Citigroup (C: NYSE) Stock reports Q1 2017 earnings on April 13th 2017. Let’s look at the eight key facts to consider before trading.

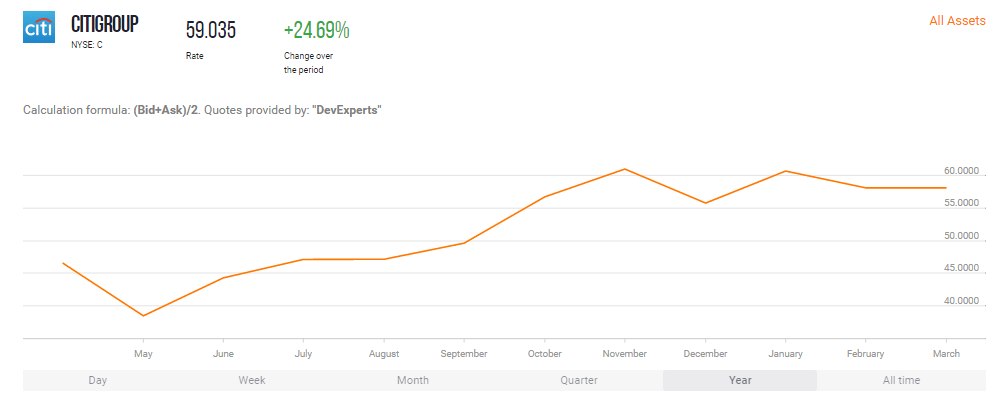

1) Price Action

Citigroup Inc has achieved a 22% share price improvement over the past six months, propagated by positive earnings surprises over the course of FY 2016.

However, the performance of the share price has somewhat been lack luster since the start of 2017. If this quarter’s financial reporting figures are ahead of expectations this is likely to stimulate improved share price momentum into the subsequent quarter.

2) Behind the competition?

Although Citigroup shares have risen 22% over the past half year period, on a relative basis this is an underperformance against its industry peers – with 26% growth recorded for the banking industry average over the same time frame.

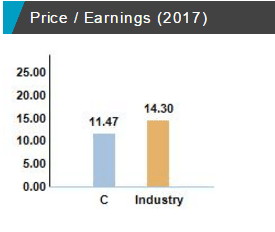

On the other hand 22% growth is still attractive enough to consider buying Citigroup shares given the fact that they are currently undervalued relative to peers on a Price to Earnings basis provided a cheap entry point:

3) Earnings

Underpinned by reduced operating expenses, Citigroup delivered a positive 1.8% earnings surprise last quarter. This was in addition to increased fixed income market revenues and declining credit costs. The consensus forecast of Wall Street analysts is that Citigroup will outperform the market in this quarters report. Analysts are forecasting an annual earnings increase of 9.07% year on year and this quarters EPS forecast at 1.24USD.

4) Trump

Trump’s policy change agenda has created uncertainty. However his pro US trade stance has also created positive sentiment in US capital markets and has enhanced liquidity in trading in the first quarter of this year. This has built on the strengthened trading activity of Q4 2016 which was led by a surge in fixed-income trading after the presidential election.

Fixed income, currency and commodity markets benefitted substantially during this period contributing to Citigroup growth and this is forecast to continue into the remainder of 2017.

5) Growth in consumer banking

Citigroup is expected to experience significant growth in the consumer banking sector. In particular Citigroup has investment plans in the pipeline to capture a larger share of global consumer banking revenues – with investment plans to be executed in Asia and Mexico this year to target this segment. Revenue growth in consumer banking is also expected in North America for 2017.

6) Income Return Growth

In 2016, Citigroup reported a dividend of 0.42 USD – a 162.50% increase over the previous year. The consensus forecast is for a dividend of 0.83 USD for the upcoming fiscal year, an increase of 96.43%.

7) Investment Banking Fees on the up

Driven by improved US economic performance, global investment banking fees climbed to a 10-year high in Q1 2017. Over half of the gains were generated from North America, with US banks topping the league tables, and Citigroup in fifth position. We can expect this trend in US investment banking to contribute to enhanced financial performance for Citigroup through 2017.

8) Credit Terms Tightening

Many of the economic fundamentals are on the side of Citigroup for 2017. However, the cost of credit is expected to be higher for Citigroup and this will negatively impact the bank’s balance sheet, reducing free cash flow. The rising cost is due to loan growth combined with an increased tax burden.

Overall the outlook is positive for Citigroup shares. This depends on whether the firm is able to deliver growth in returns amidst navigating the fast changing pace of the financial services sector as well as the dynamic political landscape under Trump.