Major last week’s events:

- Korea: Trump- Kim Jong-un summit is scheduled for the end of May-beginning of June.

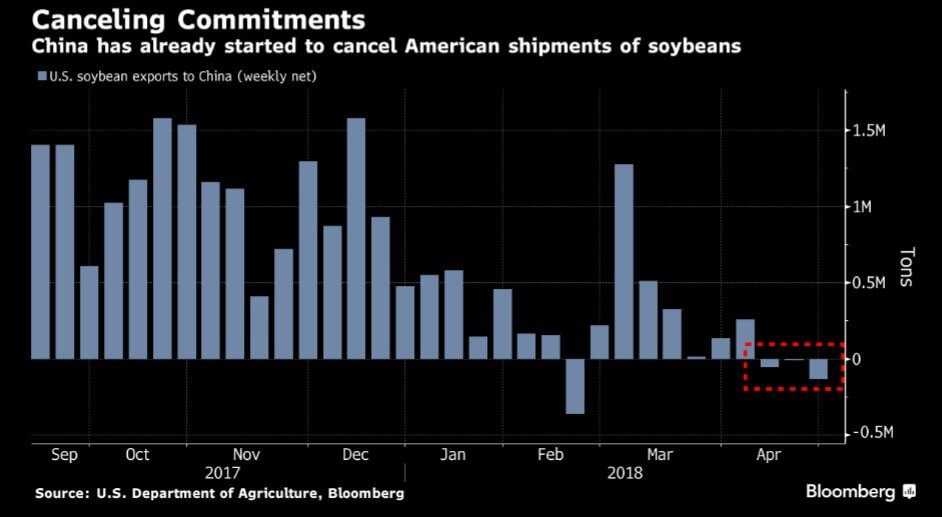

- Tariffs front: On Tuesday, EU’s, Canada’s and Mexico’s exception from current steel and aluminum tariffs was extended up until the 1st of June. On Wednesday, RUSAL (Biggest Russian Aluminum Exporter) could stop being blacklisted in USA, if Oleg Deripaska (current major shareholder, and the target of US sanctions) reduces his holdings at the company. On Thursday, US trade team visited China, but no concrete results have been announced. Meanwhile China’s importing of Soybeans have already decisively decreased.

- Expiring deal with Iran. Trump’s decision has not been made or published yet.

- Cryptos: Total market cap increased to 464B$

Last’s week’s forecasts played well:

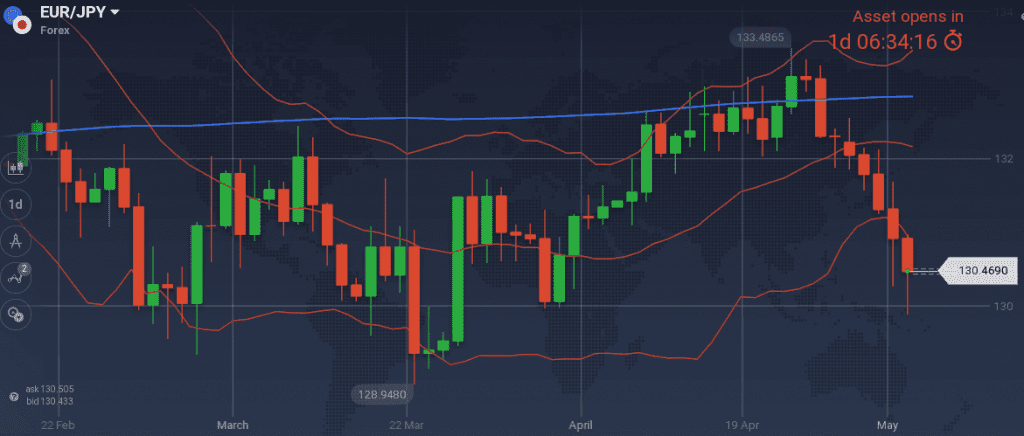

- Keeping my short EUR/JPY position paid off, but adding to my position was not possible, as the 132.60 level was never triggered.

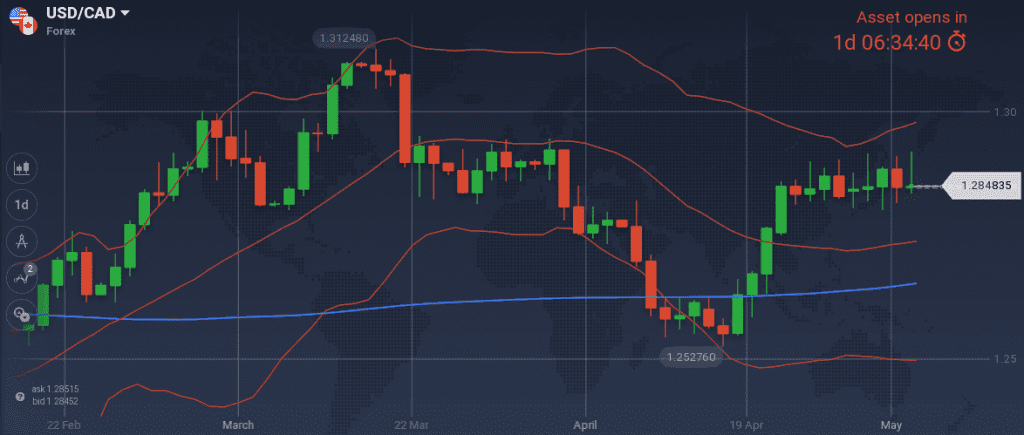

- USD/CAD moved in a narrow range of 116pips and did not triggered the noted entry levels.

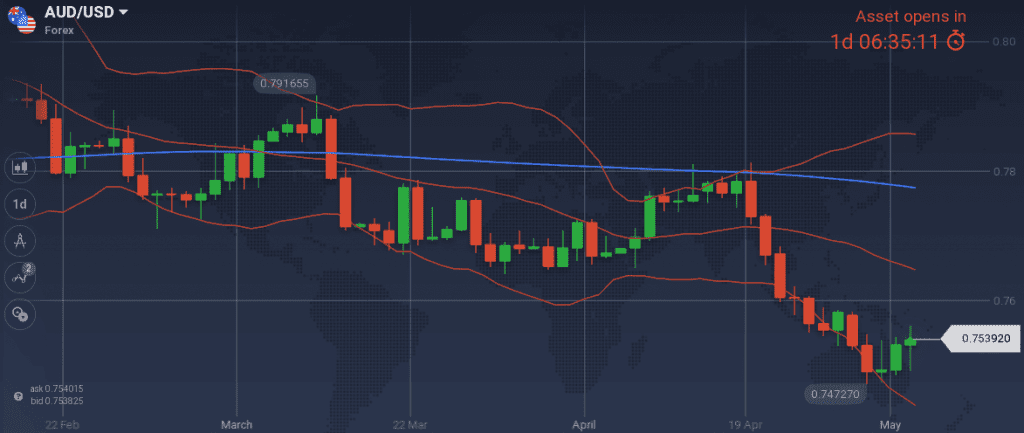

- My forecast to enter long AUD/USD at 0.7475 hit bulls-eye.

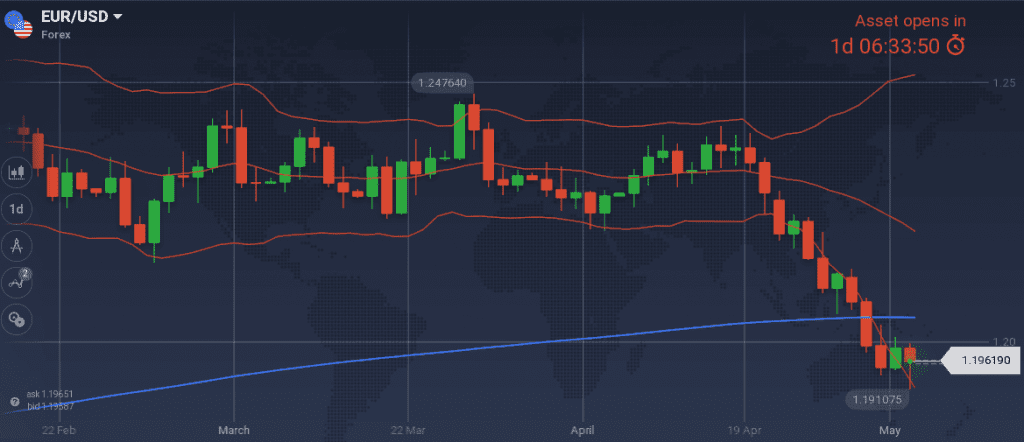

- Continuing shorting EUR/USD pays off.

- No forecast was made for the pairs of GBP.

Major next week events:

- Monetary Meetings of BOE (Central Bank of UK) on Thursday

- On Saturday (12th of May), current Iran deal expires. Trump has a final week to decide on the continuation of current deal or sanctions restart and EU-Russia-China would need to react quickly on his decisions.

JPY

I keep my short EUR/JPY bias and add positions at 131.85~131.95 range, as we are heading into a week full of macro announcements.

Snapshot:

- Inflation (excluding food-National core CPI) at 0.9% (vs 2.0% target), BOJ members expect a reading of 1.2~1.3% within 2018, BOJ rate at -0.1%

- GDP at 2.0% annual, 0.4% q/q, 10Y Government bonds yield at 0.04% (-2bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- QQE could stay in place up until 2020 or beyond. It will take time to change the attitudes of Japanese firms so that they start increasing the wages and their prices, and thus putting pressure to inflation

- decreased monetary base strengthened JPY further

Weaknesses of JPY:

- decreasing of bank lending

Watch:

- Tuesday’s 10y Bond Auction. Latest auction yielded 0.03%. I want to see a higher yield so that the continuation of QQE scenario is helped and JPY is strengthened.

- Thursday’s 0.50GMT Bank lending and Current Account. A number above 1.9% Bank lending and above 1.02T¥ helps my long JPY scenario.

- Next Monetary Meeting on 15th of June

CAD

I still believe that USD/CAD is set to range between 1.2695 and 1.3150 levels in the coming months.

Canada’s economy is running near it’s potential within macroeconomic targets. Last week’s announced trade balance and PMI reading are favoring long positioning on USD/CAD. On the other hand, the increased GDP reading is favoring CAD.

I keep my last week’s idea to search to go long at 1.2690~1.2700 levels. Increased lending is what I want to see, to speculate on next rate hike.

Snapshot Unchanged:

- Inflation increased at 2.3% (vs 1.0%~3.0% target range), BOC rate at 1.25% (3 hikes so far). Note BOC’s confidence on neutral rate within 2.5%~3.5% range.

- GDP at 2.9% annual (near potential GDP), 0.4% qoq, 10Y Government bonds yield at 2.33% (+1bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- Terms of trade (latest reading -4.1B CAD) favors USD

Weaknesses of USD/CAD, strengths of CAD:

- high oil prices. Note that the correlation between CAD and oil, used to be stronger in the past. During the last weeks, it fell to insignificant levels (0.15) and even turned negative (now stands at -0.36).

- Nafta deal happening within this week is not certain. Rules for car manufacturing, government procurement and agriculture are obstacles that need to be overcome, as time is ticking away and Mexico’s elections in July are approaching.

Watch:

- No market moving announcement is expected other than the outcome of Nafta talks. A meeting is supposed to be scheduled as early as Monday 7th of May.

- Next Monetary Meeting on 30th of May

AUD

0.7475 proved to be the perfect level to build a long position on AUD/USD and I intend to add to this position targeting to 0.7660 level.

More long positions could be taken at 0.7475 (if it is re-triggered) and at 0.7440

Snapshot Unchanged:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (3.0% could be achieved within 2018 and 2019 according to RBA), 10y Bond yields at 2.77% (-5bps w/w)

- Unemployment at 5.5% and expected to decline further

Strengths:

- improved trade balance and increased building approvals

Weaknesses:

- household consumption is a source of uncertainty. Anything that quantifies household consumption (credit growth, wage growth, private capital expenditure) should be noted in the coming months

Watch:

- Monday’s 2.30GMT Business Confidence release. I want to see a number higher than 7 to strengthen my long bias.

- Next Monetary Meeting on 5th of June

USD

Last week’s FED’s statement introduced the “symmetric 2% inflation objective” versus the previous 2% level targeting. It feels that everyone is expecting inflation overshooting during the 2nd half of 2018 but no aggressive measures will be taken.

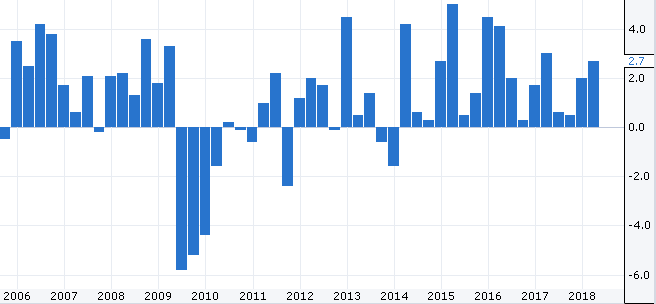

Meanwhile, macros are strong, first reading of q/q unit labor cost risen to 2.7% (vs 2.5% on Feb 2018 and 0.2% on Nov 2017), Vehicle sales increased, PMI numbers rising.

I am exiting USD long positions at current levels, and search to re-enter long the next week, after Trump’s decision on the Iran deal.

Snapshot:

- Inflation (Core PCE) at 1.9% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far and another 6 hikes expected by the end of 2019 to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP at 2.9% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.95% (-1bps w/w)

- Unemployment fell to 3.9% and expected to fall to 3.8% in 2018

Strengths of USD:

- strong macros, increasing bond yields

- geopolitical risk

Weaknesses of USD:

- protectionism

- increasing oil prices

Watch:

- Wednesday’s 18.00GMT 10y G-Bond Auction. Latest number was 2.80% and I want to see something bigger for my long USD bias to be valid

- no reason to focus on inflation readings of the week, like the core CPI release on Thursday. Given the symmetric wording, markets would need to see significantly big numbers to move

- Friday’s Consumer sentiment and Inflation expectations. Anything above 98.4 and within 2.7~2.9% inflation expectations does not change my views.

- Next Monetary Meeting on 13th of June.

EUR

I am keeping my short bias towards EUR/USD as the pair crossed south the 200DayMovingAverage. Both GDP (Economy’s Growth) and Core CPI (Measure of Inflation watched by ECB) decreased showing that European Economy is losing momentum despite the very accommodating monetary policy

Nice entry points to add to short positions is 1.2087 level.

Snapshot:

- Core CPI Inflation fell to 0.7% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP fell to 2.5% growth, 10y Bond yields of EFSF at -0.40% (+3bps w/w)

- Unemployment at 8.5%

Strengths of EUR/USD:

- latest tiny increase of both Service PMI reading (55.0 from 54.9) and Manufacturing PMI (56.2 from 56.0)

Weaknesses of EUR/USD:

- recommendations from Paul Thomsen (IMF) for continuation of very accommodating monetary policy in EU

- the different point in the cycle between US and EU economy

Watch:

- Wednesday’s 30y Bond Auction. Any yield below 1.15% validates the short EUR/USD bias

- Thursday’s French and German Bank Holliday

- Next Monetary Meeting on 14th of June

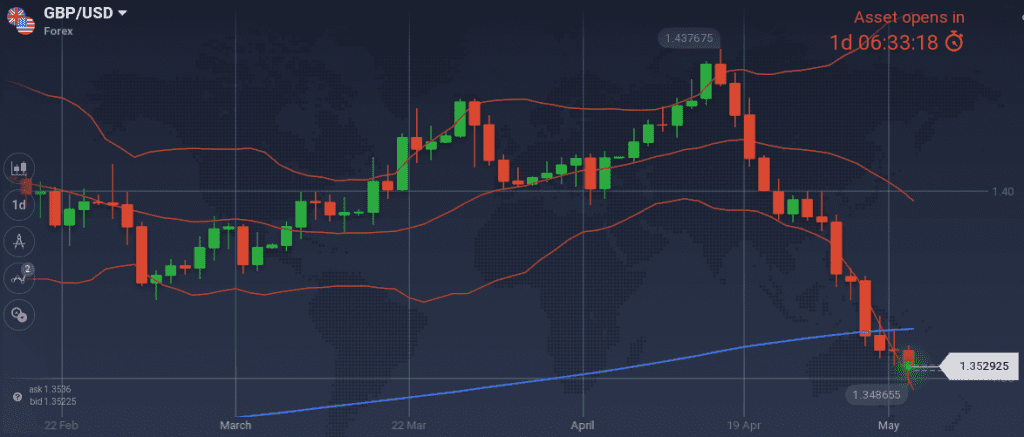

GBP

GBP ‘s anticipated correction continued during the week. The higher Construction and Service PMI where not enough to support a bounce back up, possibly because of the very low M4 reading

I will wait for the press release of the upcoming Monetary Meeting on Thursday to decide on next trades.

Snapshot:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.50% (a second hike on Thursday was anticipated for the last 2 months, but now is not)

- GDP at 1.2% growth (vs 1.4% previously), 10y Bond yields at 1.40% (-5bps w/w)

- Record low unemployment at 4.2% (42 years low)

Strengths:

- GBP/USD is currently testing the 200DayMovingAverage and a bounce back up is probable

Weaknesses:

Watch:

- The releases of Thursday 9.30 GMT, before the Monetary meeting. Manufacturing Production, Goods Trade Balance, Construction Output. I want to see increased numbers in all these releases before I considering opening new long positions at GBP.

- Thursday’s 12.00GMT Monetary Decision. Market consensus does not expect a hike.