Among other instruments like Forex and Crypto, there is one that might be attractive to more experienced investors. Novice traders tend to overlook it as it might seem more complicated than the more straightforward and familiar options. This instrument is called an ETF — exchange-traded fund. Let’s learn more about these assets and find out how to trade ETFs on IQ Option.

What are ETFs?

An exchange-traded fund is a type of trading instrument that combines a collection of securities, (stocks, commodities, currencies etc.), and it often tracks an underlying index. For example, a well-known index S&P 500 is tracked by S&P 500 ETF (SPY).

ETFs can be bought and sold just like regular stocks, which makes it a flexible and convenient instrument. Since it is essentially a basket, it combines both risky and less risky assets, allowing for more diversification.

If you would like to learn more about ETFs, have a look at this video explaining the specific characteristics of these assets.

How to trade ETFs on IQ Option?

On the IQ Option platform, it is possible to trade CFDs on ETF assets. It means that at the moment of opening the deal, a trader makes a prediction regarding the price change of the ETF.

Traders may speculate whether the price will grow or fall, without having to actually own the asset. Here is a step by step on how to trade S&P 500 ETF and other ETFs on IQ Option.

1. Pick the asset

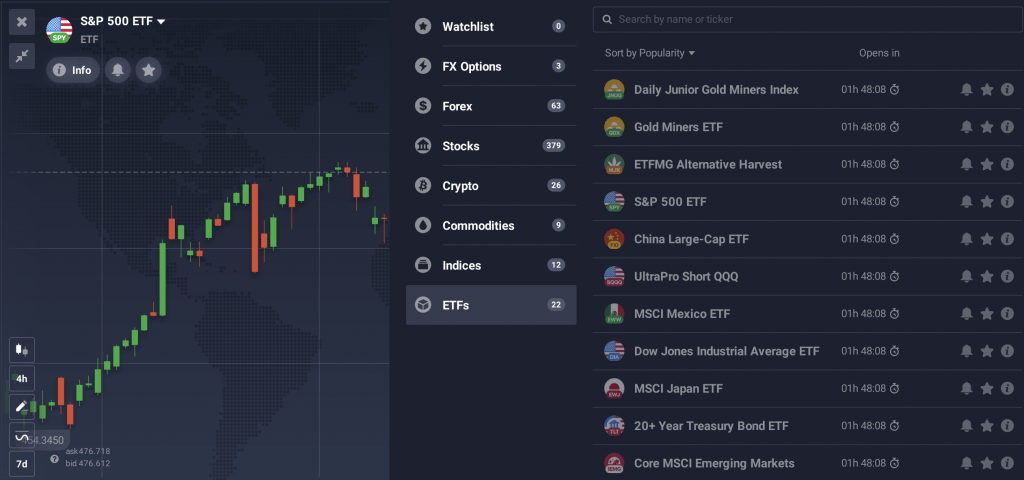

Firstly, you may choose the asset that you prefer from the list of available ETFs. The list includes many different options for every kind of trader.

The above-mentioned S&P 500 ETF (SPY) might be suitable, for example, for those looking for technology and bank stocks. Dow Jones Industrial Average ETF (DIA), for instance, may interest those seeking for a fund that includes industrial companies. Whereas Energy SPDR (XLE) is an exchange-traded fund that follows the performance of the Energy Select Sector Index, and it may be suitable for traders searching for opportunities in the energy field.

☝️

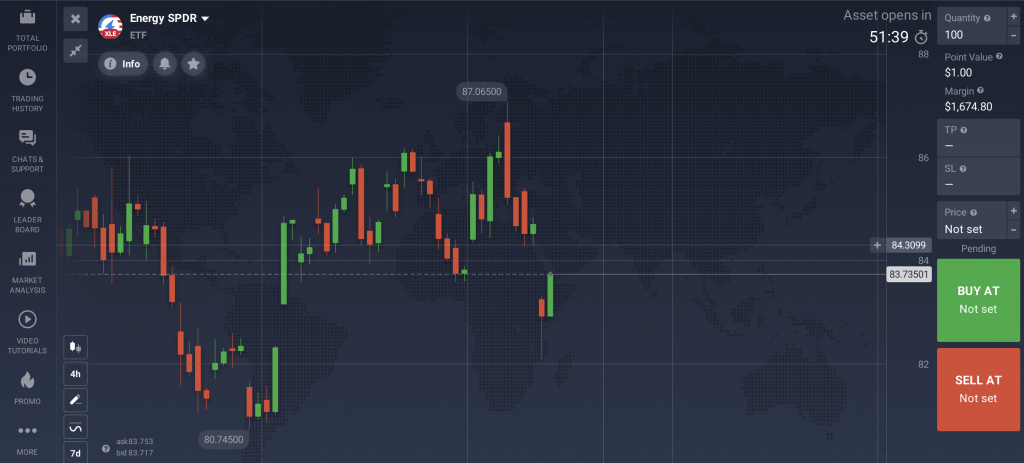

2. Choose the trade settings

Secondly, if you are looking to open a deal on the chosen asset, you may select the quantity, as well as choose the appropriate stop loss and take profit levels. It is important to note that a higher margin value may help maximize the positive outcome, but it can also maximize losses in case of an incorrect prediction. These steps coordinate with trading on other CFD assets, like Forex or Stocks.

3. Select the trade direction (Buy or Sell)

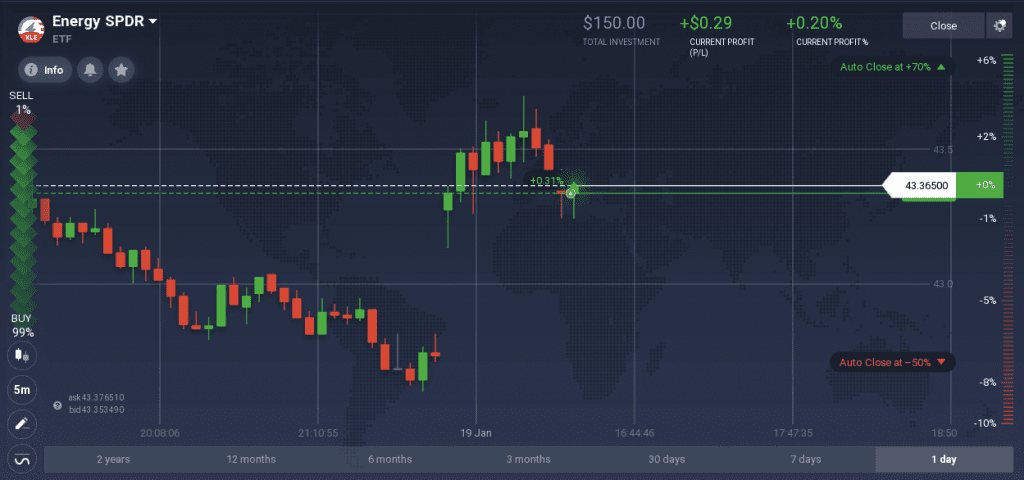

Once you have set the trade details, you may click on “Buy” or “Sell” depending on your expectation of the ETF’s price performance. Once you click the button, the deal is open.

It is possible to keep the trade open for as long as you like, but mind your stop loss and take profit levels, as well as the overnight fees. Consider applying suitable risk management techniques, as even though ETF assets imply diversification, they do not guarantee positive outcomes. Once you reach the desired outcome, it is possible to close the deal by clicking on the “Close” button.

As with any instrument, you may utilize technical and fundamental analysis in order to evaluate the ETF’s performance. Closely following the field that the ETF covers might also be a good decision.

Conclusion

ETF assets may be a solution for traders who wish to diversify their portfolio without acquiring numerous stocks and spending a large capital. With ETFs, it is possible to choose the field you wish to invest in and find the fund that suits your strategy best. As ETFs are traded like stocks, they can be bought and sold at any moment, depending on the trader’s preference.

Now that you know all the basics, you are ready to try out CFD-type trading on ETFs on the practice balance.