Following the last G20 meeting (on 19 and 20 March), IMF meeting that began on Friday and is happening during the weekend, seems to signal that no global agreement is achieved. I am not enjoying the luxury of witnessing what is discussed – it is not live streamed as it happens at Davos WEF – nor do I claim any superior insight, yet my repeatedly communicated strategy of positioning on high tension, high volatility, increasing inflation, increasing bond yields, decreasing equities scenario that favors haven currencies, pays off.

Major last week’s events:

- Syria: Trump is communicating “Mission accomplished”, all NATO members (=including Turkey) supported the 13th April air strike, Russia failed to pass its proposition in UN.

- Korea: As we are heading to Friday’s North Korea – South Korea scheduled summit, Kim Jong-un (North Korea) announced that as of 21April no more nuclear tests will be made. Last week we also learned that Pompeo (= new US Secretary of State, described as a hawk that would favor military actions over diplomacy, who also won approval on Thursday by a Democratic Senator) secretly spent the Eastern with Kim Jong-un.

- Tariffs front: no news, good news

- Sanctions on Russia: USA did not take any further sanctions on Russia despite the formal statement of US ambassador in UN. Worth noted, that Abe (Japan’s PM that met Trump on Tuesday to talk trade and Korea) communicated that Japan could potentially not back USA on sanctions over Russia if it continues not being except from steel and aluminum tariffs.

- Cryptos: Last week’s rally was not short lived. Total market cap at 370B$.

Last’s week’s forecasts played well:

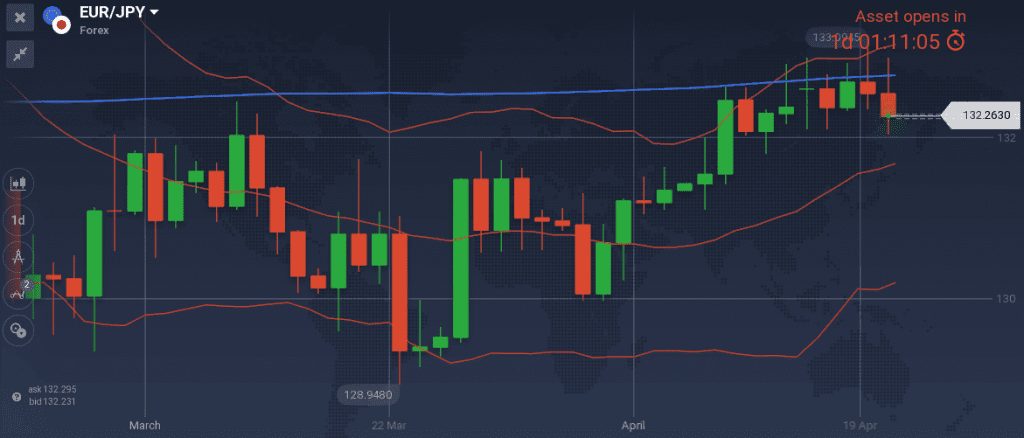

- Keeping previous week’s short EUR/JPY positions paid off.

- No forecast was made for USD/CAD or AUD/USD

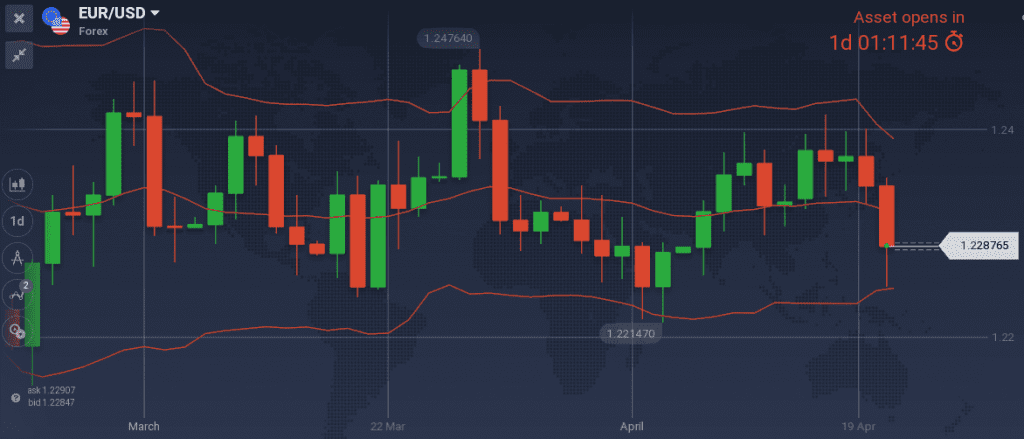

- I missed EUR/USD downtrend. 1.2410 level was in fact triggered and proved to be a splendid entry level, but that was my previous weeks advise.

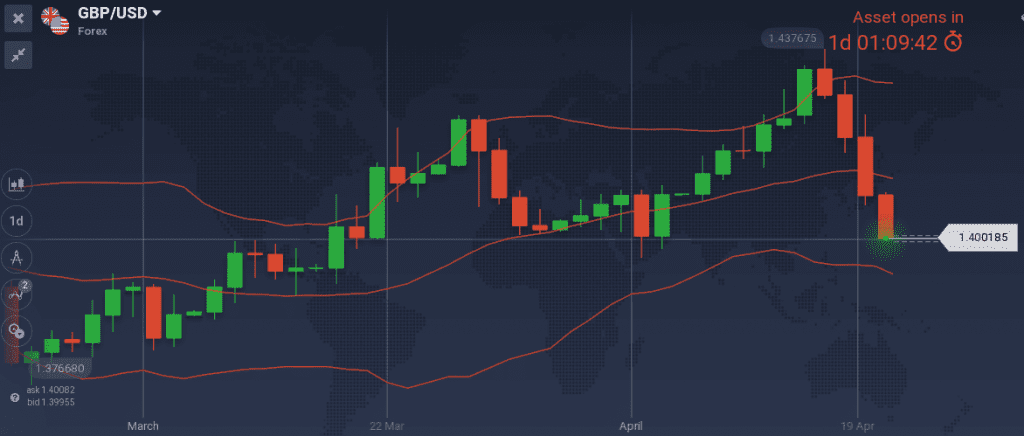

- Long GBP/USD at 1.4050 on the red, long GBP/CAD at 1.7810 pays off, long GBP/AUD at 1.8169 hit bull’s eye (third week in a row that we are enjoying such an accuracy in one of the GBP pairs), missed the EUR/GBP bounce by 10pips.

Major next week events:

- Thursday’s Monetary Meeting of European Central Bank (ECB)

- Friday’s Monetary Meeting of Bank of Japan (BOJ)

- Friday’s Eurogroup in Sofia (Bulgaria). Greek debt could potentially be in the agenda as Greek banks have succeeded in passing latest stress tests.

JPY

As we are heading to Friday’s Monetary meeting, Japan phases a difficult reality. President Abe has not managed to be exempt from US steel and aluminum tariffs nor to settle his country’ s trade relations with US via the TPP agreement. In the meantime, he is most likely set to lose the Presidency of his Liberal Democratic party, over a never-ending scandal regarding public land.

I keep my short EUR/JPY bias and I am thinking of adding short positions following the ECB’s monetary decision on Thursday if I could enter around 131.88 level.

Snapshot:

- Inflation (excluding food-National core CPI) decrease to 0.9% (vs 2.0% target) , BOJ rate at -0.1%

- GDP at 2.0% annual, 0.4% q/q, 10Y Government bonds yield at 0.06% (+2bps w/w) vs BOJ’s target of 0.00% level

- Unemployment at 2.5% (lowest levels since 1993)

Strengths of JPY:

- Last week’s decrease of inflation and increase of government bond yields give good enough reasons for the continuation of the decisive accommodating monetary policy

- geopolitical tensions and possibility of another equity sell-off.

Weaknesses of JPY:

- politics in Japan

Watch:

- Thursday’s 23:30GMT Unemployment rate and Tokyo’s Core CPI release

- Friday’s Monetary Meeting of Bank of Japan (BOJ). No change is expected. Note that current QE program is set at 80T¥ per year (=50B€ À per month), plus 6T¥ ETFs annual purchases (=3.8B€ per month) plus 90B¥ REITs annual purchases (=0.05B€ per month) which is 53.85B€ per month in total

CAD

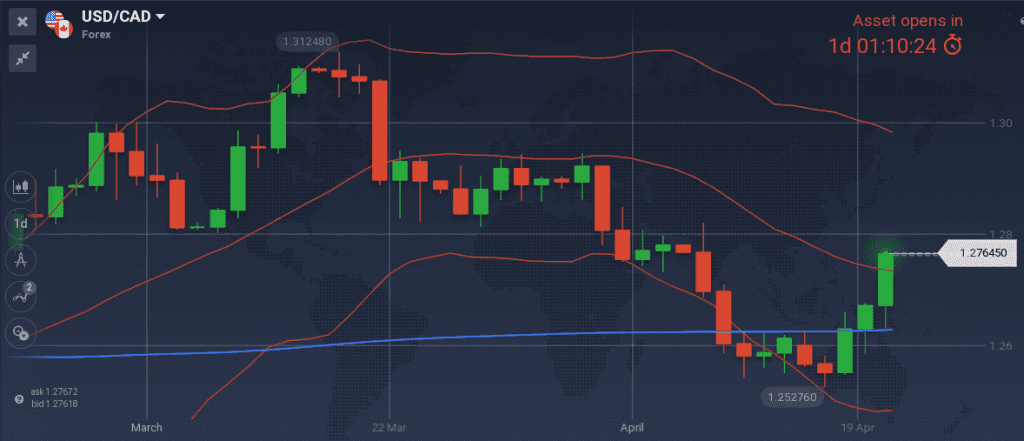

I am having hard time picking a narrative for CAD. I believe that USD/CAD will range between 1.2695 and 1.3150 levels in the coming months, but this has little value to the weekly trader.

Canada’s economy is running near it’s potential within macroeconomic targets, on Wednesday the Central Bank admitted that the real policy rate is continuing to be accommodative and will eventually become neutral but did not gave any insights on the timing. I would want to see some increased lending readings to speculate on next rate hike.

Snapshot:

- Inflation increased at 2.3% (vs 1.0%~3.0% target range) and BOC is confident that it’s models are accurate enough to predict that it will slightly increase and decrease back to 2.0% within 2019.

- BOC rate remained at 1.25% (3 hikes so far) more hikes are coming (since the neutral rate at full potential growth was once again communicated at 2.5%~3.5% range)

- GDP at 2.9% annual (near potential GDP), 0.4% qoq, 10Y Government bonds yield at 2.34% (+10bps w/w)

- Unemployment at 5.8% and expected to decrease further.

Strengths of USD/CAD, weakness of CAD:

- nothing to add other than the last weeks bounce from the 200DayMovingAverage

Weaknesses of USD/CAD, strengths of CAD:

- Oil prices increase but the correlation with CAD decreased slightly from last week’s 0.78 to current reading at 0.70

- Increasing probability of NAFTA deal within the first week of May

Watch:

- Next Monetary Meeting on 30th of May

AUD

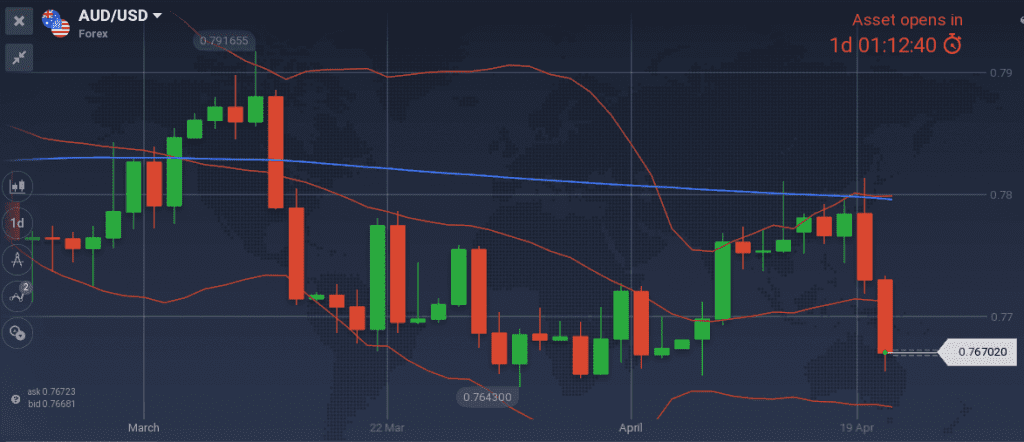

I prefer to keep silent when I have nothing to point.

Snapshot:

- Inflation at 1.9% (vs 2.0~3.0% target), RBA ‘s rate at 1.50% (no hike so far)

- GDP at 2.4% growth (2.8% was 2017 reading), 10y Bond yields at 2.81% (+7bps w/w)

- Unemployment fell back to 5.5% and expected to decline further.

Watch:

- Wednesday’s Bank holiday

- Next Monetary meeting on 4th of May. Note that markets are expecting the first-rate hike no earlier than the first half of 2019.

USD

Both politics and macro releases favoring my long bias on USD. Although the difference between foreign investments in US and USA’s investments abroad fell (from 61B$ to 49B$ m/m) both Capacity Utilization and Federal Reserve of Philadelphia’s Manufacturing Index readings were strong enough.

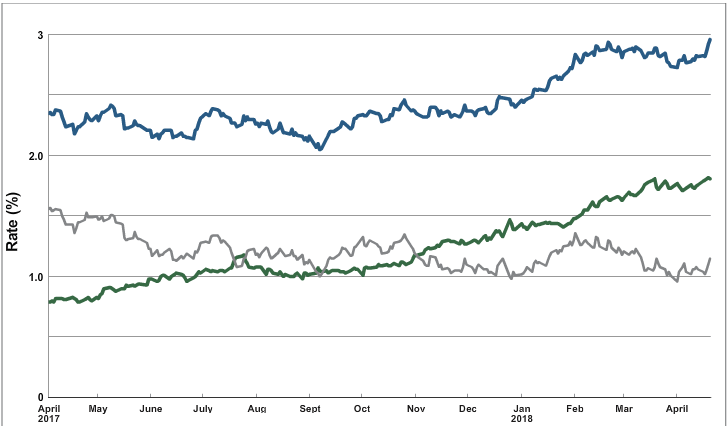

On top we witnessed an aggressive increase of Government Yields.

Snapshot:

- Inflation (PCE) at 1.7% (vs 2.0 target and 1.9% FED’s expectations), FED ‘s rate at 1.75%. 6 hikes so far and another 6 hikes expected by the end of 2019 to reach 3.25%. FED’s view of long run rate remains at 2.75%~3.00%

- GDP at 2.9% growth (FED expects 2.7% in 2018), 10y Bond yields at 2.96% (+13bps w/w)

- Unemployment at 4.1% and expected to fall to 3.8% in 2018

Strengths of USD:

- strong macros, increasing bond yields, weakening of US equities

- geopolitical risk

Weaknesses of USD:

- protectionism, although I should note the absence of new episode in that front

- increasing oil prices

Watch:

- Monday’s 13:45GMT PMI readings and 14:00GMT home sales reading. I want to see Manufacturing PMI above 55.6, Service PMI above 54 and Existing Home sales above 5.54M for my scenario to strengthen

- Tuesday’s 14:00GMT Consumer Confidence. I want to see a number above 126 (=current market consensus).

- Friday’s 12:30GMT first release of GDP q/q. I want to see a number above 2.7% (current reading is 2.9%)

- Next Monetary Meeting on 2nd of May (in 2 weeks). Market was expecting the next rate hike on 13 June meeting but the increase of yields of 3months, 2year and 10y Government bonds may accelerate things

EUR

I am keeping my short bias towards EUR/USD. On Friday Draghi (ECB governor) acknowledged that European macroeconomic readings are getting worse, suggesting that growth cycle has peaked. I am expecting a dovish communication on Thursday’s ECB’s meeting with no change on current QE program (30B EUR monthly bond purchases, scheduled to end on September 2018 or beyond).

Snapshot:

- Core CPI Inflation at 1.0% (vs 2.0% target), ECB ‘s rate at 0.00%

- GDP at 2.7% growth, 10y Bond yields of EFSF at -0.42% (-1bps w/w)

- Unemployment at 8.5%

Strengths of EUR/USD:

- tariffs serial was strengthening the pair, but no new episodes have been seen or expected

Weaknesses of EUR/USD:

- Straight forward recommendation from Thomsen (Director of the European department of IMF) for continuation of very accommodating monetary policy

- divergence of EU’s and USA’s economy that is evident at the 10y Government yields

- core CPI (inflation index watches by ECB) unchanged at 1.0% (next release on 3 May)

- latest decreased Economic Sentiment, decreased German 10y Government yields (at 0.51% -9bps from previous time), decreased Current Account

- geopolitical risk favors USD

Watch:

- Monday’s PMI readings. I want to see decreasing numbers to strengthen my scenario

- Tuesday’s 8:00GMT German Business Sentiment. I want to see decreasing numbers

- Thursday’s ECB’s Monetary meeting. (Apologies to my readers for failing to note this meeting at my last report)

- Friday’s Eurogroup in Sofia (Bulgaria)

GBP

Since the last 10 weeks that I am writing this report, it is the first time I am advising to close all long GBP positions. I believe that current levels are pricing correctly the strengths of UK’s economy and I am not expecting any more good news to push GBP further higher.

Last week unemployment decreased, but at the same time inflation seems back on track (now at 2.5% from 2.7%) to reach Central Bank’s target of 2% without the help of tightening.

Snapshot:

- Inflation at 2.5% (vs 2.0% target), BOE ‘s rate at 0.50% (a second hike on 10th of May used to be very probable but potentially already priced)

- GDP at 1.4% growth, 10y Bond yields at 1.48% (+4bps w/w)

- Record low unemployment at 4.2% (42 years low)

Strengths:

- Nothing new to note

Weaknesses:

Watch:

- Thursday’s 8:30GMT Lending and Thursday’s 23:00GMT Consumer Confidence. My scenario weakens only if we see an increased reading above 38.1K for new lending and a reading above -6 from the gfk.com survey.

- Friday’s 8:30GMT GDP q/q release. Markets are expecting a decreased figure

- Next Monetary meeting on 10th of May