A new month is at hand and with it the June round of central bank meetings. This week we’re looking at policy statements from two of the minor central banks but statements that are sure to move markets nonetheless. The most important, for traders anyway, is the meeting of the Reserve Bank of India scheduled for Wednesday.

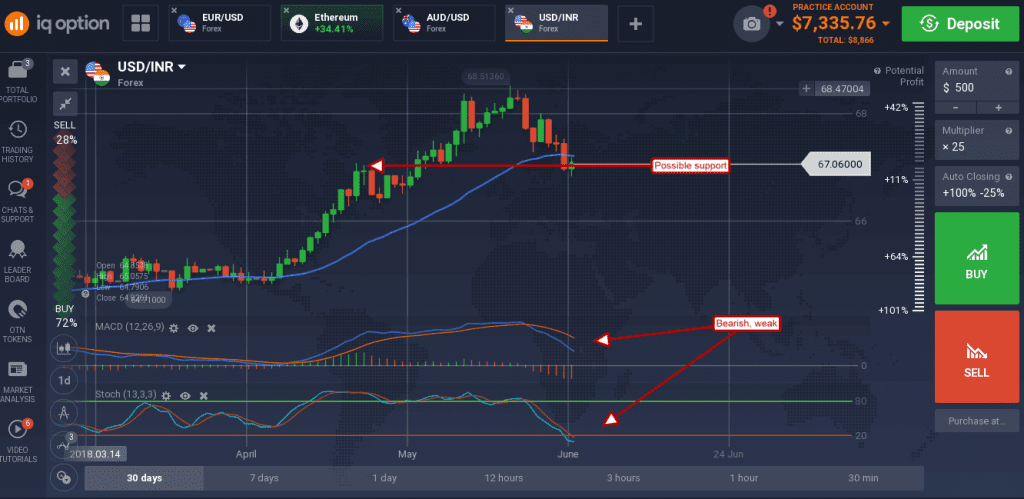

The bank is widely expected to turn hawkish at the next meeting in effort to combat spiraling inflation and may even enact a rate hike. The move would put Indian rates above 6.00%, where they have been over the last few meetings, and likely strengthen the rupee. The USD/INR has been in correction for the past two weeks and may extend the move is the RBI is more hawkish than the broad range of market participants expect. The risk is US data, US data has been on the strong side of late and this week should be no exception. The USD/INR is now sitting on support at the 67 level and waiting on cues to direction. A confirmation of support would be bullish and could take it up to retest the recent high, a break of support would be bearish and may go as low as 65.50 in the near term.

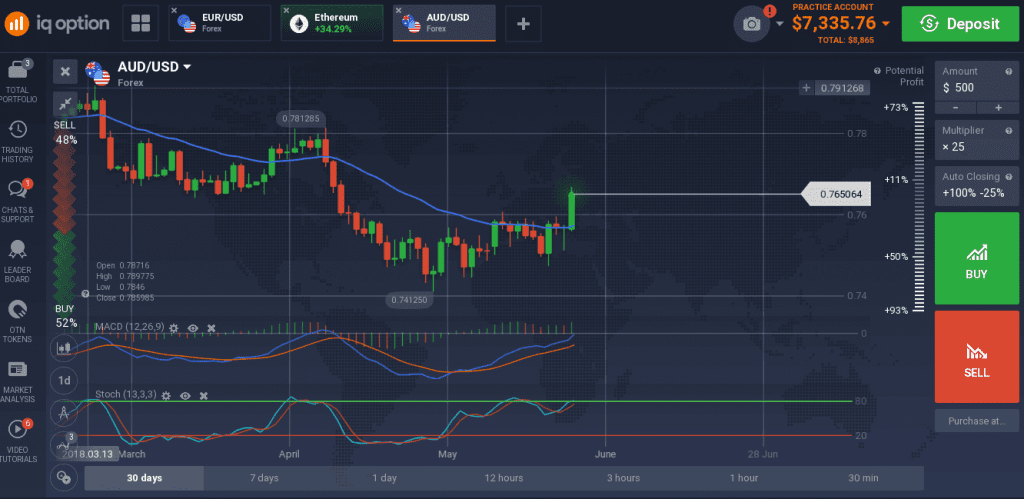

The Reserve Bank of Australia is expected to release their policy decision in the early hours of Tuesday morning. The bank is not expected to raise rates but may take on a hawkish outlook as signs of inflation continue to percolate through the economy. The USD/AUD surged in early Monday trading as the Aussie dollar gained strength ahead of the RBA meeting. The move took the pair up to 0.7650and possible resistance, resistance aided by the release of strong PMI data from the US. The indicators are bullish and suggest a bigger move is brewing so bearish traders should be cautious. A break above resistance would confirm the indicators and possibly take the pair up to 0.7800 in the near term.

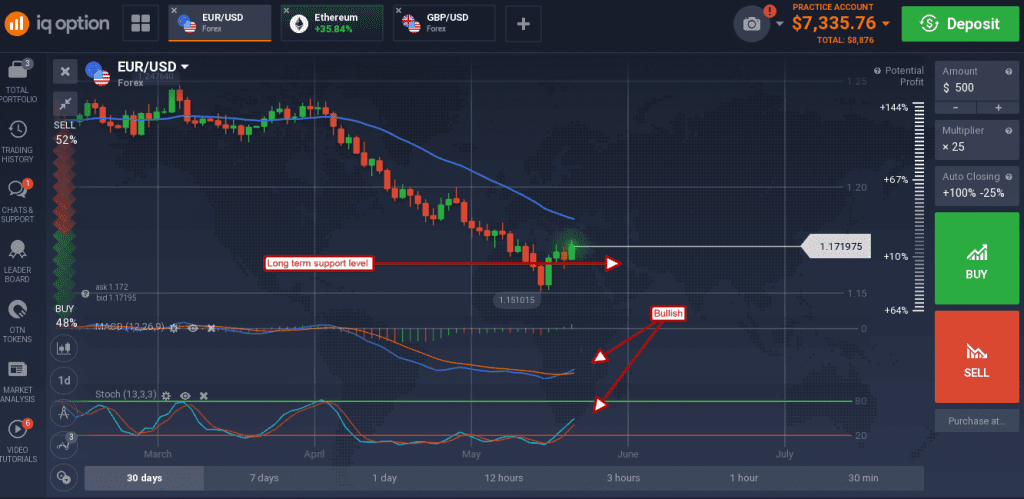

While the RBI and RBA are both important in the world of forex most traders are eyeing the FOMC and ECB meetings scheduled for next week. The FOMC will release their statement first, Wednesday afternoon, followed by the ECB statement on Thursday morning. The FOMC is expected to raise rates but also indicate a cooler outlook for future rate hikes, the ECB to stand pat and possibly mention tightening in some way, an expectation that has the EUR/USD set up for reversal.

The pair has already bounced from support and confirmed the move with a second bounce from higher support. The indicators support higher prices, the moving average is the next best target.