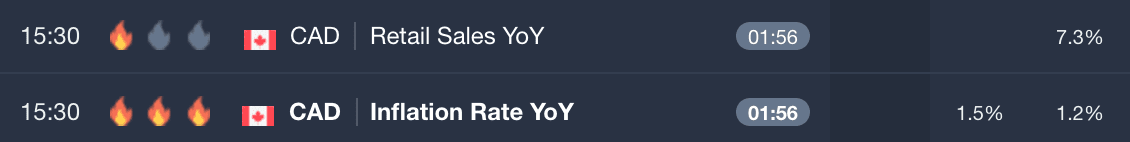

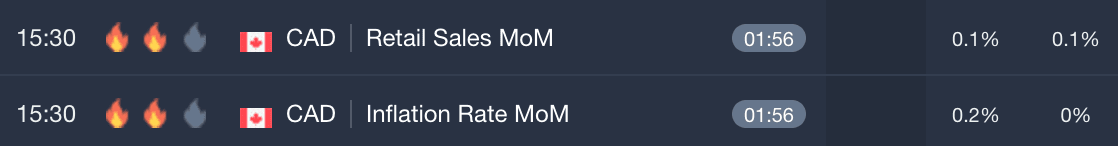

Retail sales and inflation data could spell trouble for the CAD.

Retail Sales Are Driving Growth

Canadian economic data has been indicating growth with inflation nearly non existent. The next reads on both could have a big impact on the CAD and send it moving against other world currencies.

Retail sales have been growing for more than 15 months although the pace of growth has subsided from a peak hit earlier this year. Expectations are for MOM growth in the range of 0.1% with core sales ex-autos at more robust 0.4%. Annualized sales are stronger, having risen steadily over the past year from just over 3.0% to 7.3% in the past two months. On average, over the past four months, annualized retail sales growth is trending over 7.0% and on track to continue expanding as economic growth persists.

The real threat is inflation but that has been running cool. On a month to month basis it is net positive but increases are tepid and offset by many months with declines. On a year over year basis headline inflation peaked at 2.1% in January of this year and has since subsided to near 1%. Core inflation is even cooler having fallen 1.1% to 0.9% over the last 12 months. Expectations for the current read are 0.2% MOM and 1.5% YOY.

At this level the Bank of Canada has no impetus to raise rates unless they give a big surprise. Even so, there may be reason soon enough if oil prices keep rising. The January peak in inflation was in tandem with a peak in oil prices, energy had been underpinning inflation and when oil prices fell the cost of everything else fell too. Risk today is that prices are rising to short term highs and could cause another spike in inflation. This, along with strong retail sales could strengthen the Canadian dollar versus other world currencies.

USD/CAD

The USD/CAD has been in downtrend for some time as forward FOMC has been on the decline. This pair has firmed a bit over the past few days as US data came in strong and the FOMC indicated rate a hike by December, and possibly three next year. Even so the pair is still trading below resistance targets and forming a potentially bearish triangle. Resistance is the top of the triangle where resistance crosses the down trend line. If broken it would signal a possible reversal of trend, at the very least the entrance of a new trading range.

Weak data could cause a fall from this level. Such a move is trend following and could take the pair down to new lows.

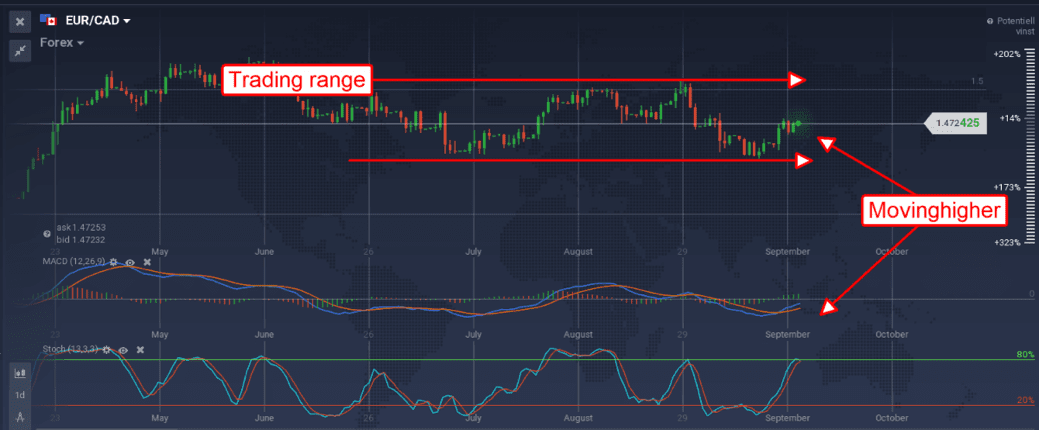

EUR/CAD

The EUR/CAD is moving up within a trading range and looks like it will continue moving higher.

Even if Canadian data comes in a bit strong it will not be enough to firm central bank outlook or strengthen the CAD. Not when the ECB is expected to begin its taper soon and embark on a path of long term policy tightening. The pair is currently forming a small flag pattern within a near term uptrend with bullish indicators. There is some sign of weakness in the signals and potentially strong resistance at 1.4750 but not enough to change outlook. A break above this level is would be a bullish signal and has a target near 1.5000.

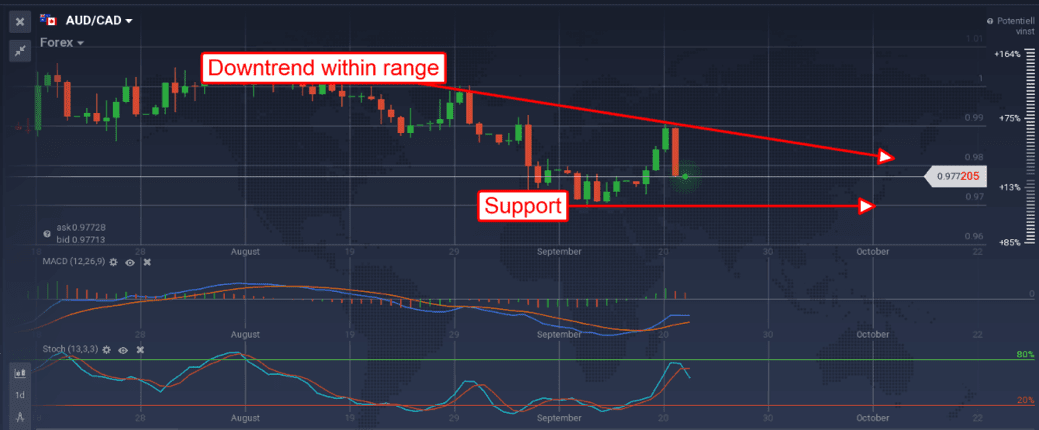

AUD/CAD

The AUD/CAD has been languishing in a range over the past year. The pair has been trading near sideways with choppy, jerky action as economic activity in both countries moves forward in fits and starts.

Current action has the price moving lower and this could continue if the data is positive. Lower targets for support are near 0.9700.