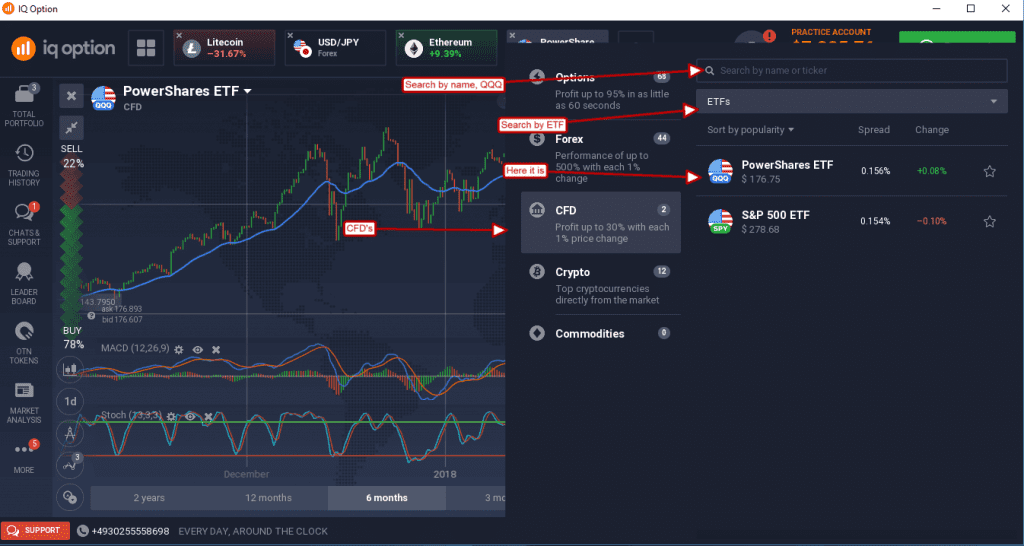

The PowerShares QQQ is one of dozens of CFD’s available on the IQ Option platform but believe me when I say it’s quite a special asset. Read on to find out why you should trade PowerShares QQQ and how to do it.

It’s an index that trades like a stock

The Invesco PowerShares QQQ is an index tracking stock, also known as an ETF. It is one of dozens of CFD’s available for trade on the IQ Option platform and I am here to fill you in on everything you need to know about it.

The Invesco PowerShares QQQ is an index tracking stock, also known as an ETF. It is one of dozens of CFD’s available for trade on the IQ Option platform and I am here to fill you in on everything you need to know about it.

The NASDAQ-100 is an index of the top companies listed on the NASDAQ Exchange. Because the exchange is relatively new compared to the NYSE and AMEX it is heavily tilted toward modern businesses and that means technology. If you have ever heard of the NASDAQ indices referred to as a tech index, or a tech heavy index, this is why.

This means, for index traders, that the NASDAQ-100 give exposure to the technology sector (higher risk, bigger returns) where the S&P 500 is a “broad” market index and the Dow Jones Industrials is the blue chips index (the oldest, largest most established businesses).

What makes PowerShares QQQ particularly attractive?

The fund holds no small cap stocks so there is no exposure to the riskiest tech stocks, the start-ups and long-shots, a good thing for serious traders. Information tech makes up the lion’s share of the portfolio at 61.25% with names like Apple, Amazon, Microsoft, Facebook and Google in the top five.

The top ten holdings are rounded out by Google B shares, Netflix, Intel, Cisco and Nvidia. Nvidia, if you don’t know, is the leading maker of chips for gamers, cryptocurrencies and data centers, the largest growth markets in microchips today.

Consumer Discretionary and Healthcare comprise another 32% of the total portfolio, both tech heavy sectors. The final 7% is filled with Consumer Staples, Industrial and Telecommunications Services companies.

How to trade the PowerShares QQQ

Trading the QQQ on the IQ Option platform is easy.

- Click the Plus button to add an asset to your chart layout and choose it from among the CFD’s.

- It can be traded with leverage up to x100 and has Autoclosing features to cut losses and take profits at predetermined levels.

- Once you have identified your entry point enter your trade amount, the direction of your trade (Buy or Sell, long or short), set your leverage and stops and you are ready to hit enter.