Five most important news to start your day. These events are very likely to influence the market and trigger exchange rate fluctuations. Read to stay informed.

China Can Achieve Its GDP Growth Target, or Can It?

China’s Premier Li Keqiang believes it is still possible for the world’s second largest economy to achieve the anticipated growth rate of 6.5 percent per year, the lowest in 26 years.. During the previous year the economy of China grew at a 6.7% rate. The country’s economic development is now primarily connected to domestic demand.

Losing momentum can be dangerous for the well-being of China’s economy. A wide range of negative effects — ranging from decreasing FDI to political instability — can be expected in such a case.

Oil Prices Recover

This Tuesday crude oil futures grew for the fourth consecutive day. Brent crude futures grew 14 cents, or 0.3% and were last traded at $46.04. WTI crude futures added 12 cents, also a 0.3% increase. The latter are currently traded at $43.52. The oil market has been steadily declining for the last five weeks but demonstrated a humble recovery four days ago. Whether the prices have been moved up by OPEC initiatives or not is yet to be seen.

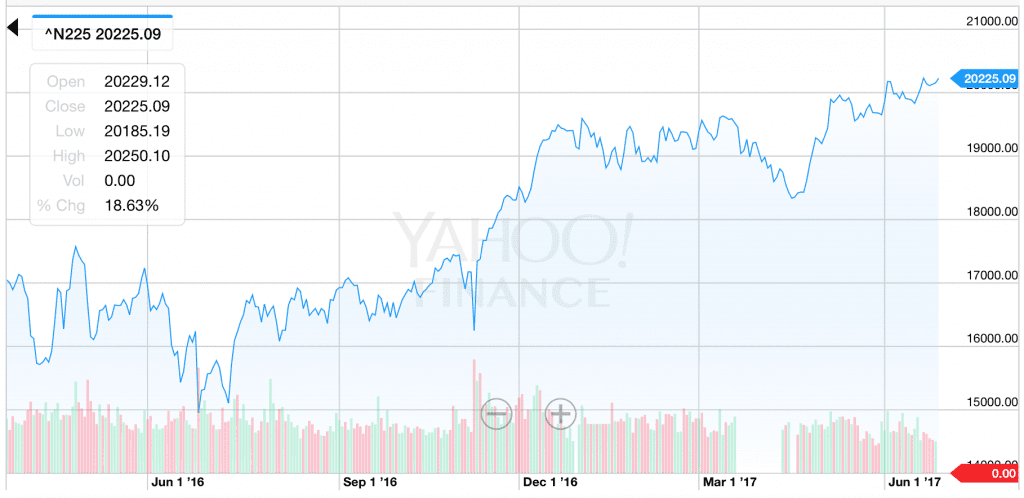

Japanese Stocks on The Rise

Japanese stocks are now ready to reach a two-year record-high level. Strong dollar, which benefits the exporters, is partially responsible. Another interest rate hike, promised by the Federal reserve, can very well contribute to the further expansion of the Japanese export-fueled economy. The Nikkei 225, a stock market index for the Tokyo Stock Exchange, was up 0.3 percent and equal to 20 210. To set a new record it needs to reach the level of 20 318, last seen in 2015.

Cryptocurrencies Crushed

How close is the end of the cryptocurrency bubble? Some may think that closer than ever after witnessing a sharp decline in cryptocurrencies on Monday. Bitcoin lost as much as 15% of its value in a matter of hours. And this is not an isolated incident.

Etherium demonstrated a flash crash during the previous week. The website of Coinbase, a San Franciso-based cryptocurrency exchange service, was reported to be down at some point in time due to massive selloff.

FDI Boost for Egypt

Despite socio-political instability the officials of Egypt expect an FDI boost in the coming months, all due to now finalized investment regulation. Greatly damaged by the 2011 revolution, Egyptian economy relies on international help and seeks recovery by the means of cheap loans (such as $12 billion International Monetary Fund lending program).”Within the last 4 months (ending in May) we already achieved $6.8 billion and based on that I am projecting that we go beyond the initial target,” said one of the top-ranking Egyptian officials.