Salesforce.com, Inc. is an American cloud computing company, operating in the spheres of customer relationship management and commercial social networking. The company will report earnings tomorrow, on August 29 after the closing bell. The consensus EPS forecast for the quarter is $0.12. The reported EPS for the same quarter last year was $0.09.

Earnings reports can seriously move the price of the underlying stock and should, therefore, be closely watched by the traders, as there is a chance to capitalize on sudden price fluctuations.

The direction of the price movement will depend mostly on the information, disclosed in the earnings report. Should the data meet the expectations of experts and investors, the stock price can be expected to go up. If the opposite is true, the price can be expected to deteriorate.

Reasons to buy

Salesforce is the world’s leading customer relationship management (CRM) platform. The company was the first one to sign up big international clients and has, therefore, established itself as a clear industry leader with a strong market position. Salesforce has been the world’s #1 CRM company for 13 years in a row. The global CRM market was estimated to be worth $39.5 billion back in 2017. This year it is estimated to grow 16%. A great opportunity for Salesforce to grow its revenue.

Salesforce’s revenues continue to demonstrate decent growth. During the last one quarter, for example, the company’s revenue went up over 27%. The growth is not only attributed to Salesforce (the product) itself but is backed by all business departments. The company has also raised its revenue outlook for fiscal 2019. Year over year, revenue is expected to demonstrate 25% growth. The company has reached the $10 billion mark in fiscal 2018 and now can be expected to surpass the $20 billion threshold in the foreseeable future. Zacks experts believe this will be done through strategic acquisitions and diverse cloud offerings.

More about acquisitions. The latter have always constituted a considerable portion of Salesforce’s growth. Over the last few years the company has acquired businesses with a combined value of over $4 billion. 13 takeover deals have been finalized in 2017 alone. MuleSoft is so far the biggest acquisition of Salesforce. Strategic merges and acquisitions are traditionally viewed as a good way of expansion.

Only 30% of revenues are generated abroad, while the other 70% come from its domestic market, the United States. For its prime competitors, the share of foreign markets is usually closer to 50%, which means that Sales force has still plenty of room for further expansion of its international operations, be it in Europe or in Asia. As a part of this strategy, the company has invested $100 million in European start-ups. In fiscal 2018 revenue, coming from Europe, demonstrated a 38% growth. 18% of the total revenue came from this region.

Possible risks

Too many acquisitions can be just as bad for the business as they facilitate long-term growth. The balance sheet of Salesforce could be negatively affected in the form of a high level of goodwill (totaled $7.4 billion or 32.4% of its total assets as of April 2018). Acquisitions have an ingrained integration risk that can stall both the mother company and the acquired business. The former can also negatively impact organic growth, which will later translate into lower than expected stock price increase.

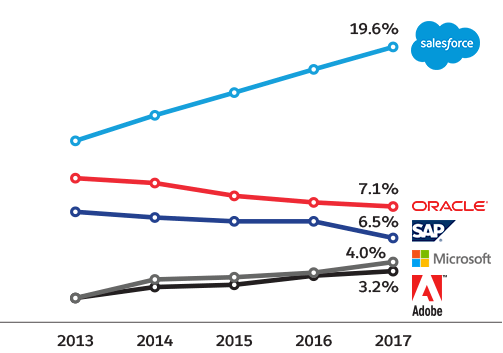

Tough competition from a lot of big names, including Microsoft and Oracle, is another risk factor to consider. The cloud-based CRM market, though big, is still limited. Should one of the above-mentioned companies come up with a radically new CRM decision, Salesforce may lose a portion of the market share and, who knows, maybe even its dominant position (which is still quite unlikely).

With a trailing 12-month P/B ratio of 9.37, the valuation looks a little bit stretched. A lot of potential investors may find this enough not to entrust Salesforce with their money.

The outlook is neutral to positive, with a chance of the stock price going up once the earnings report is revealed to the public. However, should the company report lower than expected earnings, it may lose a portion of its value (even if only for a short period of time).