2023 was a year of great market volatility, bringing strong price fluctuations that attracted many traders. As economic and political instability seem to continue in the new year, 2024 might bring new opportunities to traders and investors alike. May this be a suitable time for novice traders to enter the market? The answer depends on your personal financial goals.

To decide whether to start trading in 2024, you may consider your short-term and long-term financial objectives. Firstly, you should understand the difference between trading and investing. By enhancing your knowledge about the pros and cons of each approach, you may focus on the suitable option for you and choose the best tools and methods.

Once you figure out the difference between trading and investing it may be time to gather more information about assets for trading and choose the appropriate tools according to your trading preferences and style.

What to Trade in 2024?

Choosing the right trading instrument for you is one of the most important things. What do you prefer: binary options, stocks, forex, cryptocurrency? Maybe you are specifically interested in trading commodities? Or perhaps you don’t mind trying them all when trading in 2024?

All types of assets for trading have their own characteristics and may require different trading methods. For example, binary options and forex are among the most popular assets for trading. While having a diversified portfolio with different types of assets to manage risks is important, trading too many assets at once may be confusing for novice traders.

Below is a list of the most popular assets for trading and their characteristics.

Binary Options

Binary options are financial tools that let traders predict the future price of an asset. By engaging in binary options trading, you are essentially guessing whether the asset’s price will be higher or lower than its current value at the expiration time.

- If you choose Higher: you get profit if the closing price is higher than the opening price.

- If you choose Lower: you get profit if the closing price is lower than the opening price.

You may get the following results after closing a binary options trade.

- Your prediction was correct: investment back + payout %.

- Your prediction is incorrect: loss of investment.

- Closing price is at the same level as the opening price (“equal” result): return of investment.

When trading binary options, it’s important to choose the right strategy and apply suitable risk-management tools.

Digital Options

Digital options share a similar foundation with binary options, but they can potentially offer higher returns— up to 900%. However, keep in mind that higher payouts often come with higher risk. To open a digital options trade, you should predict whether the price of the underlying asset is going to become higher or lower than a strike price, a predetermined price level that a trader needs to choose. You can review and pick the strike price in the ‘Expiration’ tab of the traderoom.

- If you choose Higher: you get a profit if the closing price is higher than the strike price.

- If you choose Lower: you get a profit if the closing price is lower than the strike price.

You may get the following results after closing a digital options trade.

- Your prediction is correct: investment back + payout %.

- Your prediction is incorrect: loss of investment.

- Closing price is at the same level as the strike price (“equal” result): loss of investment.

The closer the strike price is to the current price of the asset – the lower your risks and potential profits.

Stocks

A stock, also known as a share, represents fractional ownership of a company. When you buy a share of a company, you are essentially buying a small piece of ownership of that business.

However, you don’t always need to actually purchase stocks for trading. You may choose to trade stocks as CFDs (Contract for difference). In this case, instead of buying a share, you would simply try to predict the direction of the future price fluctuations of the chosen asset. Depending on whether the result confirms your predictions, you may receive a profit or lose the initial investment.

On top of that, when trading CFDs, it may be possible to achieve positive results not only when the stock price increases, but also in case of a decline. This method is called short-selling, and it may offer a variety of trading opportunities in a downward market.

There are nearly 190 stocks for trading via CFDs on the IQ Option platform that include the most traded stocks from top global companies. You may choose stocks from different sectors that might perform better during certain business cycles. Check out this article to learn more about how to analyze stocks for trading and understand how CFDs on stocks are traded.

Forex

The term “Forex” refers to the foreign exchange market, or simply FX. The forex market is the largest and most liquid market in the world. This means larger trade volumes due to high demand and risks linked to market volatility. Here are 2 basic steps that may help you understand forex better when trading in 2024.

Pick a suitable trading approach

There is no one forex trading method that suits everyone. One thing you should always remember is that the forex market is open 24 hours a day 5 days a week. There are busy periods that tend to have larger trade volume and significant price fluctuations, so it may be important to choose the suitable time to trade forex. If you cannot trade during the busy periods, you may need to consider a personal forex trading approach that would suit your schedule.

Choose your currency pairs

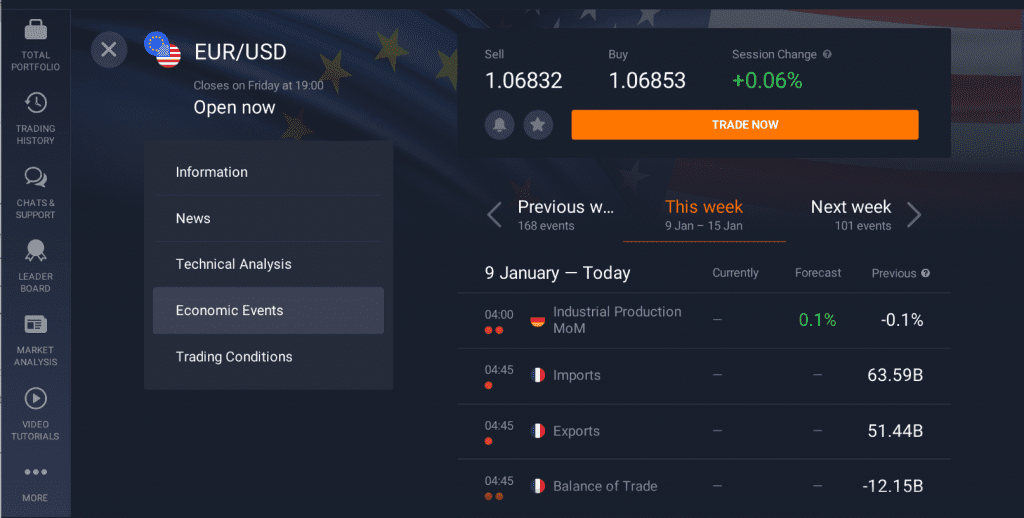

It is also important to settle on the currency pairs for trading, which are generally put into two main categories: major and exotic. The former are represented by the most popular forex pairs such as EUR/USD, GBP/USD, USD/JPY and USD/CHF. The exotic pairs are less common, but they may sometimes be more volatile. These include currencies like the Mexican peso and the Swedish krona.

Each currency pair may be affected by different external factors, so you might want to stay informed about the market news related to the chosen assets. For instance, you can check the most important events that may influence specific currency pairs right from the IQ Option platform. This way, you can start trading forex while staying on top of current news and learning about assets for trading without leaving the platform.

How much do you need for trading?

Some people think that trading requires investing large funds. However, some traders begin their journey even with small investments. For instance, the minimum deposit on IQ Option is $10 or an equivalent in your local currency. With a minimum trade amount starting from $1, traders may choose assets for trading that suit their financial conditions. Don’t forget about the risk-management rules and instruments – they may help you identify risks and manage them.

How to get trading experience?

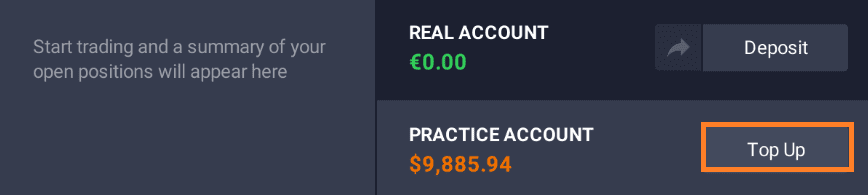

It may be a good idea to first test your ideas on the free demo account on IQ Option. It includes a $10 000 balance that can be topped up for free at any moment, so you can use it risk-free as long as you need before making the first deposit.

In Conclusion

If you are planning to enhance your trading in 2024, it is important to be more flexible and keep learning and testing different methods. Devoting some time to studying and practicing various trading methods may help you identify opportunities and get more consistent results. You might also want to keep in mind risk-management instruments and actively include them in your trading approach. Test your method and don’t get discouraged if something doesn’t work out right away — mistakes are a part of the learning process, they help us get more experience and move forward.