Trading can be thought of as a sea of opportunity waiting to be explored. However, traders who are not adequately prepared to embark on this adventure may find themselves sinking instead of swimming. Just as captains need a map to navigate their ship’s course, traders need a plan to guide them through their trades.

Experienced traders know having a trading plan is crucial for long-term success. Don’t know what a trading plan entails? Here are some of the key points included in a trading plan to get you started.

Goals

Before starting your trading day, take a moment to review your goals, both short-term and long-term. Ask yourself which ones you are close to accomplishing, and which ones may need a bit of tweaking. Are your profits realistic? Have you calculated risk/reward ratios? A trader’s success depends on their goals, so it’s important to set aside time to think them through carefully.

Instruments to trade

Assess the market and choose the instrument you want to trade. IQ Option traders have plenty to choose from: Forex, CFDs, and commodities are all at your disposal. Review economic calendars, earnings data, news, and any other resources you can use to determine the most suitable instrument for the day. It’s also a good idea to think about how many positions you are willing to trade with this instrument.

Trading times

Time can be crucial depending on the instrument you intend to trade. For example, Forex traders might want to pinpoint the times when the market is most active. High activity usually translates into volatility, which increases upside potential (though this also increases risk). Trading can also depend on your mood. If you generally feel energized in the mornings, go for morning sessions; if not, try trading in the afternoon or evenings.

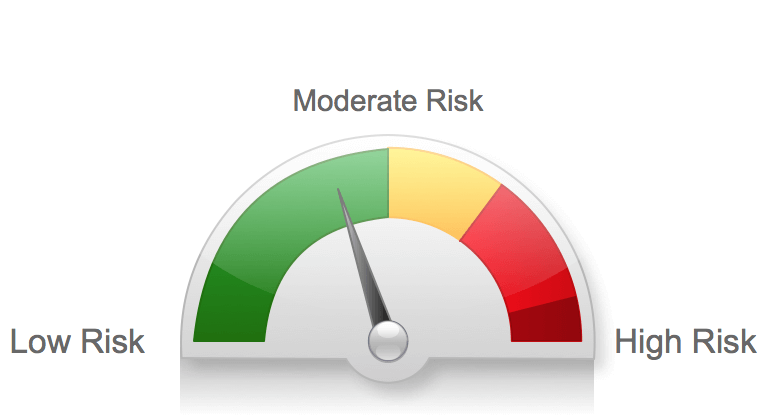

Risk levels

As a trader, one of your primary tasks is to look after your funds. You have to be honest with yourself and decide how much of your portfolio you are able to risk per position. Though risk varies according to trading style, the majority of traders tend to stick to the 2% rule. Setting risks levels allows you to take control of your losses and better manage your funds.

Entry/Exit rules

This is where your trading strategy comes into play. Make sure the strategy you want to employ is compatible with the instrument you have chosen to trade. Lay out the entry signals you’ll look for, and establish potential exits. It may be wise to use two exit rules: the first should be your stop loss, and the second should be your profit target. Setting up these signals prevents you from falling victim to emotional trading.

Note that a trading plan is not the same as a trading strategy, but they do go hand in hand. Think about it this way: your plan defines what strategies you are going to use throughout the day. There is no need for a trading plan to be extensive or elaborate. It should be clear, succinct, and suited to your trading style. Consistently planning your trades will help you become a more disciplined and confident trader. Why not grab a piece of paper and start mapping out your next trade?