The scalping strategy involves making multiple short-term trades to catch small changes in an asset’s price. It is widely used by day traders, who open anywhere from 5 to dozens of short positions, generating the outcomes of numerous deals. Sounds exciting, doesn’t it? Let’s dive in and figure out how to use the scalping strategy in trading and get optimal results.

How does scalping work in trading?

The main idea of trading with the scalping strategy is very straightforward. A fast scalper’s goal is to acquire a positive outcome over multiple short deals with small returns. Normally, scalping is performed intraday, which means that all the deals are opened and closed within one trading session (before the market closes).

Consequently, the length of the deals is also quite short. Depending on the market and the trader’s approach, a deal can last from several seconds or minutes to several hours. Scalpers may quickly close deals to move on to the next one and acquire results from a sequence of small trades.

Pros and cons of the scalping strategy

As with any strategy, scalping is not for everyone. It has some advantages and disadvantages that may be a dealbreaker for some traders. Have a look at the main points to consider and see if this strategy could work for you.

| Pros of scalping | Cons of scalping |

| Fast trading: all deals are opened and closed within the same day | Time-consuming: scalpers make dozens of trades during the day |

| No need to wait for big market moves: scalpers can trade even on small price fluctuations | Potentially higher risks: scalping often requires more leverage to maximize profits |

| No fundamental analysis required | Discipline: scalping strategy requires concentration and dedication for a trader |

How to scalp trade effectively?

Since scalp trading is extremely fast-paced, it’s important to act quickly. Here are some tools and traderoom settings that may help you achieve optimal results with the scalping strategy.

- Chart types. Since this analysis is all about making short-term deals, the convenient chart types to use may be bars and candles.

- Timeframes. It may be more convenient to set your charts to short timeframes (one-minute, five-minute and so on) to spot the smallest price changes.

- Technical analysis. Scalp traders can use technical analysis to assess the market and understand the trend direction. Technical indicators can also show potential entry points for your trades.

You can test different tools and approaches as a part of your scalping strategy. Here’s an example of a scalp trading strategy using the Moving Average Ribbon method.

The Moving Average Ribbon method for scalping

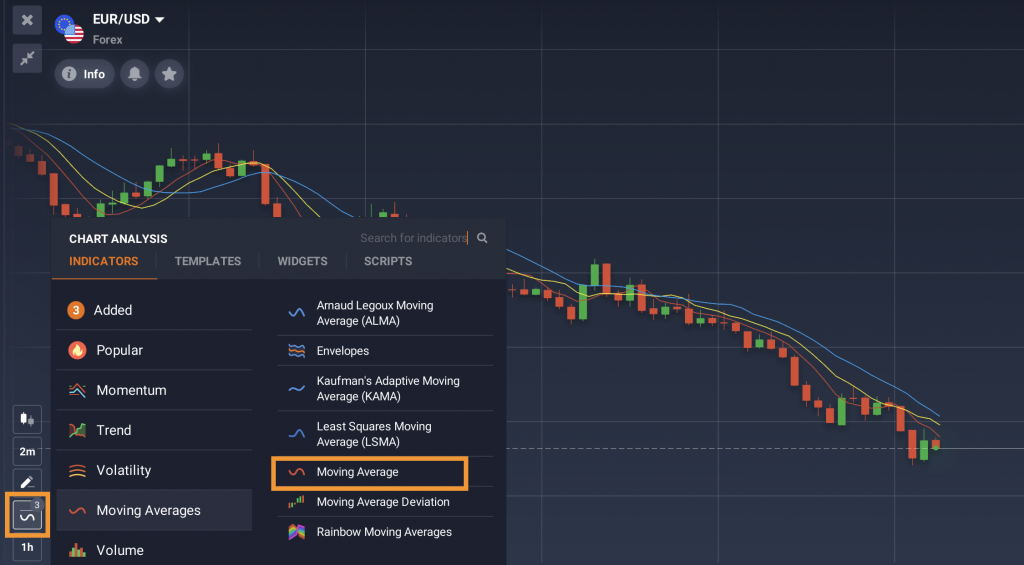

1. Go to the ‘Indicators’ section of the IQ Option traderoom and find the Moving Average indicator.

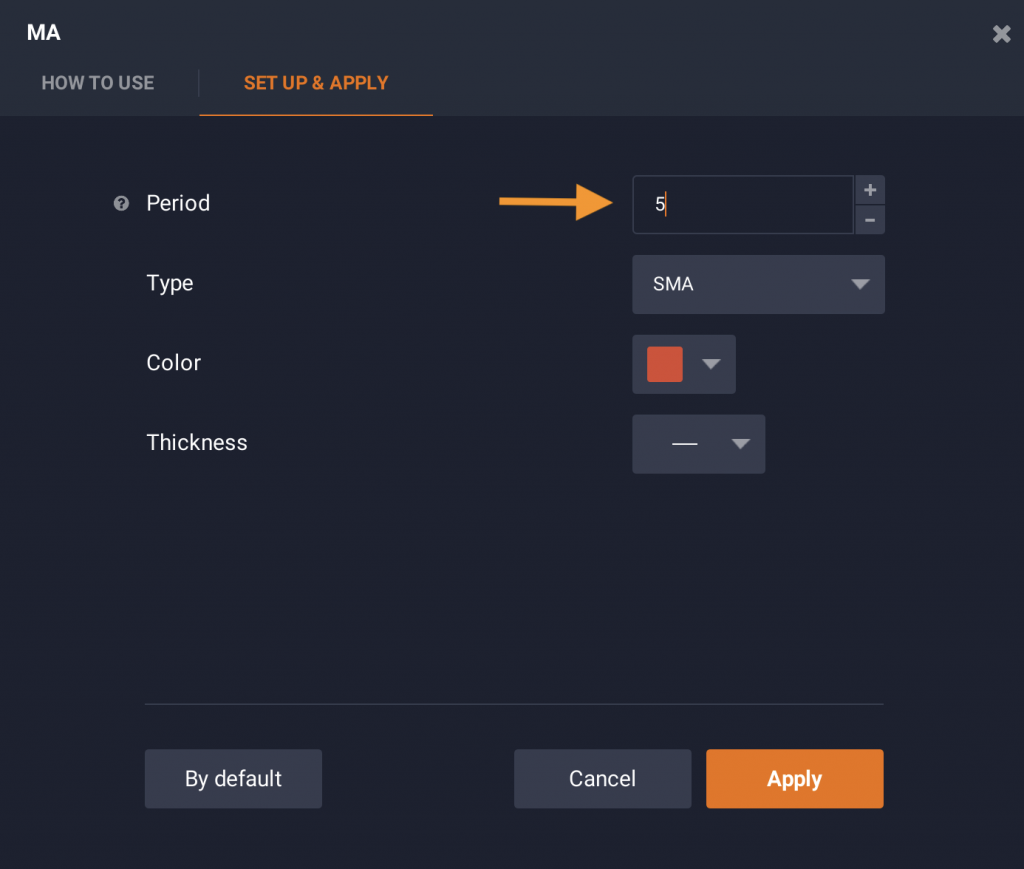

2. Add this indicator to the chart three times with different periods: 5, 8 and 13, creating the Moving Average ribbon. It’s better to choose bright colours for each indicator to see them clearly on the chart.

3. Begin by applying this method on the two-minute chart to identify strong short-term trends. Keep an eye on the ribbon as it moves and reflects even small price fluctuations.

When the main price line stays close to the 5- or 8-period MA (red and yellow), and all three Moving Averages point in one direction, it may indicate a strong trend in that direction. However, if the price line crosses the 13-period MA (blue), it may signal an upcoming reversal.

Fast scalpers then wait for all three Moving Average to turn in one direction (higher or lower) and spread out, creating more spaces between the lines. This pattern might signal an opportunity to open a BUY or SELL position in the direction of the new trend.

So, are you ready to try the scalping strategy? You can test it on the free IQ Option demo account first to get some experience and choose the best settings for optimal results.