Based in California, Nvidia Corporation (NVDA:NSQ) is a US tech company focused predominantly on designing and manufacturing graphics processing units (GPUs) for gaming as well as for professional markets. The company also designs system on a chip units (SOCs) for the mobile computing and automotive market and has significantly expanded reach into data management and artificial intelligence solutions.

1) Main Business Focus

The main business focus of Nvidia Corporation spans the segments of PC graphics, graphics processing units (GPUs) as well as artificial intelligence (AI). The Company’s operates through two dominant streams: the GPU and the Tegra Processor. The Tegra brand integrates an entire computer onto a single chip, and is capable of driving supercomputing for mobile gaming and entertainment devices, as well as autonomous robots, cars and drones.

The Tegra Processor delivers solutions to four key markets: Gaming, Datacenter, Professional Visualisation and Automotive. Meanwhile the GPU range is targeted at specific markets. For example, the GeForce is for gamers, the Quadro for designers and the Tesla and DGX for AI data scientists and big data research – each solution standing out from the crowd in their own segment.

2) Share Performance

Nvidia shares have soared recently – rising over 38% in May 2017. Estimate beating earnings announcements in mid- May sent the share price rocketing 23% higher in the week ending May 12th alone. The share price has been surging higher over the past two years – gaining 541% since June 2015. Further to this during 2016, NVDA stock gained a whopping 227%. The share price has risen as the company has deepened its market share and expanded into a wider product range – driving higher revenues and profits.

NVDA: Over the past twelve month period the share price has risen 218%:

3) Revenues

During Q1 2017 Nvidia achieved revenues of 1.94USD billion, beating analyst estimates of 1.91USD billion and delivering growth in revenues of 48% YoY. This rise is revenues is attributed to a developing and deepening product range – the company has shifted from a GPU centred business model to a model that offers platform–based solutions which incorporates their market leading GPU technology. Further, by focusing on data storage and harvesting, revenues have been boosted significantly.

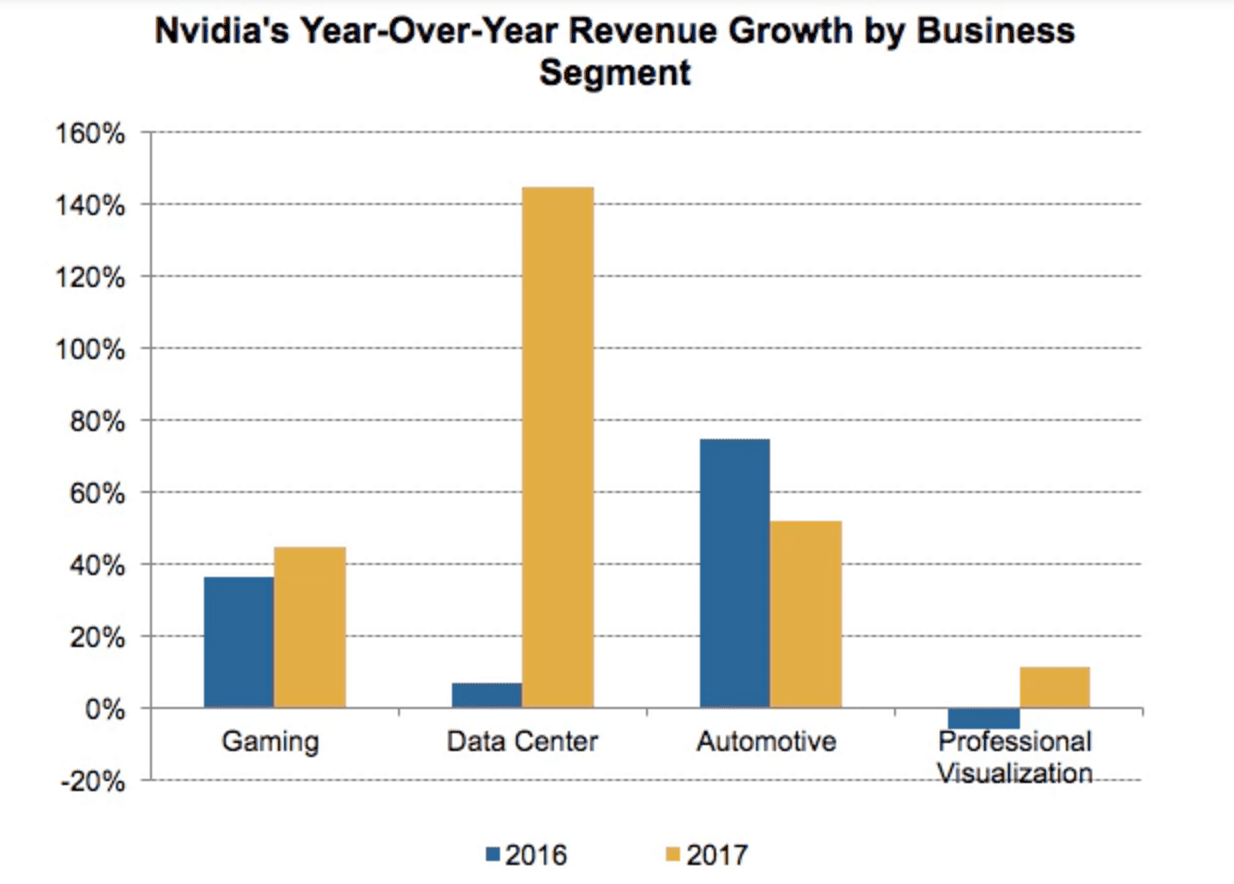

NVDA: Revenue Generation by Segment 2016 – 2017

4) Earnings

For Q1 2017, Nvidia reported an earnings per share (EPS) of 0.85USD – beating analyst estimates significantly (analyst estimate: 0.66USD) and delivering an impressive 85% YoY growth.

5) Dividends

In 2017, NVIDIA Corp delivered a dividend of 0.49 USD, an impressive 22.78% gain over the previous year. Wall Street analysts are forecasting dividends of 0.59 USD for the upcoming year – an expected growth rate of 21.86%.

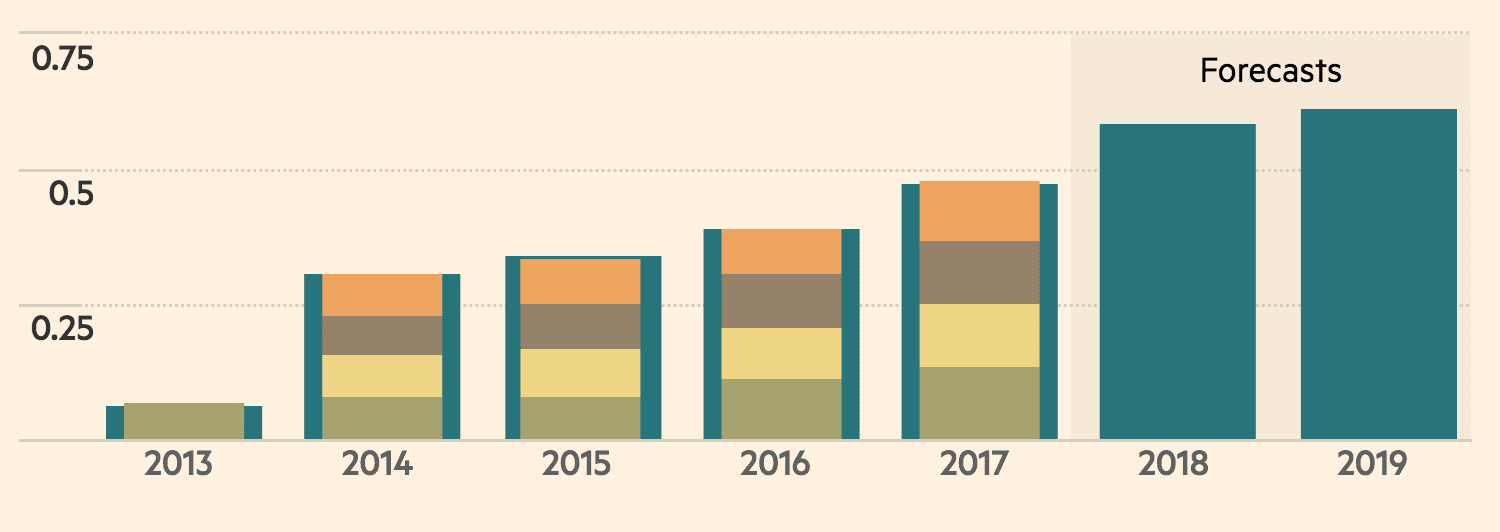

NVDA: Consistent Dividend Growth over the past 4 year period

6) Competitive Advantage

NVDA has marked itself out as a market leader in AI technology with its Pascal-based Tesla GPUs, which is a stand out solution in the deep learning segment. Advanced Micro Devices (AMD) and Intel (INTC) have been aggressively pursuing this space but NVDA has consistently captured a larger market share than its competition.

Although NVDA are a market leader in the sector, the competition is intensifying in autonomous vehicle technology. Intel and Qualcomm (QCOM) are the key competition for Nvidia in this space. Further to this Apple has indicated increasing interest in the self-driving vehicle, augmented and virtual reality, and AI – some of NVDA’s key growth drivers. It is also worth noting that Apple is attempting to target the GPU segment and if they prove successful will pose a significant threat to Nvidia growth going forward.

7) Self-Driving Partnerships

Nvidia has recently announced a partnership with Toyota Motor Corp in which the Japanese car maker would use Nvidia’s artificial intelligence technology to develop self-driving vehicle systems, planned for development over the next few years. Nvidia, has already secured partnerships with Audi and Mercedes, and is fast becoming a favourite choice in the self-driving car technology race. Nvidia’s Drive PX supercomputer processes incoming data from the car’s hardware sensors, such as cameras, and uses artificial intelligence to help the car react to its environment.

Overall the outlook is strong for Nvidia. The company is achieving consistent growth and developing new solutions at a fast enough pace to beat out intensifying competition.