did not intend to go anywhere and accused Arthur of slander.

In addition, Givers said that such behavior of the Breitman is part of an “illegal coup” in the fund and that they are trying to control the fund as their private property, bypassing the legal structure and interfering in management and operations. This, according to Givers, caused delays in the development and launch of the Tezos network.

Who is right and who is to blame for this situation is still unclear, but this undoubtedly does not help the startup’s reputation. Thus, futures for the Tezos tokens fell 75% after the scandal went public. It means that the project will suffer severe delays.

Andrew Baker’s Lawsuit Against Tezos

Under these circumstances, one ICO participant accuses both sides, the Breitmans and Grever, of committing securities fraud.

Andrew Baker leads the suit. He participated in the Tezos ICO by spending one Bitcoin. Currently, he, along with other investors who joined the lawsuit, is represented by legal company Taylor-Copeland.

The suit calls defendants Arthur and Kathleen Breitman with their company Dynamic Ledger Solutions and Johann Gevers with his Tezos Foundation. Public relations company Strange Brew Strategies, which advertised Tezos, is also part of defendants. The latter is accused of making misleading claims for promotion.

In addition, the suit accuses the Breitmans of misleading investors about the timing of project development and launch.

Thus, one of the largest initial coin offerings (ICO) became the subject of at least one major trial.

In short, the charge, which has been filed in district court in California by attorney James Taylor-Copeland, alleges that Tezos has violated the US Securities Act by offering securities while “misleading” investors about the nature of the company.

Tim Draper, a venture capitalist who supported Tezos and now acts as a defendant, protected his position by writing in his comments on Cointelegraph:

“There was nothing secretive about our purchase of Tezos. We invested for ownership in the company, which at the time was two bright young people and an idea. The sale might not have happened at all! We also participated in the Pre-sale. Most ICO founders earn tokens over time. All tokens we hope to receive that we didn’t buy in the Pre-sale (alongside with all the other investors who participated) will vest over time with the founders’ tokens. I have no intention of selling these tokens because I am a true believer in the Tezos mission: to build a Blockchain on proof of stake and open it up for developers to build and invent on a new and more relevant platform.”

Other companies are also examining the situation and preparing to join Andrew Baker by initiating lawsuits. Silver Mill, a Florida-based company, is among them. The report says:

James Taylor-Copeland claimed that the proposed class includes about 30,000 people who bought Tezzies (Tezos tokens) and want to rescind their purchases plus other damages. He added the lawsuit may be the first civil action brought over an ICO.

More Investors Plan to Initiate Lawsuits Against Tezos

Taylor-Copeland law firm is not the only one that represents investors who want to go against Tezos. Currently, it is the only one that had initiated a suit, but at least two more law firms are planning to do the same. For example, Block & Leviton, a Boston-based law firm focusing on violations of securities laws, said that scandal between the Tezos founders has led to the drop in token futures price. Given that the launch of Tezos token has been delayed, traders can trade Tezzies in the derivatives market only. The law firm said that it investigates the situation.

Restis, a California-based law, also unveiled that it had started to examine the Tezos project.

“The Restis Law Firm, P.C., located in San Diego California, is investigating a class action lawsuit on behalf of U.S. investors in the Tezos ICO. We are interested in receiving feedback from investors to learn about their experience and develop facts for the case,” the Restis representatives said.

Should the Founders Expect Penalties and Prison?

Well, there is a possibility that the US Securities and Exchange Commission may require that Tezos founders return the money to investors – all $232 million. It seems that there have been some problems in how the sale of tokens was organized – in financial, organizational and marketing terms.

However, will the charged faces end up in prison? There is a low probability for this to happen, but who knows? In the worst case for them, the founders may be fined with huge penalties.

Moreover, Tezos had previously disallowed US residents in taking part in the ICO, so the US suits initiated by the law firms on behalf of US investors may not have the expected effect. Some say that it is unlikely that US securities regulations can be applied against Tezos in a lawsuit.

Besides, to avoid US SEC regulations, Tezos has claimed the ICO and the investment as a “non-refundable donation.”

In conclusion, there are few chances that the US investors will succeed in their lawsuits against Tezos and that the founders, or at least some of them, will end up in prison.