This is a crash course for novice traders. Do you want to learn about 5 different indicators, how to apply them and understand how they work, all in under 5 minutes? Let’s go!

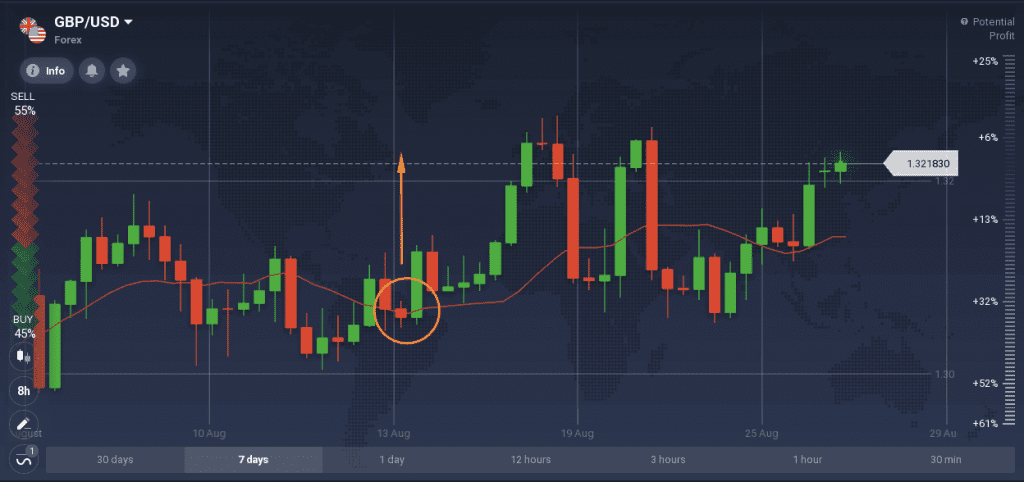

1. Moving Average (MA)

This is a trend-following indicator that’s used to smooth out the noise on the price chart and determine potential upward or downward trends. An indicator of an upward trend happens when the chart crosses the line from below upwards; when the chart crosses the MA from above downwards it may signal a downward trend. Moving Averages can be combined with any oscillator and can be effectively used in many trading strategies.

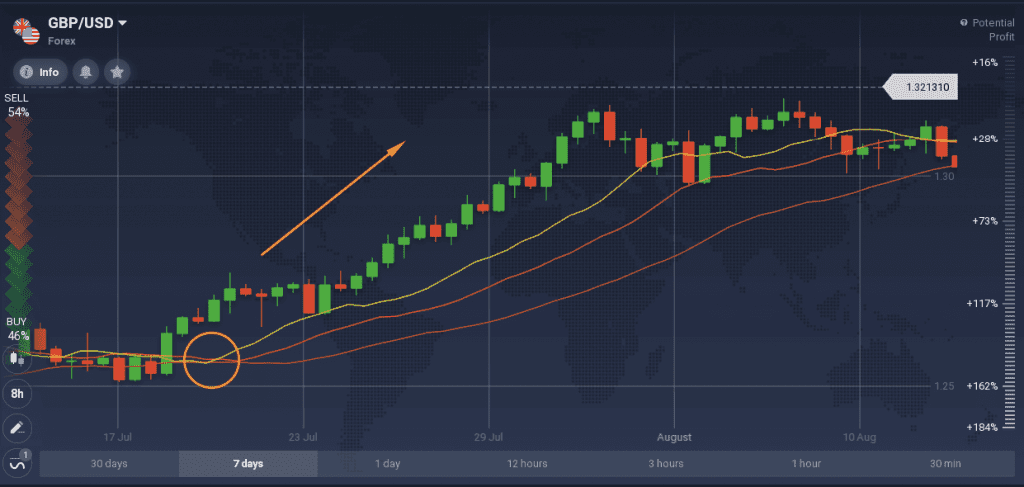

2. Alligator

It consists of three Moving Averages with different periods: they are often called the jaw (red line), teeth (orange line) and lips (yellow line) of the Alligator. The indicator shows no trend periods when the bands are sideways and emerging trends when the lines widen away from each other (the Alligator’s mouth opens). A Buy signal is received when the lips cross the teeth upwards. If the lips cross the teeth downwards, it may be a signal of a downtrend.

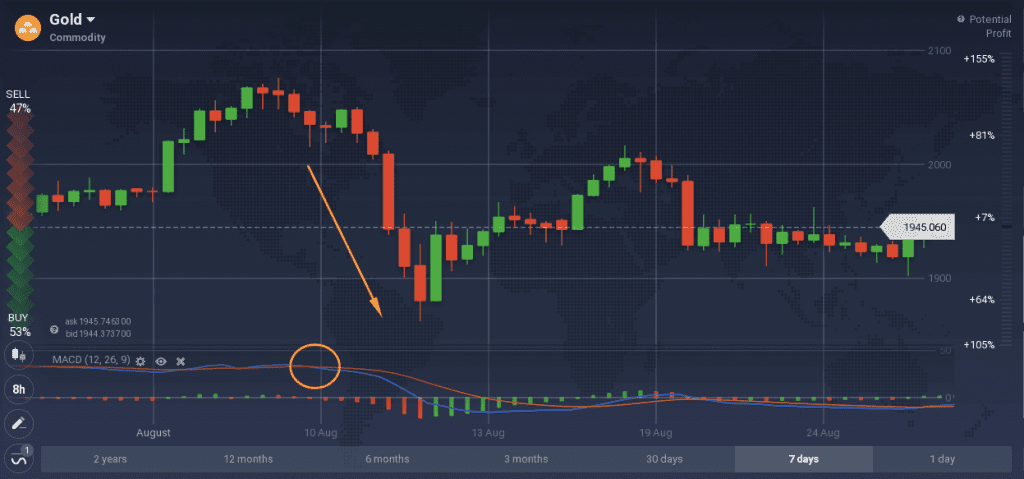

3. Moving Average Convergence Divergence (MACD)

The goal of this indicator is to spot emerging trends. It consists of two lines: a faster moving average (blue color) and a slower moving average (orange color). The green and red bars display the difference between the two MAs.

There are many approaches used with MACD. One of the indications is when the blue line crosses the orange line: if the crossing is upward, it may signal an emerging upward trend, if the crossing is downward, the price may be depreciating.

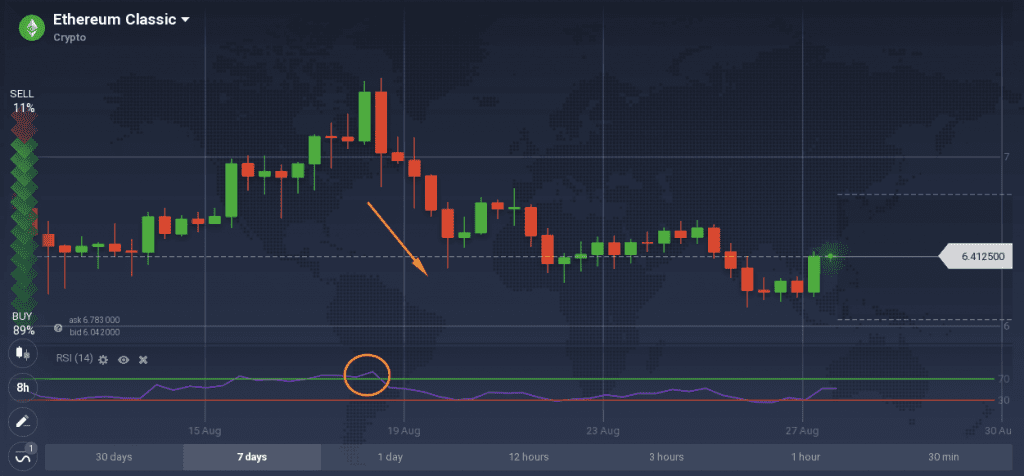

4. Relative Strength Index (RSI)

RSI is an oscillating indicator used to determine the trend strength as well as possible reversal points. The indicator moves between the two levels and the asset is considered overbought if it moves above the 70% level and oversold if it breaks through the 30% level. According to the indicator, once the asset reaches one of the areas, the price might reverse and go the opposite direction. RSI combined with a Simple Moving Average and MACD form a popular trading strategy.

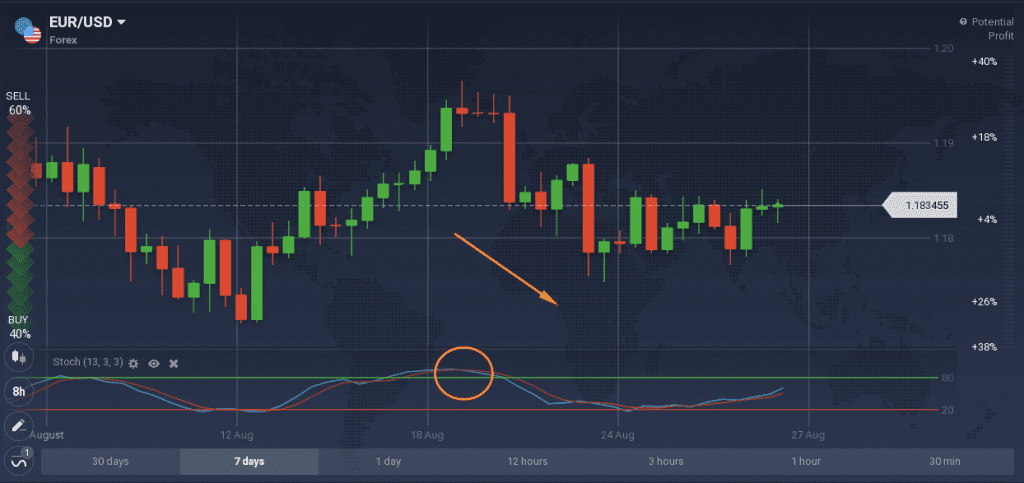

5. Stochastic Oscillator

This indicator doesn’t follow the price, but it follows the speed or the momentum of the price. And as a rule, the momentum changes direction before price. So this indicator may help traders to find trend reversal points. It consists of two MAs (fast and slow) and two horizontal lines (overbought and oversold levels). A signal to Buy, for example, is received when the blue line is crossing the red line upwards and when the lines meet below the oversold level and are coming back up. An example of a Sell signal is when the blue line crosses the red moving average downwards; also when the lines meet in the overbought area (over 80) and are coming back down.

All the indicators in the article are used with their default settings. These indicators can be combined with each other according to their type (trend indicators can be combined with oscillators). Please note that no indicator can give 100% successful results, so a risk management strategy is always required.