Imagine you have a garden. Instead of letting your plants grow into big, beautiful trees, you settle for a few small flowers. Feels like a waste, right? That’s what happens when traders cash out after a few successful trades. Reinvesting profits in trading can help turn those small wins into something much bigger.

Why reinvest profits?

Anyone can make a good trade now and then. But making those profits grow even bigger? That takes a strategy. Reinvesting profits isn’t just a smart trick; it’s a powerful way to manage your money and multiply your returns. Here’s why:

- Compounding growth. When you reinvest profits, your earnings start earning too. This can lead to huge growth over time.

- Dollar-cost averaging. By reinvesting regularly, you buy in at different prices. This helps reduce the impact of market ups and downs.

- Emotional discipline. Reinvesting keeps you from making emotional decisions with your profits. Instead of spending them, you focus on growing your investment.

The science behind reinvesting

Research on reinvestment strategies, like dividend reinvestment plans (DRIPs), shows that reinvesting can greatly increase your returns because of the compounding effect. Studies from Trading212 and Schwab highlight how this strategy allows for dollar-cost averaging, reducing the impact of market volatility and helping you build a successful trading path.

3 reinvestment strategies to consider

Let’s see how you can turn a small amount of money into a lot more using reinvestment.

1. Percentage-based reinvestment

This strategy means that you decide on a fixed percentage to reinvest and a percentage to withdraw.

Example: Reinvest 70% of your profits and withdraw 30% for personal use.

2. Profit milestones

Alternatively, you can reinvest your profits until you reach a specific target. For example, commit to keep reinvesting until your account balance is $2,000. Once you hit that target, withdraw a portion and set a new goal.

3. Cyclical trading

Use cyclical trading, where you keep reinvesting your profits into new trades, creating a cycle of growth.

Here’s a step-by-step example:

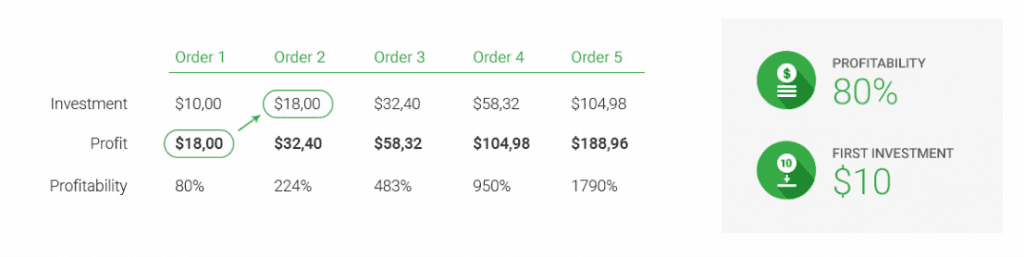

- Initial investment. Start with a small amount, say $10, on a CALL or PUT option with an 80% return rate.

- First win. If your trade is successful, your $10 becomes $18.

- Reinvest. Instead of cashing out, you reinvest the $18 into another trade.

- Cycle through. Continue this cycle. If you win five trades in a row, your $10 could grow significantly.

Here’s a calculation for five successful trades, resulting in almost $190 from just $10:

Final thoughts

Reinvesting profits is like planting a money tree and using its fruits to plant even more trees. With disciplined reinvestment, you can turn small wins into big gains, leveraging the power of compounding to grow your trading account.

So, next time you make a winning trade, think twice before cashing out. Reinvest those profits and watch your trading account grow, just like a snowball rolling down a hill, getting bigger and bigger.