Yesterday it was a day with dominant and important news related to the US dollar. There were very important news about the US economy almost all day, the majority of them were positive ending the day with the anticipated FED monetary policy decision which had no surprise as expected.

US dollar

At 12:15 GMT we had the US ADP Employment Change for the month of April 2017, which is the private sector job creation. The US private sector added 177,000 new jobs versus the expectation of 175,000 jobs, a positive effect for the dollar as labor market is closely watched by the FED:

![]()

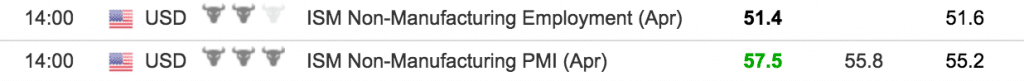

Later on at 14:00 GMT the USD ISM Non-Manufacturing Composite Index came at 57.5 higher than the expectation of 55.8:

This index shows expansion of the US economy, so the higher its value the better for the US economy. The main event though was the FED monetary policy at 18:00 GMT. There was no increase to the benchmark interest rate having a range 0f 0.75%-1.00%:

However interesting were the following comments made by the FED:

The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term.

The Fed also noted that inflation edged lower in March but that it expects it to stabilize soon.

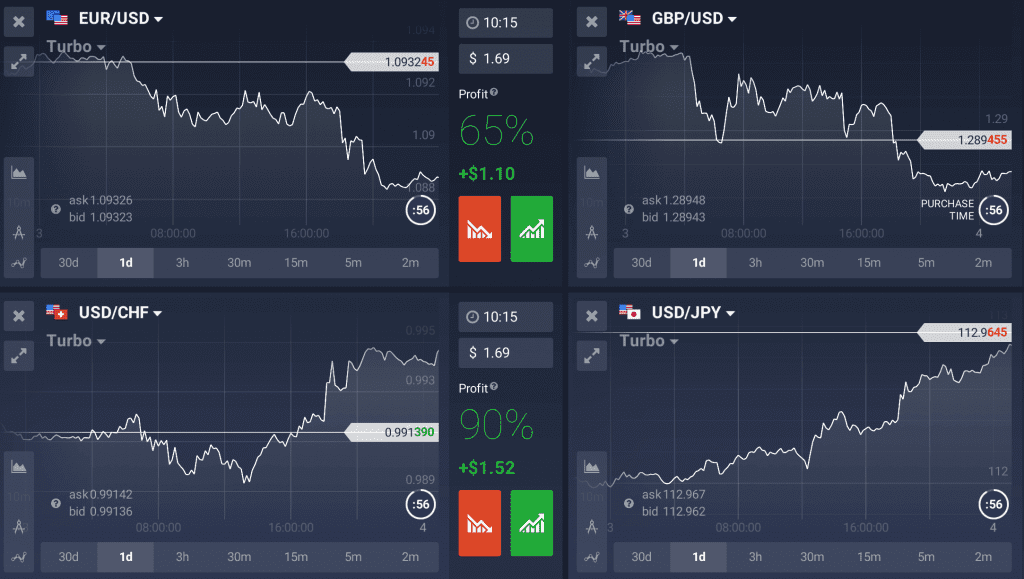

The market reacted positively to the FED comments about a transitory weakness to the US GDP growth and to the optimistic review about the overall health of the US economy. As a result after the interest rate announcement from the FED the US dollar gained versus all its major currency pairs.

The EUR/USD moved yesterday from 1.0935 to 1.0885, the GBP/USD from 1.2944 to 1.2851, the USD/CAD from 1.3670 to 1.3740, the USD/JPY from 111.95 to 112.76, the USD/CHF from 0.9886 to 0.9948 and the AUD/USD from 0.7545 to 0.7415.

British Pound

At 8:30 GMT yesterday the GBP Markit/CIPS UK Construction PMI for the month of April 2017 came at 53.1 versus the expectation of 52:

![]()

Although it was better than expected, the British Pound did not move much higher, despite the continued strength of UK economy during the past months. With Brexit negotiations and the anticipated interest rate decision from the FED, the GBP/USD moved lower all day.

Euro

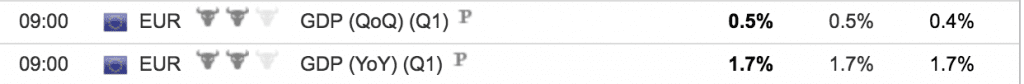

The German Unemployment Rate for the month of April 2017 was 5.8%, same as the expectation, while Euro-Zone Gross Domestic Product for the 1st quarter 2017 was 1.7%, exactly as the expectation:

These news did not move much higher the EUR/USD, which at the end of the day moved lower.

Australian dollar

Not any significant news, the Australian dollar continued its weakness as the AUD/USD moved lower driven by US dollar news.

Swiss Franc

Not any important news, the falling gold price and positive news from the US dollar moved the USD/CHF higher.

Japanese Yen

The risk-on attitude present at capital markets and positive news from the US dollar moved the USD/JPY higher.

Canadian dollar

Oil prices are the key factor. The USD/CAD had some volatility as news about the oil inventories were released, moved lower by at the end of the day continued its uptrend.

The US dollar was the main reason for moving the forex market yesterday and with some positive news and optimistic comments by the FED, it had gains versus its major currency pairs. Today there are not any very important fundamental news so the forex market will evaluate the outcome from the news yesterday related to the US dollar, and we could see some consolidation to US dollar pairs.