Oracle (ORCL: NYQ), reports Q4 2017 earnings on June 21st 2017 after the closing bell. The multinational computer technology corporation, based in California specializes in developing and selling database technology, cloud systems as well as enterprise software solutions.

The company has a successful brand due to its effective database management system product and service range. Oracle also develops tools for database development of enterprise resource planning (ERP) software, middle-tier software, customer relationship management (CRM) software and supply chain management (SCM) software.

1) Share Price Movement

Over the past twelve months the shares are up over 25%, on aggregate. However, along a similar line to other US tech stocks, the volatility over this period of time has been significantly high. The stock price tumbled lower into the tail end of 2016 and has been drifting higher steadily since the start of the year. The stock is also up 25% YTD.

2) Earnings Expectations

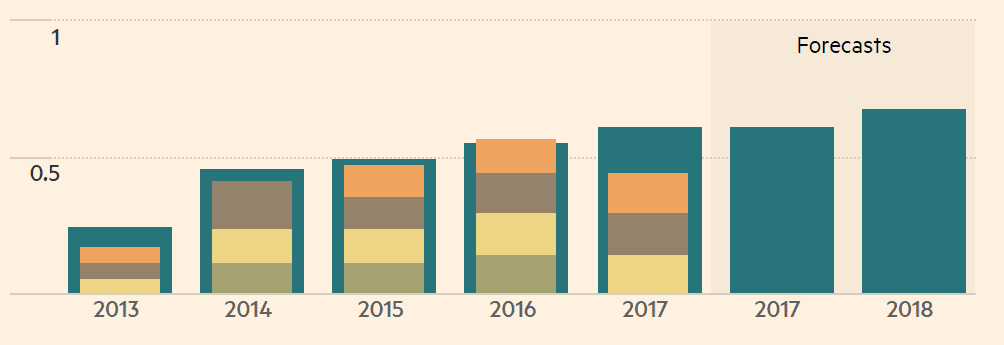

Oracle reported Q3 2017 earnings on March 15th 2017 – reporting EPS of 0.69USD per share. This result exceeded the consensus analyst forecast of 0.62USD per share and also delivered a year on year improvement from Q3 2016 of 7.81%. The forecast for this year is for earnings to decrease by -1.05% compared with last year and further to this Wall Street analysts expect earnings growth of 8.5% in 2018 as compared with 2017. For the next five years the forecasted expectation is for an average annual rate of earnings growth rate of 10.33%.

3) Competition Heats Up

Microsoft and Amazon have made announcements and significant investments in the database and cloud service space. Both companies are intending to ramp up their solutions and platforms in this sector which will directly impact Oracle market share – acting as significant potential threats for the core business of Oracle and its industry leading database software. In order to maintain market share and profit margins Oracle will need to expand into new areas and invest in continual innovation to keep pace with these competing tech giants.

4) Dividend Income

Oracle reported a dividend of 0.57 USD for 2016, delivering an 18.75% increase over the previous year. For the upcoming year the consensus forecast is for dividends of 0.62 USD the 2017 financial year – representing an 8.95% annual improvement.

5) Value Entry Levels

Oracle shares offer investors a good value entry point into the data solutions sector – with a low price to earnings ratio that presents a relatively cheap buying opportunity. The company currently operates with a price to earnings ratio over 50 percent lower than that of its peers.

Overall the outlook is flat for Oracle shares over the medium term. The company has the fundamentals in place for moderate growth for 2017 and 2018. However, the competition in the tech sector is intensifying at a quickening pace – especially in the data storage and management sector – which has significant potential to lead to reduced bottom line for Oracle as soon as the medium term time frame.