Spread betting allows you to speculate on the rise or fall of financial assets such as stocks, commodities, currencies, or indices without actually owning them. You merely “bet” on the direction of their price movement rather than buying. Nonetheless, it provides leveraged exposure, which enables you to manage a bigger position with a smaller initial investment. While this helps you maximize profit, it also raises your potential risk.

Therefore, you must understand what spread betting is, how spread betting works, its benefits and risks involved, before committing your hard-earned money. This is the primary focus of this guide, and by the end, you’ll also get to know various strategies for controlling your risk exposure.

How Does Spread Betting Work?

Spread betting allows you to make predictions about a financial asset’s price without actually owning it. The difference between the buy (ask) and sell (bid) prices that shows up when you select a market to trade is the spread. If you believe the market will rise, you buy (go long); if you think it will fall, you sell (go short). Your risk tolerance determines how much you profit or lose for every point the market moves.

However, it is a leveraged product and permits you to open bigger positions with just a small deposit (referred to as the margin) of the entire trade value. Because leverage increases your exposure, it makes trading more profitable, but also raises your risk.

Your profit or loss is calculated by multiplying the number of points the market moves by your chosen stake per point. Therefore, if you purchase say XAUUSD at $3,500 with a $10 stake per point and the price moves up to $3,550, you will profit by $500 from that 50-point movement.

Those same points turn into a loss if the market moves against you instead. You have the option to exit your position at any time, or it might do so automatically if your account’s margin runs low or stop-loss or take-profit levels are reached.

Drawbacks and Risks Involved In Spread Betting

Of course, spread betting is not without its downsides. In fact, the very features that make it appealing, like leverage, also make it risky if not used properly. Below are the main risks associated with it:

Leverage Magnifies Losses

Leverage increases losses in the same way that it increases profits. A minor negative change in the market can result in a significant loss in comparison to your starting margin. These rapid losses may result from market volatility, particularly if you use a very high leverage.

Margin Calls

The broker may issue a margin call, requesting that you make additional deposits, if your account balance drops below the necessary margin. Your position may be automatically closed at a loss if you don’t.

Emotional Pressure

Spread betting can lead to emotional decision-making, especially when using high leverage. Traders frequently behave irrationally out of fear and greed as a result.

Potential to Lose More Than Your Deposit

It is possible to lose more money than you initially deposited with certain brokers, particularly during periods of extreme volatility. However, a lot of brokers now offer protection against negative balances. These risks are significant, but with the correct strategies, they can be fully controlled.

What are the Benefits of Spread Betting?

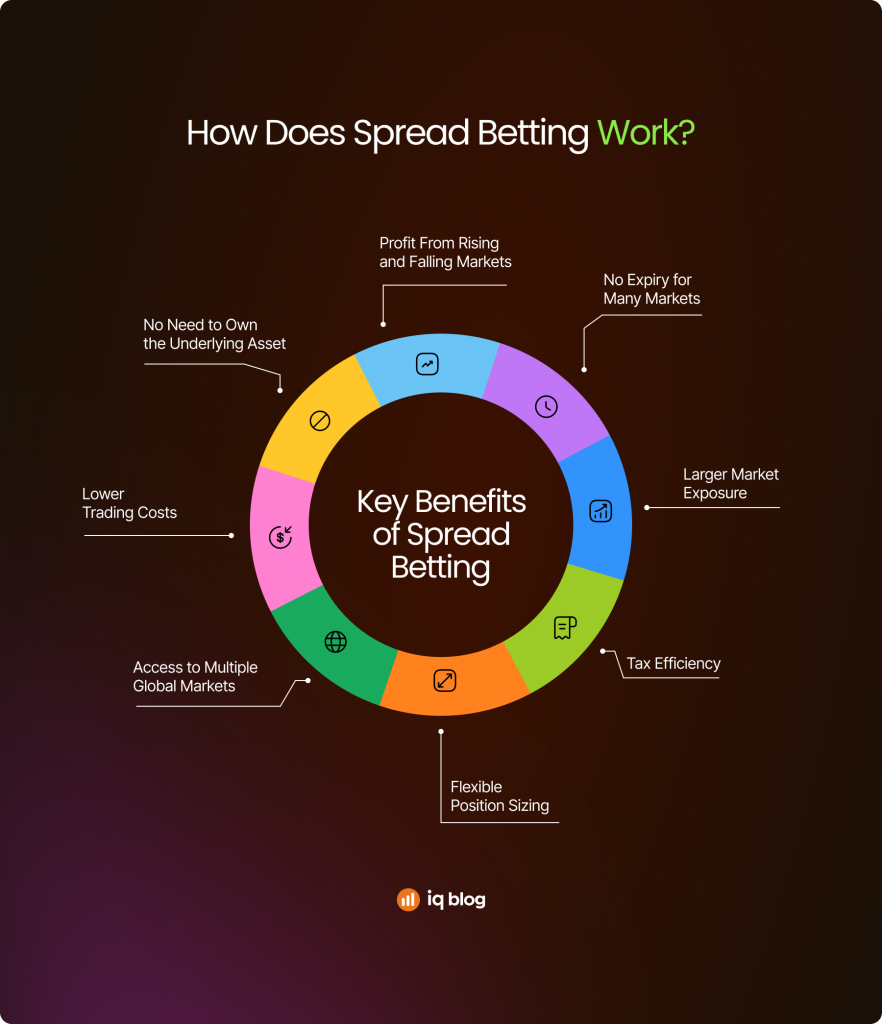

Despite the risks involved, spread betting has a number of benefits that draw traders of all skill levels. Below are the main advantages:

Profit From Rising and Falling Markets

The ability to profit from spread betting regardless of price movements is one of its greatest benefits. You open a buy (long) position if you think the market will rise. Also, you can open a sell (short) position if you believe it will fall.

In contrast to traditional investing, which primarily makes money when prices rise, this implies that you are never restricted to only upward movements. Spread betting increases your trading opportunities in a variety of market conditions, including volatile, trending, ranging, and even uncertain economic times.

No Need to Own the Underlying Asset

Since you never need to own the underlying asset you’re trading, spread betting removes a lot of the costs related to traditional investing. Costs like custody fees, transfer fees, stamp duty in some places, and even the trouble of holding or storing tangible assets are automatically avoided. This is because you’re only speculating on price movements rather than actually obtaining the asset.

All of this makes the entire process smoother, more efficient, and far less burdensome compared to managing actual asset ownership.

Tax Efficiency

In nations like the UK and Ireland, where spread betting is predominantly traded, it is legally categorized as gambling and not an investment. Therefore, profits made from their involvement are usually not taxed, whether as stamp duty or capital gains. This, however, drastically reduces overall trading expenses, making it cost-effective.

Verifying your country’s tax laws is essential because they vary by region. This possible tax benefit is still one of the most enticing features of spread betting for a lot of traders.

Larger Market Exposure

Being a leveraged product, spread betting offers traders like you larger exposure to the market. Consequently, this allows you to open positions that are way bigger than your initial margin or deposit.

For instance, on a 100:1 leveraged account with a deposit or margin of $100, you can open a position as high as $10,000. Any profits you made from such trade are entirely yours. However, leverage should always be used carefully and with appropriate risk management because it amplifies losses as well.

Lower Trading Costs

Spread betting platforms typically earn their revenue through the spread rather than by charging separate commissions, which immediately simplifies the cost structure for traders. As a result, many trades come with no commission fee at all, keeping costs transparent and easy to understand. This also means you avoid the extra charges that traditional brokers often impose. Therefore, making spread betting a more cost-effective option, especially for active traders who execute multiple positions regularly.

Access to Multiple Global Markets

Spread betting provides access to a wide variety of global financial markets from a single trading account. Traders can speculate on the price movements of numerous instruments without physically owning the underlying asset. This allows for portfolio diversification across different asset classes and geographic regions. Such instruments that traders can access through spread betting include stocks, bonds, commodities, forex, indices, and even cryptocurrencies.

It’s easy to switch between markets and adjust your strategy to suit changing conditions and trends when you have everything you need in one place.

Flexible Position Sizing

Since spread betting allows for flexible position sizing, traders can vary their positions depending on their risk appetite at any instance. This is to match your level of confidence and market outlook at such an instance. It is therefore suitable for both experienced traders who need room to expand their positions and beginners who want to start small.

You can typically stake as low as $1 per point and as high as $100 per point or even more. If you want to modify your trades and risk exposure swiftly, this flexibility is very beneficial.

No Expiry for Many Markets

Depending on the market and the kind of product your broker offers, you can hold a position for as long as you like. This could be a few days, a few weeks, or even months. Riding long-term trends, strategically managing your trades, and avoiding being forced out of a position before you’re ready are all made easier by this increased flexibility.

Compared to certain derivatives that expire automatically, this open-ended structure gives you far greater control over how you execute and maintain your trading strategy.

Risk Management Strategies for Spread Betting

To spread bet responsibly, risk management is your best friend. Here are practical strategies to help protect your account:

Use Stop-Loss Orders

A stop-loss order limits potential losses and helps you avoid making irrational decisions during volatile times. It does this by automatically closing your position when the market reaches a specific level.

Set Take-Profit Levels

Setting a take-profit level enables your trade to automatically close once your target profit is reached, much like using a stop-loss to limit possible losses. By eliminating the temptation to hang onto a winning position for too long, which could put you at needless risk if the market abruptly reverses, this not only helps you lock in gains but also maintains your discipline.

Avoid Over-Leveraging

Over-leveraging is a way of over-trading, but with the use of unnecessarily high leverage. As a trader, it is important to know that every account size has a permissible size of trades it can accommodate. Exceeding that puts your accounts at unnecessarily high risk, as a little change in price could wipe out your account in minutes.

However, using modest leverage is a more prudent strategy as it lowers your risk. This enables you to play the game longer, safeguard your funds, and make more deliberate, controlled trading choices.

Never Risk More Than You Can Afford

Expert traders generally agree that you should never risk more than 1% to 2% of your entire account balance on a single trade. Even in the event of a reversal, this protects your capital and limits your loss. As a result, you can bounce back fast and carry on trading without suffering significant setbacks. Moreover, it prevents emotional overexposure, encourages discipline, and manages your overall risk.

Analyze Before You Trade

Both technical and fundamental analysis are advised before making any trading decisions. Technical analysis includes studying charts, recognizing patterns, and the possible use of indicators. On the other hand, fundamental analysis involves paying attention to news, assessing market reports, and economic events. You can obtain a clearer, more thorough understanding of the market and make better decisions devoid of emotion or speculation by combining these two strategies.

Diversify Your Trades

To lower your overall risk, spread your exposure across a variety of instruments and industries rather than putting all of your money into one market. This kind of diversification protects your capital because the performance of other markets lessens the impact of a market move that goes against you. It’s a straightforward but powerful method to balance your trading approach and prevent becoming unduly reliant on the performance of a single position.

Keep Emotions in Check

While your emotions cannot be totally eliminated in trading, it is important to keep them in check to avoid making irrational decisions. Most successful traders, however, approach every decision with structure and discipline. They treat spread betting more like a business rather than gambling. They do this by establishing a well-defined trading strategy, adhering to it despite intense emotions, and controlling their expectations sensibly.

Examples of Spread Betting

Let’s examine the example below, which illustrates how spread betting functions in actual market conditions, to help clarify this.

Consider a quote for the FTSE 100 of 6,500 (sell) / 6,502 (buy). You open a buy bet at $10 per point at the buy price of 6,502 because you think the index will rise. The market has moved 48 points in your favor (6,550 – 6,502) if the FTSE reaches 6,550. You would make $480 if you multiplied those 48 points by your $10 investment.

However, if the market drops by the same points to 6,468, you will have a loss of $480 at $10 per point.

Spread Betting vs CFDs

While spread betting and contract for difference trading permit the use of leverage, there are key differences worth noting.

| Spread Betting | Contracts for Difference |

| Often tax-free in some regions like the UK and Ireland | Generally subject to capital gains tax. |

| You stake an amount per point of movement. | You buy a contract representing the price difference between opening and closing. |

| Spread betting is more popular among casual traders because of its simplicity. | CFDs are often preferred by professional traders who want more precise position sizing, hedging options, and advanced order types. |

| Spread betting is mainly available in the UK and Ireland. | CFDs are traded worldwide. |

| They both incur spreads. | In addition to spread, CFDs sometimes have overnight financing charges that vary in structure from spread bets. |

You can check out this Beginner’s Guide to Contracts for Difference if you want to know more about trading CFDs.

Conclusion

While spread betting provides traders with a flexible and accessible means of making money from the financial markets, it does come with risk. One of the reasons why it is considered risky is its leverage feature, which offers larger exposure to the market. While this can greatly magnify profitability, it can also result in significant losses and even wipe out your account.

It is, therefore, advisable that if you want to venture into spread betting, treat it as a business rather than a get-rich-quick scheme. Have a trading system, which includes your plan, strategy, and risk management, in place and disciplined in your execution. With all these in place, you have a higher chance of success in spread betting.