Forex, being one of the most popular trading instruments, has many approaches that traders utilize daily. Some traders use currency pairs that they already know, researching for opportunities for the chosen assets. Others experiment with assets and timeframes. There is no right or wrong approach — no trading method will work for everyone. However, some Forex trading strategies are more universally popular than others.

These 3 basic Forex trading strategies are quite straight-forward and easy to apply, which makes them a popular choice for both experienced and novice traders all over the world.

1. Day Trading

One of the most popular Forex trading approaches is day trading. It is designed for trading the market within the same trading day, implies that all the deals are closed before the market closes. A trader opens a deal to follow a short-lived trend, then closes the deal and waits for the next short trend. Depending on the trader, they might make anywhere from 10 to 100 deals within one day, making sure to utilize risk management tools to manage losses.

This kind of approach means that traders will not be charged with overnight fees and may receive the result of their trading within several hours. The length of such deals may vary from several minutes to several hours, but all the positions are closed before the market closes.

Pros and Cons of Day Trading

Day trading, as was mentioned above, means that you will not be charged with a swap fee, and you will see your results within the same day. In addition to this, there might be several trading opportunities during the day which traders can focus on.

Among the cons of Forex day trading are relatively lower potential returns. As assets rarely make significant moves within the same day, the returns will largely depend on the investment and the multiplier. Another con is the riskiness of short-term trading of such type: traders have to be cautious and control their emotions.

A Tip for Forex Day Trading: Use Technical Analysis

Day traders normally heavily rely on technical analysis. There is little that a day trader can do with economic news, since the impact of fundamental factors will be reflected on slightly longer timeframes.

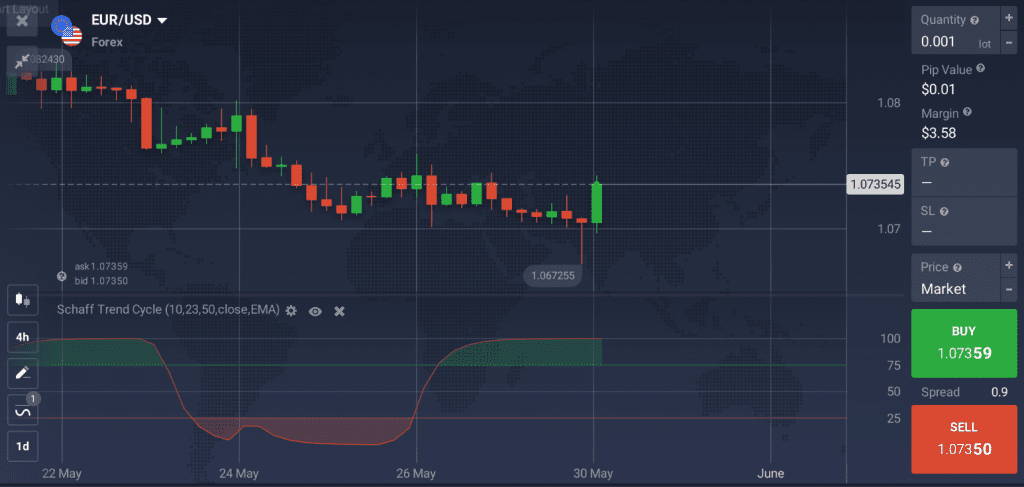

However, technical tools such as indicators may be a valuable addition to your Forex day trading method. These instruments may help traders catch upcoming trend reversals, identify the best moment to enter or exit a deal and much more. There are over 100 technical indicators on the IQ Option platform: you may apply them separately or in combination to spot the most interesting trading opportunities. For instance, the Schaff Trend Cycle indicator might hint at the trend direction and offer buy and sell signals.

2. Position Trading

More patient, or, perhaps, more cautious traders prefer the position trading approach, which means that a trading position is held open for a longer period of time. Traders that favor this method normally aim to possibly take advantage of larger-scale market movements. Small price changes are irrelevant in this approach, since traders are focused on the bigger picture.

Pros and Cons of Position Trading

One of the main advantages of using this Forex trading strategy is that positions remain open for longer periods. This means that traders don’t have to stay in the traderoom all the time, looking for entries and exits. They may open a few trades and check on them occasionally, without obsessing over minor short-term price fluctuations.

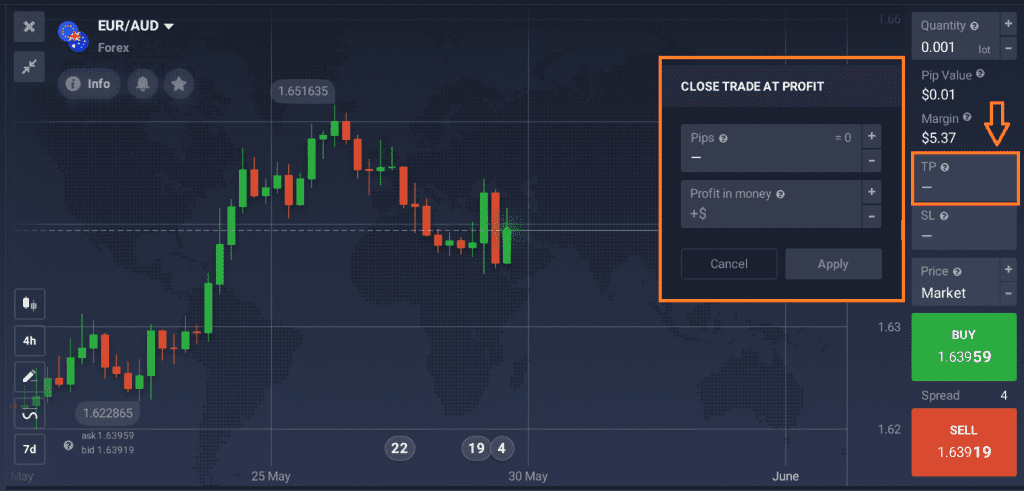

The main question traders may face with position trading is how long to hold the deal for. If day trading has the answer in its name, with position trading it may be a bit more complicated. A general approach is to focus on certain outcomes that traders may try to reach, such as a specific amount of profit. Setting take-profit and stop-loss levels may help to control emotions and point to the most favourable time to exit a trade.

A Tip for Position Traders: Try Fundamental Analysis

Since the strategy is oriented on bigger price swings, traders generally look for fundamental factors to base their forecast on. A good understanding of how economic factors affect markets is crucial for traders that wish to exercise this approach. Most traders combine fundamental and technical analysis for better results, and many traders look for candlestick patterns in order to attempt to predict the market movements.

3. Scalping

One more addition to the top Forex trading strategies is the scalping method. Active traders that prefer the process of trading itself often turn to scalping as their main method. This Forex trading approach involves opening multiple short (30 seconds – 1 minute) trades within the day, with minimal investments.

Pros and Cons of Scalping

Traders that implement this approach consider small outcomes sufficient, focusing on maximizing opportunities and the number of deals they make during a short period of time. Since the deals are so short, traders may use small investment amounts. But the flow of this approach is still quite risky, since deals can turn unprofitable and a trader can lose their whole balance in an attempt to recover.

A Tip for Scalpers: Beware of False Signals

When it comes to scalping, technical analysis may be useful as many indicators work well on short timeframes. The only important point to note is that past performance of an asset is not a correct indicator of the future price changes. Any indicator can make a mistake and show incorrect signals. When scalping, traders have to be extra conscious of that since catching false signals on such short timeframes may be challenging.

No matter which one of these Forex trading strategies you choose, it is always better to test it out on the practice account first. Trying every strategy with practice money before utilizing your real funds is a good way to safely explore your trading preferences.