Since its inception, Ripple has presented itself as a digital currency that works closely with regulators. Now Ripple is using its platform to promote more regulation in the cryptocurrency market. Specifically, Ripple would like British regulators to follow Japan’s lead and implement new rules to put an end to crypto’s “Wild West” days, where there are few rules, and even less consequences.

Now is the time to establish crypto framework

As reported by The Telegraph, Ripple’s head of regulatory relations, Ryan Zagone, urged the UK to strike a balance between “capturing risk and enabling innovation.” He cited consumer protection, anti-money laundering, and financial stability as three “pillars” to consider when crafting new legislation. Comparing the current state of cryptocurrency to the early days of the internet, Zagone believes the time is ripe for regulation:

“We’re at that time now where we need more clarity and rules and we need more certainty. It’s a good time to start revisiting that ‘wait and see’ approach taken by regulators.”

Due to the fact that crypto regulation has been lacking in the UK, seven of the UK’s leading cryptocurrency exchanges came together to form a self-regulating body by the name of CryptoUK. However, last month, UK Chancellor Philip Hammond revealed a new task force to manage risks around cryptocurrency.

For the past year, Japan has been at the forefront of the movement to revamp cryptocurrency regulation. Zagone proposed that Japan be used as a “blueprint” for establishing anti-money laundering regulation as well as legislation for consumer protection. According to Zagone, “regulation creates the guardrails on the highway that allows new entrants to come in, particularly institutional investors.”

Ripple on the rise

Ripple has been on the rise thanks to its multiple partnerships with banks and financial institutions, so it makes sense why the company would be in favor of more regulation in Europe. Last week, Spanish-based international bank Santander launched its One Pay FX app, which uses Ripple’s blockchain technology to transfer money across Europe and the US. The app is currently available in Spain, Brazil, Poland, and the UK.

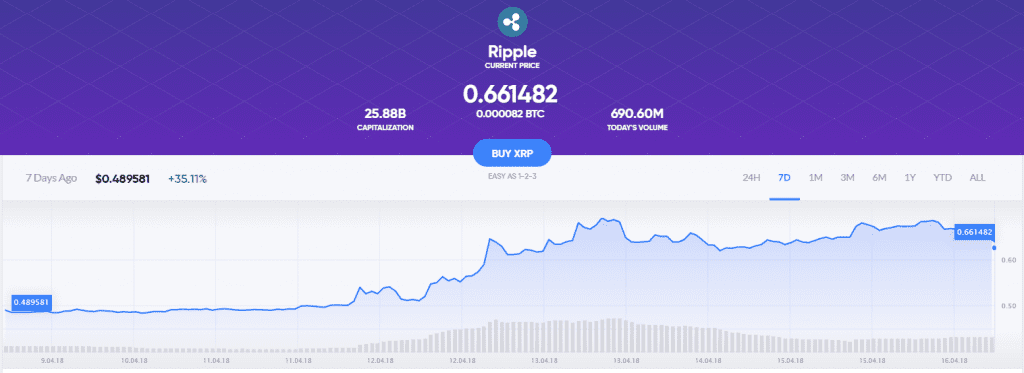

Ripple (XRP) market data by coinrate.com

Following news of the app’s release, XRP climbed steadily, finding a footing above $0.60. In an interview with CNBC, Ripple’s chief market strategist, Cory Johnson, clarified rumors surrounding Rippe’s status as a security. Many crypto traders speculated that XRP has not been added to popular exchanges such as Coinbase or Gemini since the U.S. Securities and Exchange Commission warned exchanges not to list coins that could be deemed securities. “We absolutely are not a security,” Johnson said. “We don’t meet the standards for what a security is based on the history of court law.”

Even though XRP has not been listed on these major exchanges, Ripple is making strides on its own. Needless to say, when XRP finally makes its way to more exchanges, it will be great news for investors. For now, Ripple appears to be focused on clarifying the regulatory ambiguity currently present in crypto.