The Martingale strategy is one that is 100% accessible to every trader. It is one of the common approaches to trading and that is why it is quite popular among traders. It has been around for years and many traders use it or combine with other strategies. Let’s have a closer look at the pros and cons and see how it can be applied in practice.

How does it work?

This strategy can work with any instrument but it is widely used in Forex trading: it relies on the theory of mean reversion – currencies tend to trade in ranges over the time, so the same levels may be revisited multiple times. Although it definitely helps if you have an understanding of the market, the Martingale strategy does not depend on it.

The principle behind this approach is quite simple: the trader doubles the amount of investment each time the previous deal closes in a loss, until eventually a deal closes in the money. This allows to possibly generate profit and cover the previous losses due to a doubled investment.

Here is a very simple example of how it can be applied:

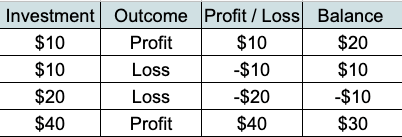

1) Let’s say that I am starting with a $10 balance and I make an investment, with my first deal closing in the money.

2) I open a new deal with the same investment, but this deal closes out of money, causing me to lose $10.

3) According to the Martingale strategy, I double my next investment and make it $20.

4) If my next deal closes out of money again, I double the next investment and make it $40. In case the deal closes in a loss, once again, I double my next investment. If this deal closes in the money, the profit covers all my previous losses.

Of course, in Forex trading there can be a certain profit or loss and it is not necessarily a 100% return. In practice, you may set a Take Profit or a Stop Loss level to adjust your order to close at a certain level of profit and loss and maintain the same movement for each new deal.

The pros and cons

As was already mentioned, this tactic is based on multiplying the investment after each out of money deal, making it possible to cover the losses and even generate profit in the right market conditions. However, this approach may also lead to a greater loss in case multiple trades close out of the money.

This strategy requires minimal practice and, at the same time, having an unlimited supply of funds. Though the last successful deal will cover the losses for previous ones, in real life, not every trader can keep doubling the size of the trade.

That is why it is very important to decide on a trading plan which will determine the length of the trading sequence (the amount of deals in a row) and your drawdown limit for it. Once a sequence of trades ends, regardless of the outcome, it is important to move on to cut your potential losses.

Conclusion

As you can see, the Martingale strategy has a set of rules to be followed and it can be used to cover previous losses and possibly generate potential profit. But it could also increase the risk of bearing much higher losses and, to some traders, it can be unacceptable.