CFDs enable you to speculate on price movements without ever taking ownership of underlying assets. You can gain returns from rising or falling markets through the use of leverage to achieve maximum gains. Leverage also brings risk, so CFD trading is only for individuals who understand the mechanics and are willing to incur losses.

In this guide, we will take you through all you need to know about CFDs and how to trade them. We will also look at how to approach risks, choose a suitable broker, and develop a systemized approach to trade in CFDs.

What Are CFDs?

A Contract for Difference (CFD) is a financial derivative that allows you to speculate on price movements without taking possession of the underlying asset. Traded CFDs are contracts where you agree to swap the difference between the opening and closing value of an asset.

Think of a CFD as a bet on whether an asset price will increase or decrease. If you think the price of Apple shares is going to increase, you buy a CFD. When the price increases, you profit on the difference. If the price decreases, you lose.

The advantage is that you don’t have to own Apple shares to profit from their price movement. You are only betting on the price difference.

How Do CFDs Work?

CFDs mirror the underlying asset’s price movement, like stocks, indices, commodities, or currency. The price of Apple stock increases by $1, and so does the price of Apple CFD. Your loss or profit will be determined by how much you profit or lose between your close and open prices, times the number of CFDs you sold or bought..

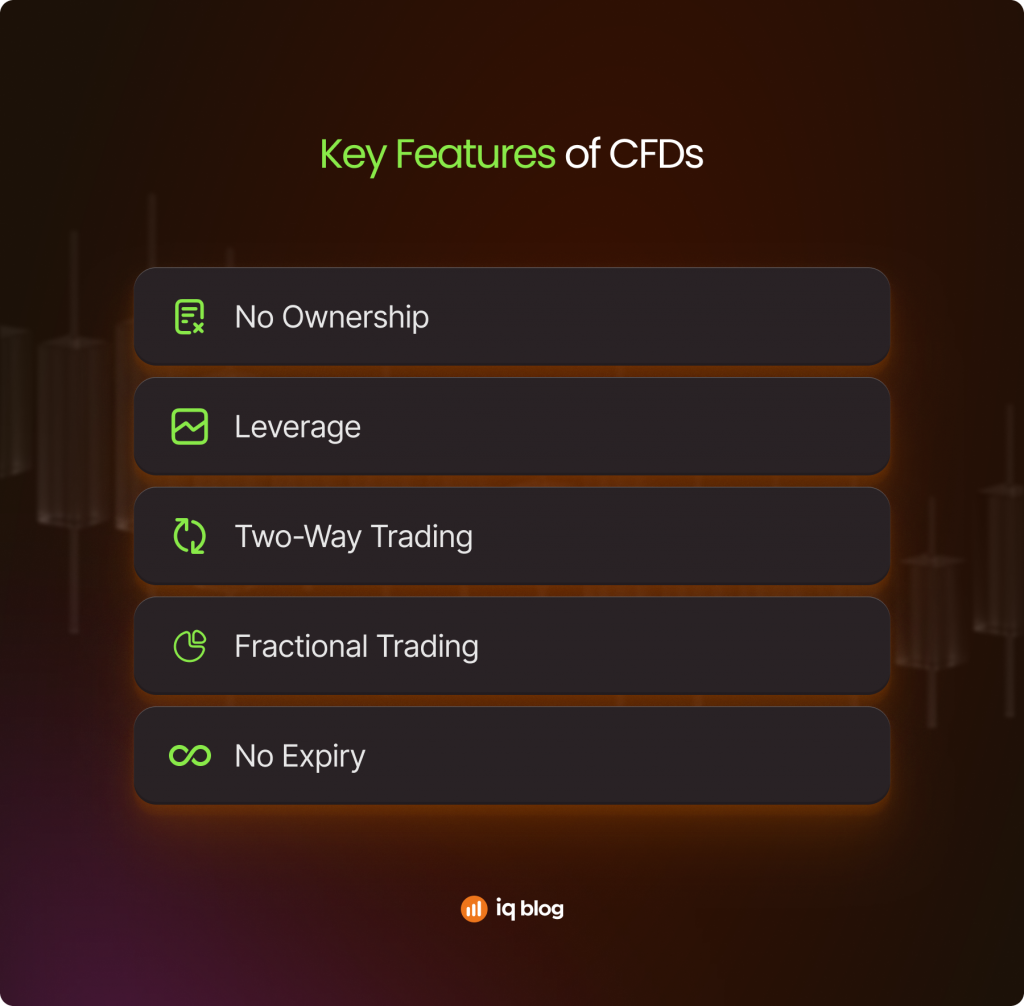

Key Features of CFDs

- No Ownership: You do not own the underlying security whatsoever, but rather the right to profit from price movement.

- Leverage: You are able to control big positions with comparatively modest capital.

- Two-Way Trading: You can profit from both uptrend and downtrend markets.

- Fractional Trading: You can buy and sell fractions of a share or units.

- No Expiry: Most CFDs never expire, although you pay overnight rates for holding positions.

How CFD Trading Works

CFD trading requires opening and closing positions according to your market forecast. Knowing how it works makes it easy to trade effectively.

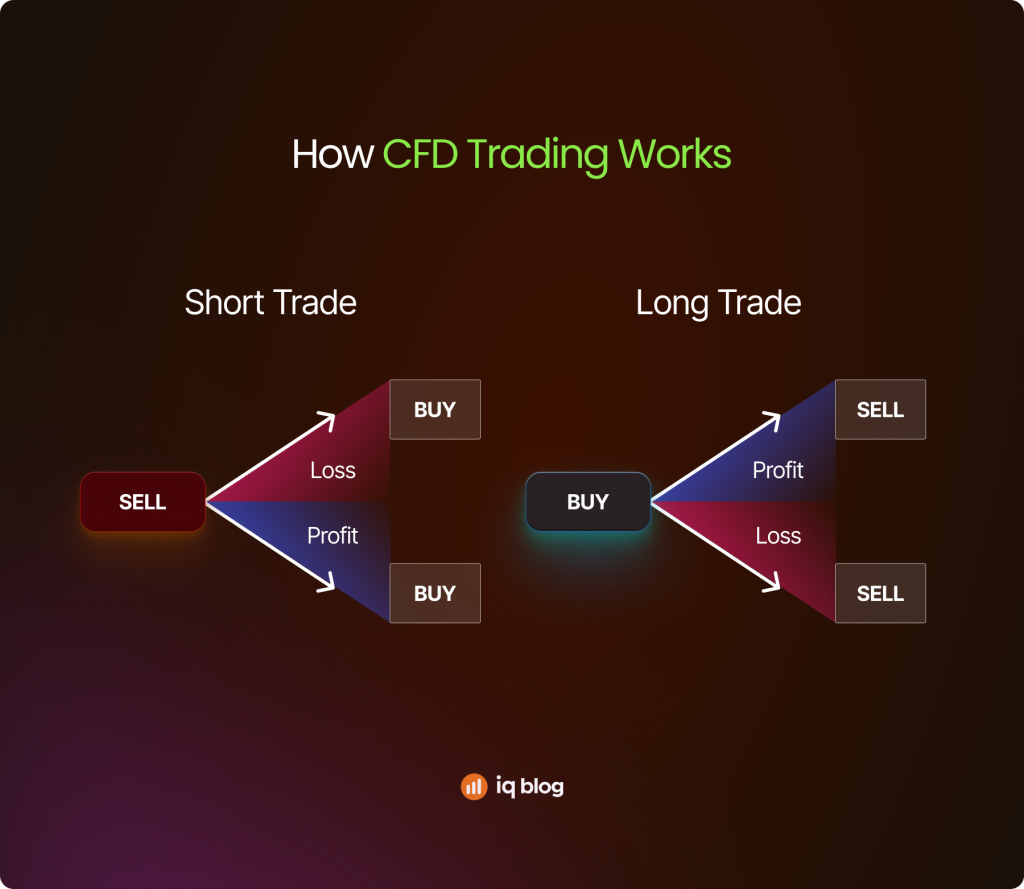

Opening and Closing Positions

When you open a position in CFD, you’re entering into an arrangement with your broker. You’ll “buy” (go long) if you expect prices to rise, or “sell” (go short) if you expect prices to fall. To wind down your position, you make the opposite trade. If you bought CFDs, you sell them to close. If you sold CFDs, you buy them back to close.

Long vs. Short Positions

- Long Position (Buy): You make money if the asset price goes up. For example, if you buy 100 Apple CFDs at $150 and the price rises to $155, you make $500.

- Short Position (Sell): You make money if the asset price falls. If you sell 100 Apple CFDs at $150 and the price drops to $145, you make $500.

Profit and Loss Calculations

CFD profit calculations are easy:

Profit/Loss = (Closing Price – Opening Price) × Number of CFDs × Direction

Direction is +1 for long and -1 for short.

Example Long Position:

- Purchase 200 Apple CFDs at $150

- Sell at $155

- Profit: ($155 – $150) × 200 × 1 = $1,000

Example Short Position:

- Sell 200 Apple CFDs at $150

- Buy back at $145

- Profit: ($150 – $145) × 200 × 1 = $1,000

Break-Even Analysis: Your break-even is your opening price plus/minus the spread and overnight fees. Factor these costs into your trading decisions.

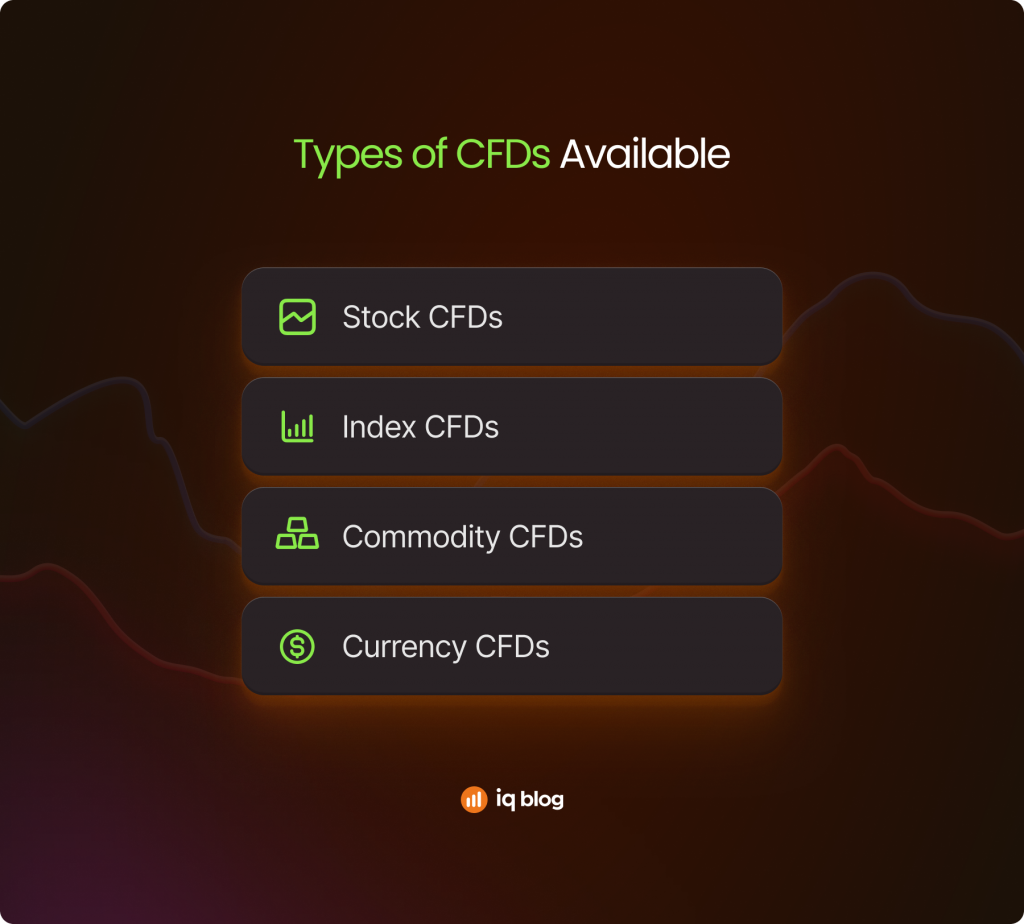

Types of CFDs Available

Different types of CFDs give you exposure to different markets and asset classes. Each has unique features and considerations when trading.

Stock CFDs

Stock CFDs track the price of individual companies’ shares. You can purchase or sell Apple, Google, Tesla, or other listed company CFDs without borrowing the underlying shares. Stock CFDs typically have tight spreads and good market hours liquidity. They are best for equity market-experienced traders.

Index CFDs

Index CFDs track market indices like the S&P 500, FTSE 100, or DAX. They provide exposure to the overall market without trading individual stocks. Index CFDs benefit from diversification and are less risky than an individual stock. They are suitable for traders who prefer to perform market-wide analysis instead of single stock picking.

Commodity CFDs

Commodity CFDs provide exposure to agriculture, energy, and precious metals. You can sell or buy coffee, wheat, oil, or gold CFDs based on futures prices. Commodity CFDs have wider spreads and are potentially more volatile than stock CFDs. They are best traded by those traders who are well-versed in fundamental analysis.

Currency CFDs

Forex CFDs or currency CFDs involve dealing in currency pairs like EUR/USD or GBP/JPY. The forex market is the most extensive and liquid globally. Currency CFDs have the tightest spreads and highest leverage. They’re a 24-hour market and a quick price supporter favorite.

CFD Trading Costs and Fees

Understanding CFD fees is crucial to profitability in trading. There are several fees that will cut into your returns, and minimizing them maximizes your profitability.

Spread Costs

Spread is the difference between the buy and sell price. This is your key cost of trading and varies with asset and market conditions. Major currency pairs could have spreads of 0.5-2 pips, but individual stocks could have spreads of 2-10 cents. Volatile markets tend to have wider spreads.

Overnight Financing Charges

When you hold CFD positions overnight, you will receive or pay financing charges. They are computed on the financing rate of the underlying instrument plus/minus broker margin. Financing fees typically mean charges for long positions, but short positions can earn interest. The actual calculation will be determined by prevailing interest rates and your broker’s terms.

Commission Models

Some brokers charge commissions on CFD trades, especially stock CFDs. These can be in the form of flat fees per trade or percentage fees. Commission-free brokerages typically compensate by having wider spreads. Consider the overall cost of trading, not commission percentages only.

Cost Management Strategies:

- Consider the spreads between various brokerages

- Avoid overnight unless absolutely necessary

- Consider all costs in your trading plan

- Employ limit orders to control execution costs

CFD Trading Strategies for Beginners

Successful CFD trading requires systematic approaches rather than random guessing. There are several systems best suited to different market conditions and trader personalities.

Day Trading

Day trading involves opening and closing positions on the same day. It avoids overnight finance charges but requires constant attention and quick decision-making. The most effective day trading strategies include scalping (very short-term trades), momentum trading (riding strong price movements), and range trading (buying support, selling resistance).

Swing Trading

Swing trading involves holding for weeks to days, taking medium-term price moves. Swing trading requires less time and effort than day trading. Swing traders often use technical analysis to decide when to enter and when to exit, considering trends and chart patterns but not minute-by-minute price action.

Position Trading

Position trading involves holding CFDs for weeks to months, aiming for major market trends. This strategy requires strong fundamental analysis skills. Position traders need to account for overnight financing charges, which can be substantial in the longer term. They make use of wider stop-losses in order not to get stopped out by short-term fluctuations.

Risk Management in CFD Trading

Profitable CFD trading, as opposed to account destruction, relies on good risk control. All serious traders prioritize risk control over profit maximization.

Position Sizing Rules

Never risk more than 1-2% of your account equity on any single trade. This will enable you to ride 20-50 consecutive losing trades and still have capital to trade with. If you have a $10,000 account, risk no more than $100-200 per trade. Using proper position sizing, you can ride 20-50 consecutive losing trades and still have capital remaining with which to trade.

Stop-Loss Implementation

Always use stop-losses to minimize potential losses. Place them at technically appropriate levels, not arbitrary percentages or dollar amounts. A suitable location for a stop-loss would be slightly below a recent swing low on a long or slightly above a recent swing high on a short.

Risk-Reward Ratios

Make efforts towards trades with a possible profit greater than a potential loss at least 2:1. While risking $100, target at least $200 of possible profit. This risk-reward ratio allows you to profit even when you are wrong more often than right. You can have a 40% winning ratio and still be profitable with a 2:1 risk-reward ratio.

For more important tips, read our post on “5 Risk Management Tools and Tips for Traders”.

How to Get Started with CFD Trading

Starting CFD trading requires rigorous preparation and realistic expectations. Transitioning to live trading too early always results in defeat.

Choose a CFD Broker

Your broker can make a big difference in how your trading experience will be. Look for a properly regulated broker with tight spreads, good execution, and reasonable customer service. Ensure that your broker offers negative balance protection so that you do not owe more money than your balance.

Broker Evaluation Metrics:

- Regulation: Choose brokers with regulation by reliable authorities

- Spreads: Compare fees between asset classes

- Execution Quality: Test order execution speed and accuracy

- Customer Support: Verify responsive support during your trading hours

- Educational Resources: Choose brokers with education offered for trading

Select Your Platform

Platforms for trading should be intuitive, stable, and offer you the tools you need for analysis. MetaTrader 4, MetaTrader 5, and proprietary broker platforms are among the most well-known platforms. Test demo accounts on platforms before risking real money. Ensure they are operating correctly on your equipment and internet.

Practice Account Benefits

Demo accounts enable you to trade CFDs with no risk of actual money. Experiment with them to hone strategies, familiarize yourself with platforms, and build confidence.

Remember, however, that demo trading does not reflect the emotional subtleties of risking real money. Start with infinitesimal live positions once you feel prepared.

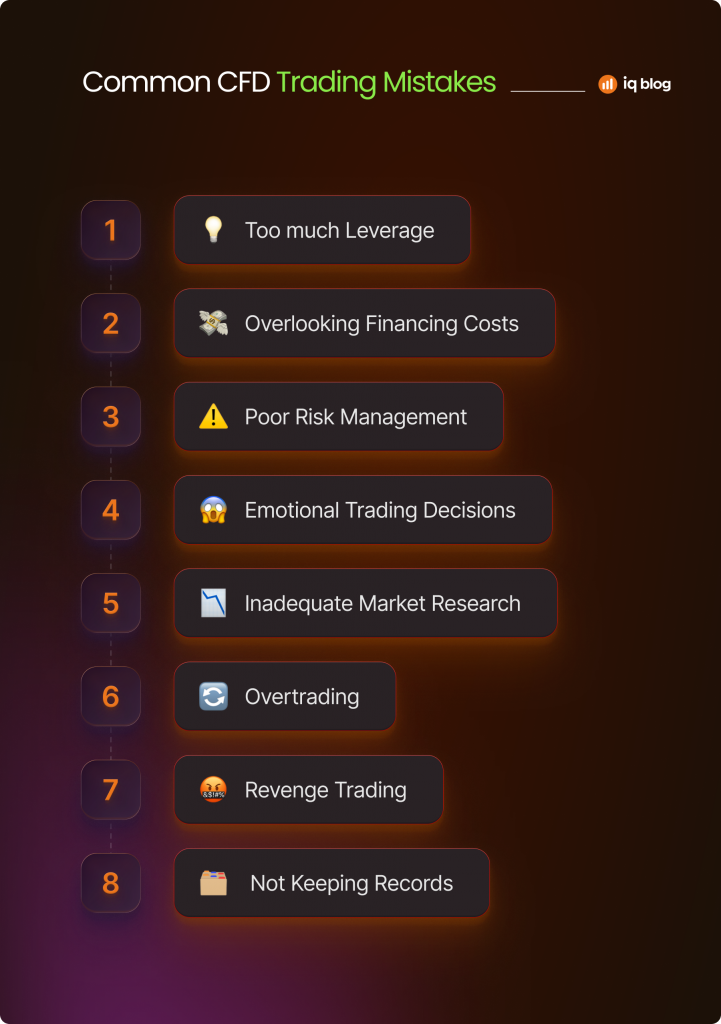

Common CFD Trading Mistakes

- Too much Leverage: New traders use high leverage, hoping to accelerate profit. Conversely, it typically accelerates losses and leads to fast account demolition.

- Overlooking Financing Costs: Overnight holding positions have financing charges that slowly deplete profit. Consider factoring these charges into your trades.

- Poor Risk Management: Most traders risk too much on each trade or fail to use stop-losses. This approach works in the short term but leads to considerable losses in the long term.

- Emotional Trading Decisions: Fear and greed dictate most trading decisions. Experienced traders use systematic approaches rather than emotional commands.

- Inadequate Market Research: Hurrying into trades without proper analysis lowers your chances of success. Develop systematic processes for market analysis.

- Overtrading: Too many trades rack up expenses and are likely to lead to poor decision-making. It’s better to have a few good trades than lots of bad ones.

- Revenge Trading: Trading more to recoup is often counterproductive. Take a loss with dignity and stick to your plan.

- Not Keeping Records: Without keeping records, you can’t know what works and what doesn’t. Keep journals of every trade and every decision.

To know how best to avoid some of these mistakes, you can check our posts on 7 Habits That Define Winning Traders or 3 Steps to Improve Your Trading Psychology.

Conclusion

Without the hassles of owning underlying assets, CFD trading provides strong opportunities to profit from market movements across a variety of asset classes. However, success demands thorough risk management, disciplined planning, and reasonable expectations. Although CFDs’ flexibility and leverage can increase profits, they can also increase losses, so before risking actual money, it is crucial to get the right training and experience.

FAQs

Q. What is the lowest CFD trading deposit?

Most brokers require a minimum deposit of $100-$500, but you can start trading with lower balances. However, $1,000-2,000 gives more room for risk management.

Q. Can I lose more than my initial investment?

You cannot lose more than what is in your account with negatively balanced-protected accounts from authorized brokers. However, this protection might not be provided by unregulated brokers.

Q. How are overnight finance charges determined?

These charges are calculated daily on the basis of position size and available interest rates. Short positions typically have fees, but long positions might earn interest.

Q. How are CFDs different from futures?

CFDs lack expiration dates, and no contract sizes exist as a standard, whereas futures possess expiration dates and contract details. CFDs are also more accessible to the retail trader.