The time before money

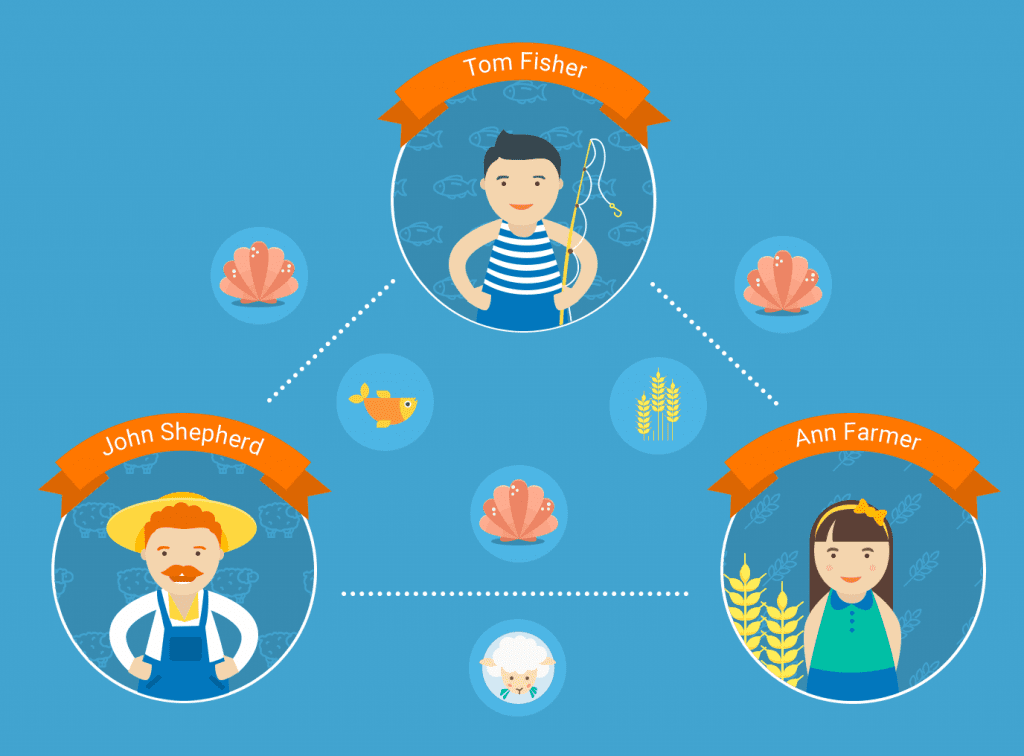

Hard to believe, but money didn’t always exist. That’s right – about 5000 years ago, back when life was much simpler, people used to build, grow and do things for one-another. They were exchanging their goods and services, keeping tabs on who owed them and whom they owed. This type of relationship is known as barter.

Within small communities people largely relied on their memory to keep track of debtors and their own debt. However, as communities grew and the exchanges became more complicated it quickly became obvious that barter had to evolve. People began using tokens (such as stones, animal teeth and seashells) in exchange for goods to track who owed them and how much. And while initially the tokens were meant to only signify debt, people realized that they could trade in that debt for other goods and services. Once the tokens took on this perceived value, a primitive form of money was born.

However, the system had its faults. The problem with tokens was, each community had their own, which made trading with the outsiders very difficult, if not impossible. To establish a common currency, people had to find something that fitted several important criteria:

It needed to be

- Limited in supply (otherwise a single low-tide could turn one into a millionaire)

- Hard to forge (unlike the round stones which all look the same)

- Durable (to pass through thousands of hands without any signs of wear)

- Portable (‘cause who wants to carry around a sack of stones?)

- Divisible (as the prices can’t always be even)

Gold ticked all of those boxes. And so a new era in the history of money began.

Gold

Gold appeared to be the perfect form of money. Besides being scarce, impossible to forge, durable and portable it had one more thing going for it: intrinsic value. People have been fascinated by this shiny metal since the dawn of times. That means it had the same value in any part of the world.

The creation of a universal currency that could buy you basically anything caused people to accumulate capital. Soon it became evident: the more money you have, the more powerful you become. The richest people at the time – Emperors and Kings – would mint their own golden coins, but even that wasn’t enough. In their insatiable hunger to become even more powerful they began diluting gold with cheaper metals, creating coins that were worth less than its face value.

That was the first tiny step towards a disconnect between money and its value in gold.

Paper Money

Golden coins, though they became a universally accepted currency, had their disadvantages. For one, they weren’t as portable in large quantities, which was crimping international trade. Also, storing it at home was quite unsafe.

The Early Chinese were the first ones to try and solve these problems. Instead of taking their coins abroad, they resolved to keep the gold back at home and instead issue a certificate whenever a payment was required. Although these certificates – these ancient IOUs – were just pieces of paper of no intrinsic value, merchants knew they could always exchange them for a stated amount in gold or silver.

Meanwhile in the Western World, where the golden coins were still the primary currency, the people were concerned with the safety of their capital. This desire to protect one’s gold lead to the creation of banks. For a small fee the bankers were willing to store gold in their secure vaults and in exchange gave the depositor paper banknotes stating the amount of gold those were payable for. Those banknotes became the money as we know it now. But they were still connected to the gold amount.

Want to learn how it liberated from gold and went digital? Give us a Like.