The US and China have announced another round of trade talk and sent equities shooting higher. The talks are scheduled for late August and have raised hopes the world’s two largest trading nations can make amends.

While the news is a balm for nervous markets there is reason to believe the talks will not amount to much; the talks are not between high ranking officials but a vice minister of Chinese commerce and an under-secretary within the Treasury Department. Previous talks were held between a Vice Premier of China and two cabinet level members of the Trump administration.

The exact date of the meeting is unknown but there is speculation it could come before August 23rd. The two nations have traded tariffs twice already, the next round of US levies is due to take effect on that date.

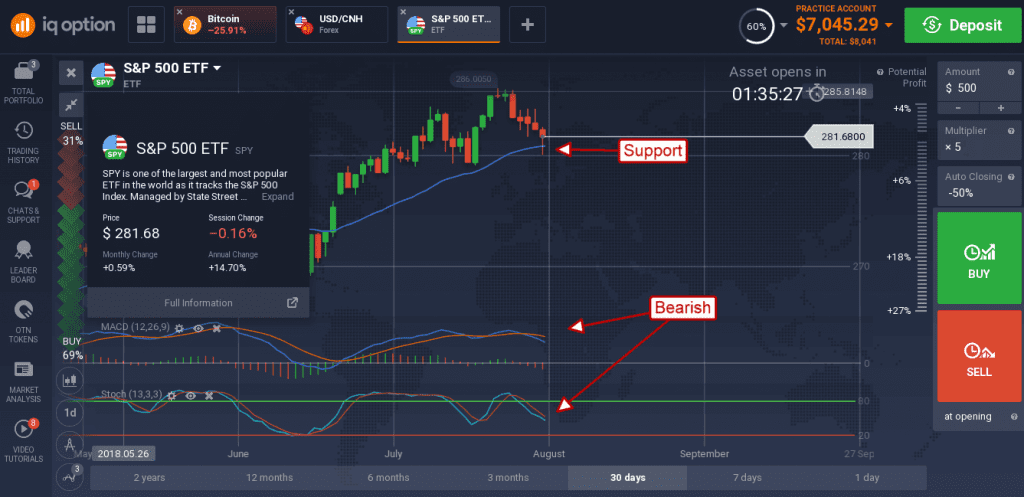

US equities futures jumped more than 0.50% as traders hone in on the news. The S&P 500 advanced more than 15 points erasing nearly all the previous day’s losses. The index is confirming support at the short-term 30-day exponential moving average and heading higher. The index is poised to retest its all-time high near 2,880 and may do so over the next week.

The risk for traders is this; the earnings cycle has end leaving the market with little to support it other than geopolitics. The indicators remain weak and are pointing lower which suggests this week’s volatility is not over. Today’s swing in prices is the 4th such swing in four days and easily reversed.

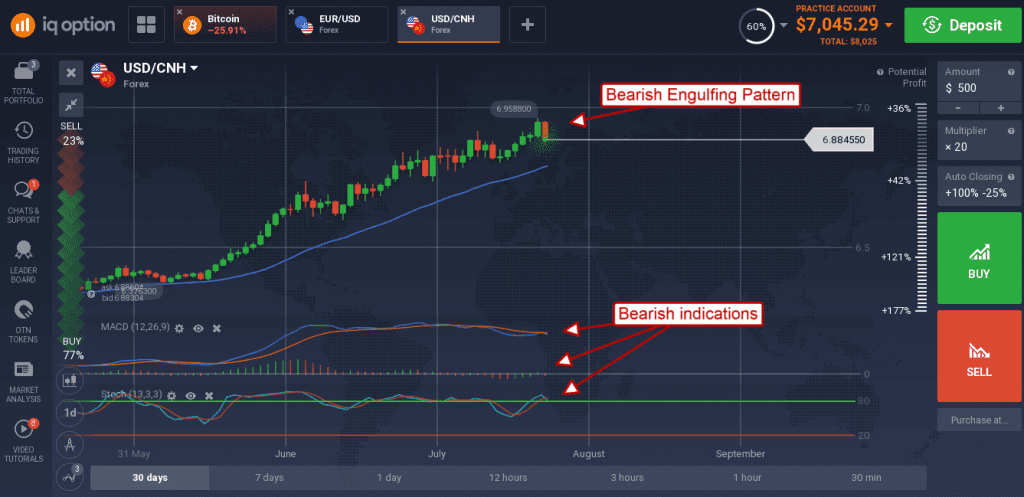

The US dollar shed some ground versus the Chinese yuan and may be indicating a reversal is imminent. The pair created a bearish engulfing pattern at the top of a strong uptrend and the pattern is confirmed by the indicators.

Both the MACD and stochastic have rolled over and fired bearish crossovers indicative of weakening price action. Support may be found at the short-term moving average, near 6.80, a break below there would be bearish.