What Is Portfolio Hedging?

Portfolio hedging is a strategy used to limit losses in turbulent market conditions. The object here is not to make more money but rather to limit losses if the market goes against one’s positions. Hedging is similar to buying insurance: one pays a small cost now to avoid a larger loss later.

Hedging makes sense when the markets are volatile, major news is expected, or the portfolio has gained value and you want to protect those gains. It works to assist traders in managing risk without having to close core long-term positions.

Why Use Options for Hedging

Options are popular for hedging because they offer flexibility and controlled risk. When you use options, you can protect your portfolio without selling your existing positions. This keeps your long term strategy intact while reducing exposure to short-term volatility.

Options allow you to define your maximum loss in advance. You choose the strike price, the expiration, and the level of protection you want. This makes them far more precise than other hedging methods.

Another advantage is that options enable you to hedge just a part of your portfolio. You can hedge a single stock, a sector, or the entire market by using index options. That level of customization provides traders with greater control and helps balance risk without sacrificing potential upside.

Key Option Concepts You Must Know

To hedge with options, you need to understand a few core terms. These concepts determine how much your hedge costs and how much protection you get.

- Call Option – A call option gives you the right to buy an asset at a set price. Calls are mostly used for bullish strategies, not for hedging. They are mentioned here only to help you understand the difference.

- Put Option – A put option gives you the right to sell an asset at a set price. Puts are the primary tool for hedging because they rise in value when the market falls. This makes them ideal for protecting a portfolio during downturns.

- Strike Price – The strike price is the level where the option becomes effective. A lower strike offers cheaper protection but covers less of the downside. A higher strike costs more but gives stronger protection. The strike you choose defines your safety net.

- Expiration Date – The expiration is the date the option contract ends. Short expirations cost less but only protect you briefly. Longer expirations offer more stability but increase the cost. Choosing the right duration depends on how long you want protection.

- Premium – The premium is the amount you pay for the option. It is the cost of the hedge. Premiums rise when volatility increases, so timing matters. The lower the premium, the more efficient your hedge becomes.

When to Hedge a Portfolio

It is most effective in times of uncertainty or when your portfolio is exposed to higher risks. The goal is to protect value, not to increase returns.

Traders hedge when the markets appear to be volatile and during any major events that are most likely to cause a sudden crash. These can come in the form of economic reports, central bank decisions, earnings releases, or geopolitical news. Hedging before these events helps minimize potential losses.

Hedging is also helpful when your portfolio has gained value and you want to secure part of those gains. Instead of selling your positions, you can buy protection and keep your long-term investments intact. This allows you to stay in the market while limiting downside risk.

Hedging Strategies Using Options

Options allow you to build different types of hedges depending on how much protection you want and how much you are willing to pay. Here are the most common strategies traders use.

Protective Put

A protective put is the simplest hedge. You own the asset and buy a put option on the same asset. If the price drops, the put increases in value and offsets part of the loss. This strategy gives strong downside protection while allowing the asset to keep rising.

Collar Strategy

A collar uses two options. You buy a put for protection and sell a call to reduce the cost. The sold call limits your upside, but the reduced cost makes the hedge more affordable. Traders use collars when they want low cost protection and accept a capped profit.

Covered Call

A covered call is not a direct hedge, but it helps reduce risk by generating income. You sell a call option on a stock you already own. The premium collected offsets potential losses if the stock falls. This works best in sideways or slow markets.

Index Options Hedge

Instead of hedging one asset at a time, you can hedge your entire portfolio using index options such as S and P 500 or Nasdaq puts. These options act as broad protection when the whole market is at risk. This is efficient for diversified portfolios.

Volatility-Based Hedges

Some traders buy options on volatility instruments such as VIX options. These options often rise when fear increases in the market. They can act as a hedge during sharp downturns or sudden risk events.

How to Calculate Hedge Size

To hedge your portfolio correctly, you need to know how many option contracts are required to match the value of your holdings. You are trying to achieve a balance where the gain from the hedge offsets the loss in your portfolio during a market decline.

Start by calculating the total value of the position you want to protect. If you hold individual stocks, use the current market value. If you want to hedge a full portfolio, use the total value adjusted for volatility or beta. Beta measures how closely your portfolio moves compared to the market. A portfolio with a beta above one may need a larger hedge to match the same level of protection.

Next, check the contract specifications of the option you plan to use. Most equity options cover one hundred shares. Index options represent a larger notional value, which means fewer contracts may be needed. Divide your total exposure by the value covered by one contract to get the number of contracts required.

Finally, adjust for the strike price. Options with strikes farther from the current price provide weaker protection and may need more contracts to offer effective coverage. Options closer to the current price offer stronger protection and usually require fewer contracts.

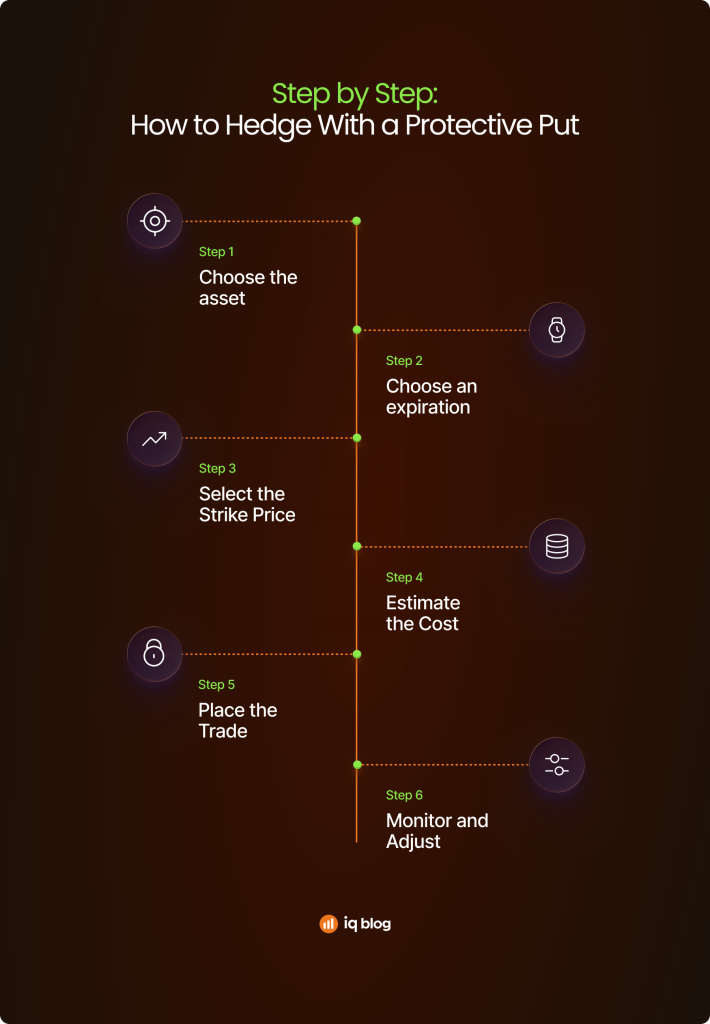

Step by Step: How to Hedge With a Protective Put

A protective put is the simplest way to hedge a stock or a portfolio position. It works like insurance. You keep your asset, and the put protects you if the price falls. Here is how to set it up in a clear, practical way.

- Pick the Asset You Want to Hedge – Start by identifying the stock or index you want to protect. This should be an asset that makes up a meaningful part of your portfolio. The hedge will only work if it matches the position you hold.

- Choose the Expiration Date – Pick an expiration that covers the period of risk you are worried about. Short expirations cost less but offer brief protection. Longer expirations provide more stability but are more expensive. Your timeframe should match your outlook.

- Select the Strike Price – The strike sets the level at which protection begins. A strike near the current price gives strong protection but costs more. A lower strike is cheaper but leaves part of the downside uncovered. Choose the strike based on how much protection you want.

- Estimate the Cost – The option premium is the cost of the hedge. It reduces your net return but protects you from larger losses. Compare the premium with the value of your position to make sure the hedge is worth the cost.

- Place the Trade – Once you choose the strike and expiration, buy the put. You still keep your original position. The put will increase in value if the asset drops, helping offset losses.

- Monitor and Adjust – Watch how the hedge performs. If the market stabilizes, you may close the put early to save part of the premium. If the risk continues, you can roll the option to a new strike or expiration to extend protection.

Cost of Hedging

Hedging with options always comes with a cost. This cost affects your overall return, so it is important to understand what you are paying for and why.

The first cost is the premium. This is the price of the option you buy. Premiums rise when markets are volatile because demand for protection increases. When volatility is low, premiums are cheaper. Timing your hedge during calmer periods can reduce the cost.

Time decay is another factor. Options lose value as they approach expiration. This means your hedge becomes less effective over time if the market does not move. Longer expirations slow down time decay but increase the upfront premium.

Implied volatility also plays a role. High implied volatility makes options more expensive even if the market has not moved. Hedging during spikes in volatility can reduce efficiency because you pay more for the same level of protection.

Because hedging reduces net gains, traders must decide if the cost is worth paying. The goal is not to maximize profit but to protect capital during periods of uncertainty. A well-timed hedge can save more than it costs.

Common Mistakes When Hedging With Options

Many traders understand the concept of hedging, but still make certain mistakes that weaken the protection. Knowing these kinds of mistakes helps you avoid unnecessary risk and improve the hedge’s efficiency.

- Hedging Too Late – Traders often wait until the market drops before buying protection. At that point, volatility is higher and options are more expensive. A late hedge costs more and offers less value. Hedging works best when applied before major risk appears.

- Choosing the Wrong Strike Price – Strikes that are too far from the current price offer weak protection. Strikes that are too close cost more than needed. The best strike is the one that matches your risk tolerance and the size of the potential drawdown you want to avoid.

- Using Expirations That Are Too Short – Short-term options decay fast. It can make your hedge expire well before the risk is over. Many traders underestimate how long market volatility can last. Using expirations that match your time horizon offers improved stability.

- Hedging the Wrong Part of the Portfolio – Some traders over-hedge, hedging away upside everywhere. Other traders under-hedge, leaving a majority of their risk uncovered. The size of the hedge should be appropriate to your exposure, market view, and risk tolerance.

- Ignoring Implied Volatility – Implied volatility affects option prices. Buying hedges during high volatility means paying a higher premium. Many traders do not consider this and end up with an expensive hedge that loses value quickly once volatility drops.

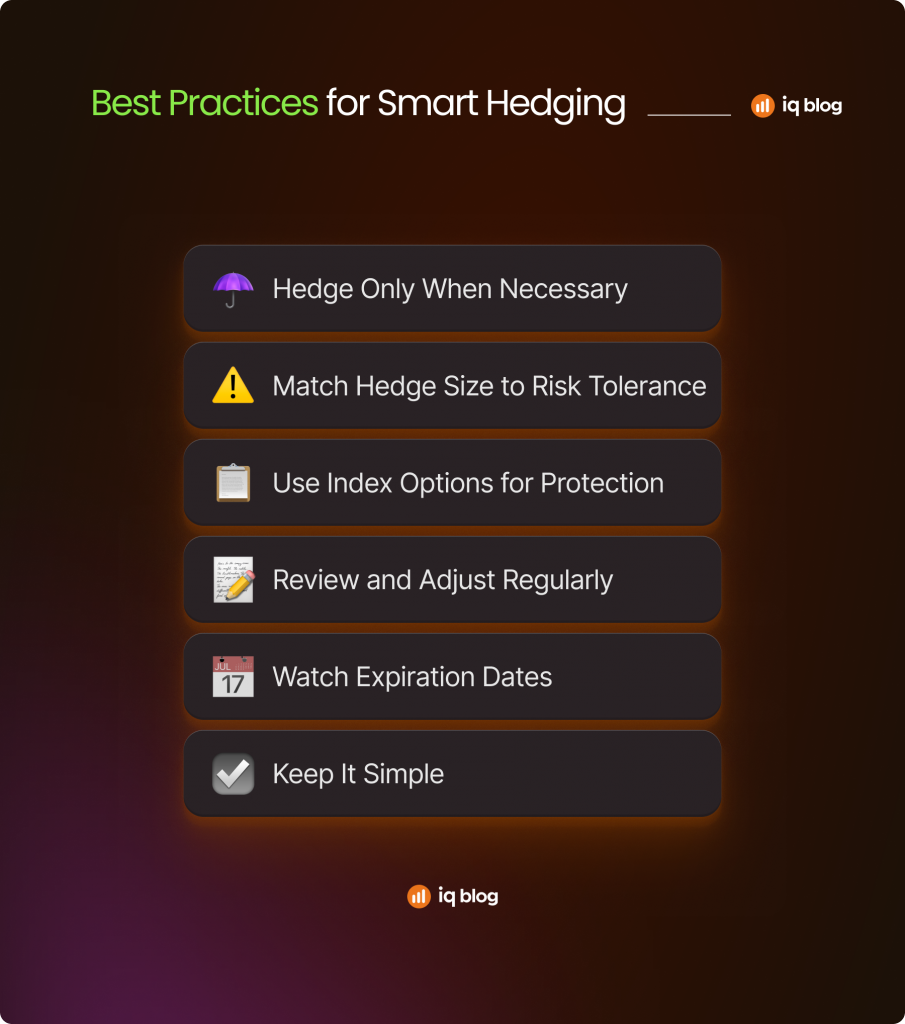

Best Practices for Smart Hedging

Good hedging balances protection with cost. The goal is to manage risk without giving up too much potential profit. These practices help you build a hedge that stays effective and consistent.

- Hedge Only When Necessary – Hedging is not something you need to do all the time. It is most useful during uncertainty or when protecting gains. Hedging too often reduces returns without adding real value.

- Match Hedge Size to Your Risk Tolerance – Your hedge should reflect the level of risk you want to reduce. A full hedge offers strong protection but limits potential growth. A partial hedge reduces cost and still softens major drawdowns.

- Use Index Options for Broad Protection – Index puts offer efficient coverage for diversified portfolios. They often cost less than hedging each stock individually and protect against broad market drops.

- Review and Adjust Regularly – Market conditions change. A hedge that works one month may become unnecessary or ineffective the next. Check your hedge as the market moves and adjust the strike or expiration if needed.

- Watch Expiration Dates – Do not let your hedge expire without noticing. Time decay affects protection. Rolling the option before expiration keeps your coverage active.

- Keep It Simple – Simple hedging strategies are easier to manage and understand. Complex structures may look efficient, but often behave unpredictably. Clear rules lead to better results.

Conclusion

Hedging your portfolio with options is a simple, effective way to manage risk in uncertain markets. Options give flexibility, controlled downside, and the ability to stay invested while protecting your capital. A correctly chosen put or index option could reduce losses and help you hold gains that took months to build. Successful hedging takes planning.