Schaff Trend Cycle (STC) is an oscillator-type indicator that can help you identify positive and negative trends, pinpoint entry and exit points, as well as provide buy and sell signals. What’s so special about it and why you might want to use it in trading?

First, it is easy to understand. Schaff Trend Cycle is basically your most typical oscillator spiced up with a cycle component. Secondly, it was developed as a “better and more accurate version” of MACD (according to its author). Read the full article to understand how to trade with Schaff Trend Cycle and add it to collection of your trading strategies.

How does it work?

As already mentioned, Schaff Trend Cycle works in a similar fashion to MACD. It also incorporates the notion of cycles, crucial to the global financial markets, to make it easier to spot positive and negative tendencies.

Here is how to understand the readings of this indicator. There are two thresholds: one at 25 and the other at 75.

☝️

When the indicator crosses below the 75 line, a downtrend is believed to be present.

When the indicator is between the 25 and the 75 lines, the trend is developing in one of the two directions.

When the indicator turns into a straight line (which only happens at its uppermost and lowermost points), the asset is either overbought — when above the 75 line, or oversold — when below the 25 line. In both cases, a trend reversal can be expected, but no exact timeline is provided.

How to use Schaff Trend Cycle in trading?

STC is a pretty straightforward indicator, as there are not so many ways in which it can be used. And remember, though originally designed for Forex trading, it can be effectively applied to all asset types and all time frames. Here’s how traders usually use Schaff Trend Cycle.

When the indicator goes above the 25 line, the trend is believed to be taking a positive turn (according to the indicator). It is when traders may consider opening a buy position, but only if the confirmation is received.

What is a confirmation? A candle after the current one that moves in the same direction can be considered a confirmation. Readings of other indicators that go in line with STC can be treated as a confirmation as well.

The same rules apply to negative trends. When the indicator goes below the 75, some traders might consider opening a sell position. However, it is always necessary to double-check the readings of any indicator you use, including STC.

Now, what is the optimal time to close the deal? Some say it is when the indicator turns to the straight line, as it means that the trend has run out of its power and a new trend is required to open another deal.

How to set up Schaff Trend Cycle?

When working with IQ Option, setting up the Schaff Trend Cycle indicator is easy. Here’s what you need to do:

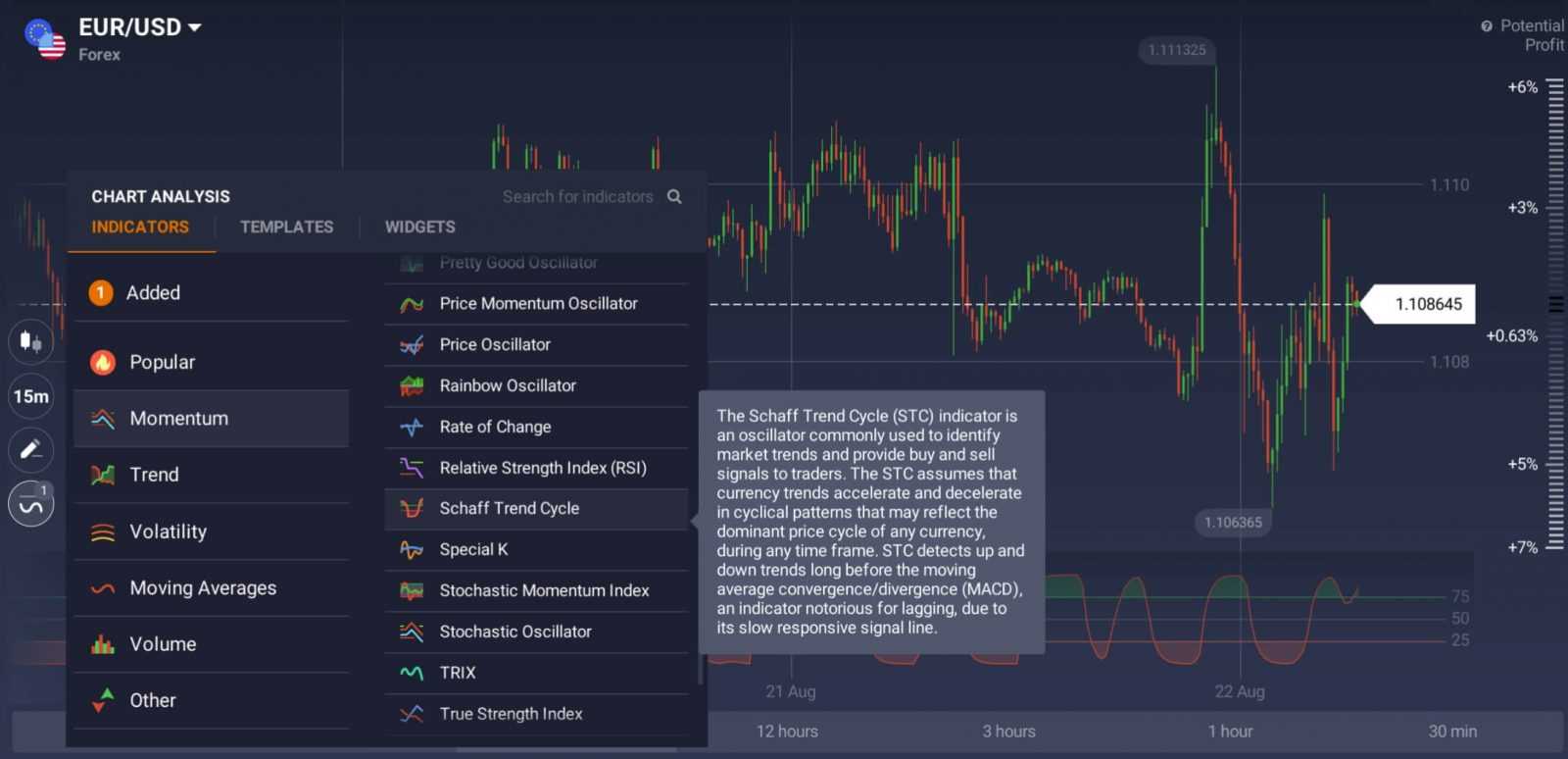

1. Click on the ‘Indicators’ button in the left-hand bottom corner of the screen and go to the ‘Momentum’ tab,

2. Choose ‘Schaff Trend Cycle’ from the list of available indicators,

3. Without changing the default setting, click the ‘Apply’ button. Experienced traders can adjust settings to their liking, but this option is not recommended for novice traders.

The indicator is ready to use!

Final thoughts

Schaff Trend Cycle is a great oscillator to learn and add to your portfolio of useful indicators. The only thing to remember is that STC, as any other technical analysis tool, is incapable of providing accurate signals 100% of the time. Therefore, it will return false signals from time to time.

STC is a leading indicator, which means that it sends a signal before the price move has occurred. It also means that it lacks the accuracy of lagging indicators and should be used in conjunction with other technical analysis tools.