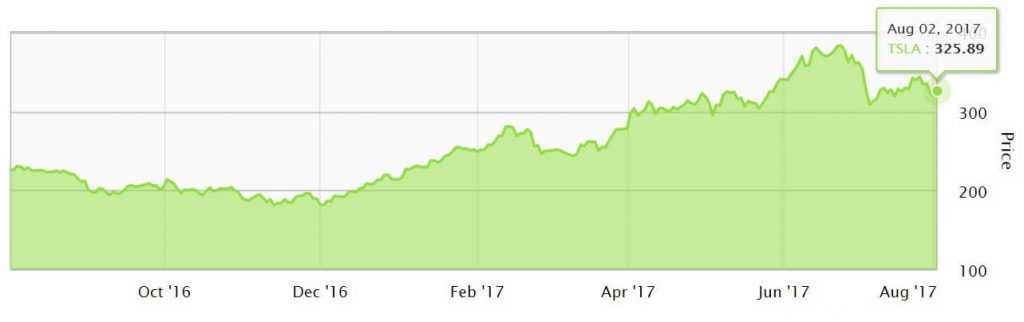

Tesla is still the United States’ most expensive automotive manufacturer. However, the company is not doing well in terms of financial performance and investors may sooner or later start getting rid of the stocks that had great potential but failed to deliver expected results.

TSLA stock dropped in value due to lower than expected number of vehicles delivered to the market. Despite higher than expected revenue of $2.79 billion, Tesla demonstrated negative earnings per share of $1.33.

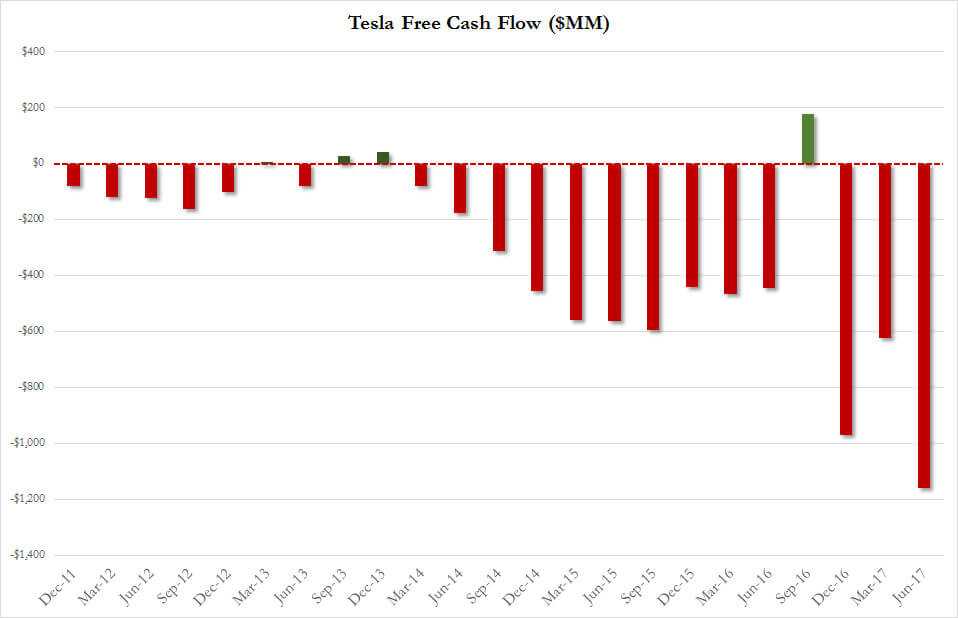

Elon Musk’s enterprise is burning cash at a record-high rate. During the last quarter, the company lost $1.16 billion of funds or approximately $13 million per day, which even Netflix can envy and almost double the Q1 results. Tesla expects to burn another $2 billion during the second half of the year, which perfectly correlates with Musk’s statement regarding falling margin.

The company is happy to report $3 billion of cash at hand but for some reasons forgets that it takes $3.9 billion in accounts payable and accrued liabilities to do so. Last quarter was the first one when payables and accrued were nearly $1 billion more than cash and equivalents.

EPS forecast is not expected to grow, just quite the opposite — it is still falling. And still the market drives the price of TSLA stock higher and higher.