Guest analysis by Cameron Bowen of Invezz.com.

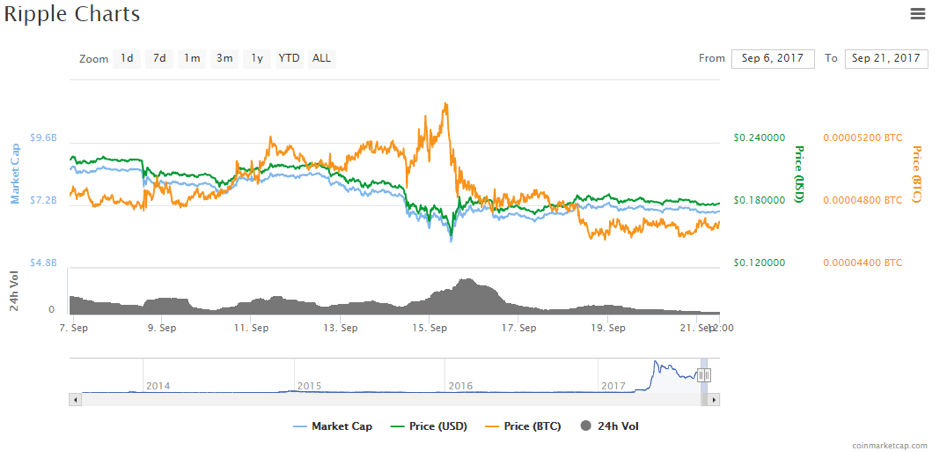

Since the sell-off in cryptocurrencies across the board, Ripple’s daily trading volume has given an insight into market sentiment.

Ripple’s lowest point against the dollar during the recent decrease in price was $0.1455. During that period, the highest trading volume was $225,285,000 over 24 hours. Compare that to the bounce afterwards when volume reached a high of $318,093,000 over 24 hours.

This increase in volume for the move higher suggests that buyers are still in control of this market and that we should still be looking for areas to buy Ripple.

South Korea is a leading participant in the Ripple market. Their top cryptocurrency exchange, Bithumb, accounts for 28.47% of traded volume, over double that of the second largest exchange, Poloniex. Combined with the two other leading South Korean exchanges, South Korea’s trading volume constitutes nearly 40% of all Ripple volume.

South Korea’s influence in Ripple does not stop there. Ripple is close to launching a blockchain-based, cross-border payments program for Japanese and South Korean banks.

This application of Ripple technology in the financial services sector is further evidence that the underlying technology of Ripple has capabilities outside that of just a cryptocurrency, and has ‘real world’ applications.

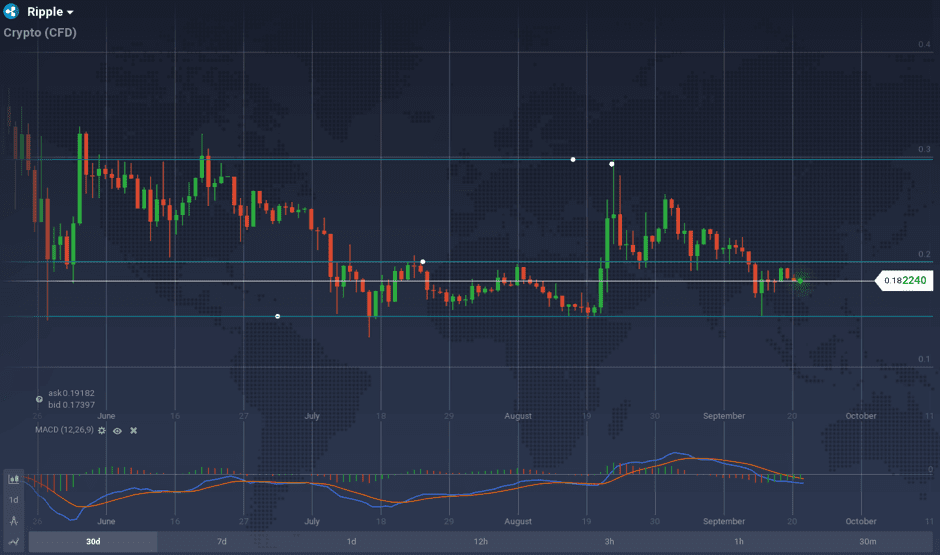

Bullish Technical Outlook Presents Buying Opportunity

- Major support level at 0.15 and resistance at the 0.20 handle.

- MACD histogram reducing suggesting momentum to the downside is slowing.

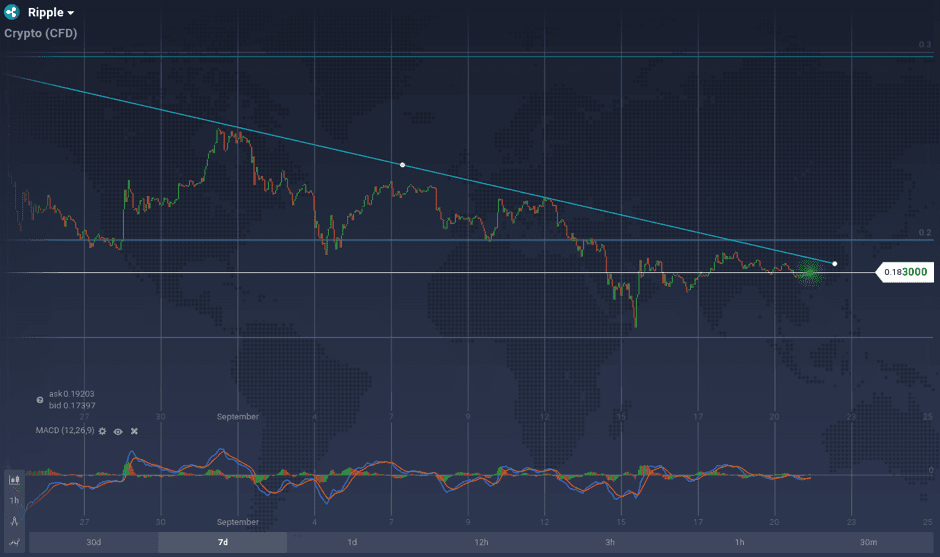

- Currently forming lower lows and lower highs, but sitting at major support

- Major downward trendline currently holding. Once broken, expect significant moves to the upside.

Summary: Bullish technicals will be supported by massive fundamental tailwinds

Given what was highlighted at the beginning of this article, I think the sentiment of this market is to the upside. Given the increased trade volume for moves higher and downward momentum decreasing, it looks like the market is consolidating before breaking higher.

The 0.15 handle has held five times now, which shows the strength of that level. The next point of resistance then becomes the 0.20 level. If the market doesn’t get back to 0.15, then I would be looking to buy on a breakout through 0.20. A break through this level would be extra confirmation that this market will continue higher.

Despite most of the indicators pointing higher, the current downtrend should signal caution to traders. This is confirmed by the downwards trendline that has held three times.

A break of the trendline will add more evidence to an upside move. Confirmation that the downtrend is over would be the break of the previous high (0.2325). Through there and I would expect to see this market test the 0.30 level.

Given the volatility in all crypto markets, a wide stop loss is advised to avoid any whipsaw moves that they are prone to having.