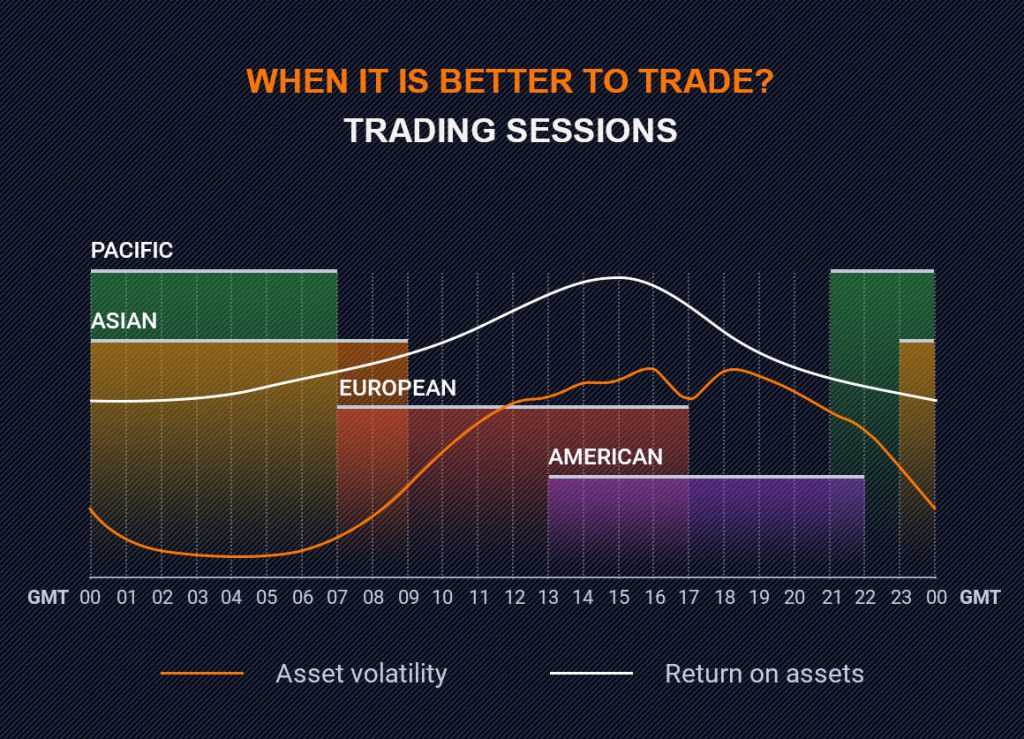

Financial exchanges are a 24/5 market. When it is evening in one part of the world and people stop trading, in another part of the world it is just the beginning of the day. Trading sessions follow each other over and over. Depending on the time of the day, volatility for different assets vary.

An experienced trader who knows which assets are more volatile at specific times of the day has a competitive advantage and can trade much more effectively. Compared to other assets, it is possible to trade currencies 24 hours per day, 5 days a week, with weekend breaks, now we offer Bitcoin as a weekend.

There are four trading sessions:

From the table above we can see that some trading sessions overlap. During such periods there is higher activity and volatility in the market. Many traders like such overlapping periods the most, because they are easier to analyze. Furthermore, at the very start and at the very end of the trading sessions there might be a great deal of movement due to the fact that at the beginning of the sessions there are a lot of traders who want to open a new position and by the end of it a lot of positions are closed in order to avoid risk.

Key features of the trading sessions:

Pacific trading session:

The foreign exchange market starts with the Pacific trading session at 21:00 GMT. The key feature of the Pacific TS is that it is the least volatile, and massive price movement should not be expected.

Experienced traders try to refrain from trading during this period of time, but they keep analyzing the market, checking whether the historical and psychological levels are broken or not. These traders usually avoid trading in high volumes during the Pacific TS as trading movements are harder to analyze.

During the Pacific trading session, such assets as AUD/USD and NZD/USD are the most popular as both AUD and NZD are the national currencies of Pacific countries.

Asian:

At 23:00 GMT the Asian session starts. The Tokyo stock exchange is the first to open and an hour later the Singapore and Hong Kong markets open as well. Activity on the markets increases.

The most volatile currency pairs are those with JPY – USD/JPY, EUR/JPY, GBP/JPY. Also, EUR/USD and AUD/USD should be taken into consideration, usually the Asian session is the one that sets the day’s trends.

The most volatile period of the Asian TS is closer to the end of it, yet in general the market is pretty quiet during the Asian TS.

European:

There are many financial markets in Europe, but the most important of them are Frankfurt, Paris, Moscow and London with some 30% of the total volume of the financial markets.

The important feature of the European TS is that it overlaps with the Asian trading sessions in the morning and overlaps with the American trading session in the evening. Despite the fact that the volatility increases there is no aggression in the market.

During the whole trading session there is quite high volatility and the amount of assets available for trading is high. Currency pairs with EUR, GBP and CHF are the most popular during the European TS. For example, EUR/USD, GBP/USD, CHF/USD, EUR/JPY, GBP/JPY.

American:

Another important trading session, the American TS, starts at 12:00 GMT or 13:00 GMT, depending on daylight savings time. It is important to keep in mind that the American trading session (the United States, Canada etc.)

The American trading session is very volatile and aggressive because market participants pay too much attention to the published news. During the American trading session the actual trend can change easily. Key economic news is announced between 12:00 and 14:00 GMT, and news has a massive impact on currency conversion rates.

There is a high trading activity during the American trading session. The majority of traders pay attention to those assets that involve either USD or CAD and volatility on assets with JPY increases as well. Those who enjoy trading on rapid rate movements often trade on such cross-assets as GBP/JPY and GBP/CHF.

The key to success in trading in financial markets consists of several important factors. One of the key components to successful trading is the ability to act and trade correctly during different trading sessions. The specifics of trading during different trading sessions will allow the trader to use his time and resources effectively and efficiently.