Blockchain is the hottest topic now, together with Bitcoin and cryptocurrencies. However, if some people are worried that Bitcoin might be a bubble, almost everyone agrees that the technology behind it is disruptive and will continue its path to the point of full adoption and integration with the internet.

Even Jamie Dimon, the CEO of JP Morgan, who was so critical against Bitcoin and caused so much agitation in the cryptocurrency community, agrees that the distributed ledger technology (DLT) has great potential to change the financial and other sectors. Moreover, JP Morgan tests blockchain for different use cases together with other banks. But first, let’s define it.

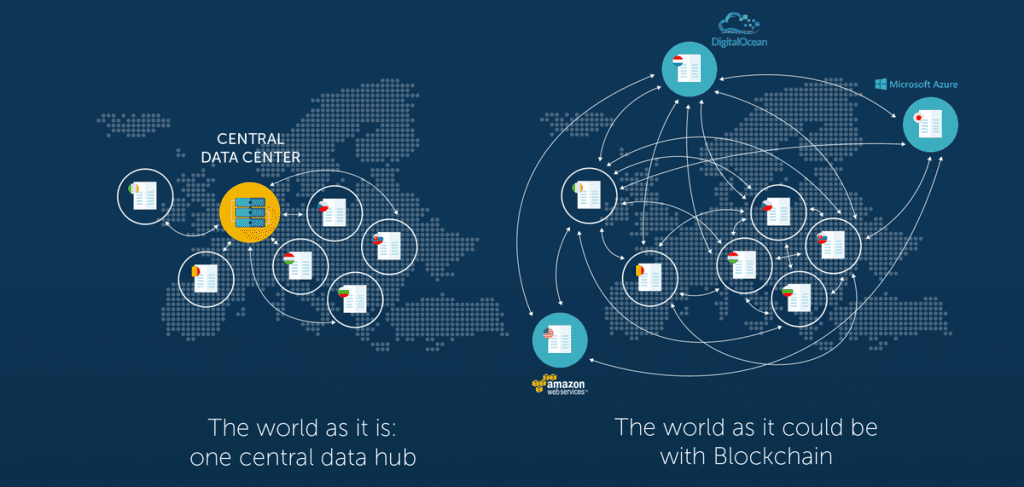

There is nothing complicated about blockchain – it is a distributed ledger or database within a network. The ledger is shared by all the network participants, suggesting that the whole system has no single authority and has no single location, as multiple replications of the same ledger version are simultaneously located in many places.

All of these replications get updated when new data or transaction is recorded into the blockchain through the consensus of all participants. Miners are responsible for approving transactions and monitoring the network by solving sophisticated formulas with the help of computing power. It is a peer-to-peer (P2P) system that removes all intermediaries, which increases security, transparency, and stability, and reduces costs and human errors.

Blockchain and the Internet

Today, we can divide the modern technology era into two distinctive periods: before the internet and after the internet, this is how disruptive the World Wide Web has become. The internet boom transformed the way we carry out transactions, communicate, share information, promote business, entertain, study, and so forth.

You would think everything we do now is somehow connected to the internet. Well, many experts like to think that blockchain technology has the potential to generate the same revolution as the internet has done.

Here are some aspects of today’s blockchain hype, which are very similar to the internet boom before 2000:

- The experts agree and bring us to the attention that blockchain has the potential to change pretty much everything.

- Big companies are investing in blockchain and test it for different use cases, being very positive about its capabilities.

- People invest in almost any project that is somehow related with blockchain. For example, a NASDAQ listed company changed its name from Bioptix to Riot Blockchain and saw its share price surge by more than 20%. Elsewhere, a UK investment firm changed its name from On-line Plc to On-line Blockchain Plc and saw its price jump by 394% at some point.

- There is no blockchain infrastructure at the global or international level, but the enthusiasm and number of pilot tests are

- People don’t really understand what it is, but they are sure it can transform our lives.

Will the History Repeat Itself?

Given the long list of similarities between the two eras and phenomena, some experts warn that the blockchain hype might end the same as the dot come bubble did in 1999, and then reach a maturity level when it gets widely adopted. It means that the blockchain industry creates the conditions for overvalued assets, which can potentially cause a future market correction that may affect many companies and whole sectors.

I don’t know the future, but I know that despite the correction or crisis from 1999, the internet didn’t disappear, but continued its direction by shaping whole industries. I think the same will happen with blockchain technology, suggesting that it won’t be affected entirely by a potential correction.

Blockchain can really transform markets, as we can get the control over every transaction, contract or any move inside a network. We can make transactions and P2P processes become fully transparent, secured with the help of cryptography, time-stamped, and easy to monitor. This is different from today’s internet, where intermediaries play the key role. Companies like Facebook, Google, governments, banks, tech companies are all intermediaries that affect the information and processes within the internet network. Blockchain remove such players for the benefit of everyone.

What We Have Today?

Blockchain is at a nascent stage today. Here are a few examples where companies and governments test the technology:

- A few days ago, energy giants British Petroleum and Shell announced that they would lead a consortium and venture capital firm along with other oil companies and banks, to create a commodity trading platform based on blockchain.

- R3, a blockchain-oriented consortium of banks, recently announced the development of a real-time payments infrastructure. Some banks that will get involved in the project are HSBC, BBVA, Barclays, Commerzbank, CIB, and US Bank among others.

- A consortium of South Korean banks and financial institutions announced a blockchain-based project called Chain ID, which is to be used for user authentication.

- IBM Watson Health and the Centers for Disease Control (CDC) will collaborate to test blockchain technology and promote its adoption in the healthcare sector at the US federal level.

- The Monetary Authority of Singapore (MAS) and the Hong Kong Monetary Authority (HKMA), which act as central banks, announced a collaboration to create a blockchain ecosystem.

- The Information and Communications Technology Council (ICTC) of Canada along with other entities will work towards creating a national blockchain ecosystem.

- In Spain, Alastria, a consortium of banks, telecommunication companies, universities, and other entities, will form a national blockchain system. The list of members includes BBVA, Banco Santander, Banco Sabadell, Fujitsu, Deloitte, Orange, and Gas Natural Fenosa among others.

- Hyperledger, a blockchain-based project, connects banking and tech giants across the world. Some names include IBM, Cisco, Baidu, Samsung, Airbus, Huawei, and more.

- Russia announced that it would test blockchain for its Unified State Register of Real Estate.

- JP Morgan announced a partnership with other banks to launch a blockchain-based Interbank Information Network (IIN).

- The Australian Stock Exchange (ASX) should announce in December whether it would fully adopt blockchain for settlement processes. At this point, the exchange is testing it.

The Final Note

The list of blockchain use cases and companies testing it can go on. I have tried to make an image so that you could see how it is slowly adopted in different regions of the world, from the US to Russia and from Europe to China or Australia.

Given the significant advantages of DLT – among which we can name transparency, decentralization, security, anonymity, equality, and low-costs – we can rest sure that the technology will show its full capacity in the years to come.