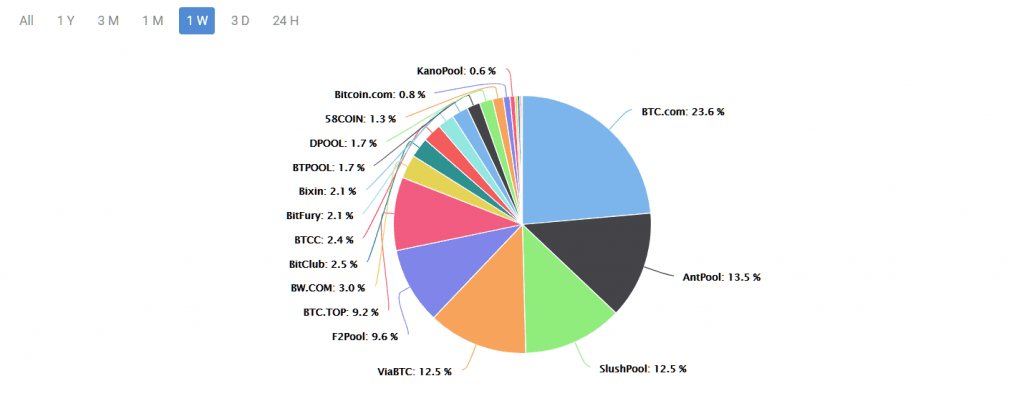

According to data from BTC.com, two of the largest Bitcoin mining pools, BTC.com and AntPool, account for a hash rate of over 37.1%, given that each miner accounts for 23.6% and 13.5% respectively. The problem is that both mining pools belong to the same entity – Bitmain, probably the most influential mining operator and mining equipment manufacturer and distributor. Well, for Bitmain itself this kind of dominance is not a problem at all, but the crypto community is watching how the Chinese company is approaching the 51% figure, and when that happens, things might turn out tricky.

The fact that the combined hash rate of Bitmain’s mining pools touched a record high in late June has already made the headlines. The company’s reported hashing power went beyond 42% at that time. However, should we worry about it?

What’s the problem with having 51% dominance?

Bitcoin started as a decentralized and peer-to-peer system that allowed everyone to make transactions without any intermediaries. To maintain the technology that underpins the whole system, the anonymous creator(s) invented the so-called miners – entities who ensure the smooth work of the network and validate transactions by creating new blocks. This is done by solving complex formulas, and miners are then rewarded for their effort.

Miners have to compete to generate new blocks by spending more computational power than others. If a miner has more computational power, he has more opportunities to reach the solution faster than the rest of miners, so that the latter would only approve all the transactions inside the new block. However, as the experts warn, if a miner has more than 51% of the hashing power, it can literally take control over the whole network by blocking other’s transactions, double-spending Bitcoins, or invalidating the entire blockchain. Given that Bitcoin has already gone mainstream, this might sound apocalyptic, but it’s not far from reality.

When miners try to validate a block, the only way for them to do so is to try multiple hashing combinations until they find the one that fits. Once a new block is added to the network, let’s say the block #10, all mining nodes will try to validate the next one, the eleventh, by making reference to that (the tenth). If there happens to be more than one chain, the mining nodes will look for the one that is older. However, if an entity has more than 51% hash rate, it can pick an older block somewhere in the chain and start re-mining from there, creating a new chain that would overtake the original one. This would make all the original transactions invalid. In another scenario, the entity with 51% hashing power can ignore attacking the whole system but choose to double spend some Bitcoins whenever it feels to.

If any of those scenarios is spotted by the Bitcoin holders, the cryptocurrency would instantly lose its relevance and credibility. The price would immediately collapse as everyone would try to get out of the market. In short, this might be the end of Bitcoin as we know it.

51% attacks have already happened

Bitcoin investors have real reasons to worry given that 51% attacks have already happened with several altcoins, such as Verge, Bitcoin Gold, and ZenCash among others. In May 2018, it was noted that an estimated 380,000 Bitcoin Gold tokens had been double-spent. In April, the Verge lost a quarter of its value overnight after the company announced a mining attack. Even if the team assured everyone that the problem was solved, the price still hasn’t recovered since then.

In fact, we don’t have to go too far with the examples. Bitcoin itself had an incident in 2014 when GHash.io had more than 51% of the hashing power. Unlike Bitmain, which acts as a company, GHash was more like a pool of different miners. Nevertheless, GHash chose to voluntarily drop the hashrate by having its miners moved to other pools. It picked 39.9% as the highest limit for its hashing power and recommended all miners to do so in the future.

However, even though Bitmain exceeded 40%, it doesn’t show any signs to consider that limit.

Is Bitmain really a threat?

We don’t know this for sure, but one thing is certain – Bitcoin has become more centralized than ever. It is losing its fundamental principles right before our eyes. The mining process is dominated by a few entities, most of the transactions are carried out via crypto exchanges rather than peer-to-peer, and finally, it’s hard to call Bitcoin transactions anonymous, as most of the major exchanges require ID verification before making any crypto operations.

Bitmain has its responsibility for neglecting the decentralized nature of Bitcoin. Moreover, we don’t even know the true figure of Bitmain’s hashing power. The company officially owns BTC.com, AntPool, and ConnectBTC, which together account for over 37% of the hashing power in the last three days. However, some say that Bitmain has shadow relationships with large miners like ViaBTC (with 12.5% hashrate), and BTC.TOP (with 9.2%). If this is true, then Bitmain can already conduct its 51% attack. However, the company denied any relationships that would hurt the Bitcoin network, even it is indeed the sole investor in ViaBTC.

In June, Bitmain CEO Jihan Wu told Bloomberg that he was open to having an initial public offering (IPO) in Hong Kong. If this happens, then Bitmain will be impossible to run away from responsibility in the case when it chooses to manipulate Bitcoin’s blockchain.

In conclusion, if Bitmain has the theoretical possibility to double-spend Bitcoins and carry out an attack, it is already a threat indeed. However, it would be inappropriate for investors to panic right now. Bitcoin represents an entire ecosystem with many big players involved, and they wouldn’t let such an attack happen.