The price of Bitcoin tends to decrease after the forks. But not for the reason you think… Collective fear is not the prime driver behind the plunge, the cold-blooded premeditation is. Whales, investors capable of moving the market with enormous trades, bring the Bitcoin market down.

Three different versions of Bitcoin are currently available on the market: Bitcoin itself (BTC), Bitcoin Cash (BCH) and Bitcoin Gold (BTG). The last two emerged through the process known as hard fork, when the original blockchain is split in two. While Bitcoin Cash was trying to solve the problem of low transaction speed, Bitcoin Gold is aimed at miners. BTG developers want to make mining easier, decentralize the network even further and open up to a wider audience.

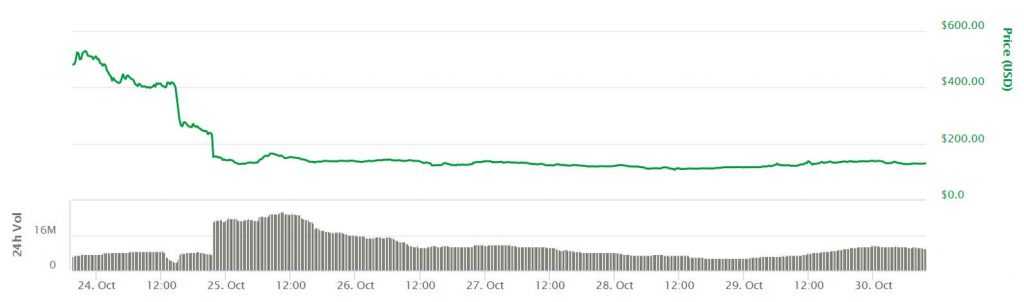

While the first hard fork in the history of Bitcoin took place in July, the second one happened on October 24th. Bitcoin Cash, an alternative bitcoin born during the first fork, initially demonstrated growth and was once traded at around $914. As of today, it is priced at $465. Bitcoin Gold has already lost over 70% of its value. In both cases lack of community support is the main reason behind the weak price action.

As mentioned above, hard forks also influence the price of the original blockchain, which is Bitcoin. Both times the cryptocurrency has depreciated in the days following the fork. The involvement of the so-called whales is believed to be the prime factor and here is why.

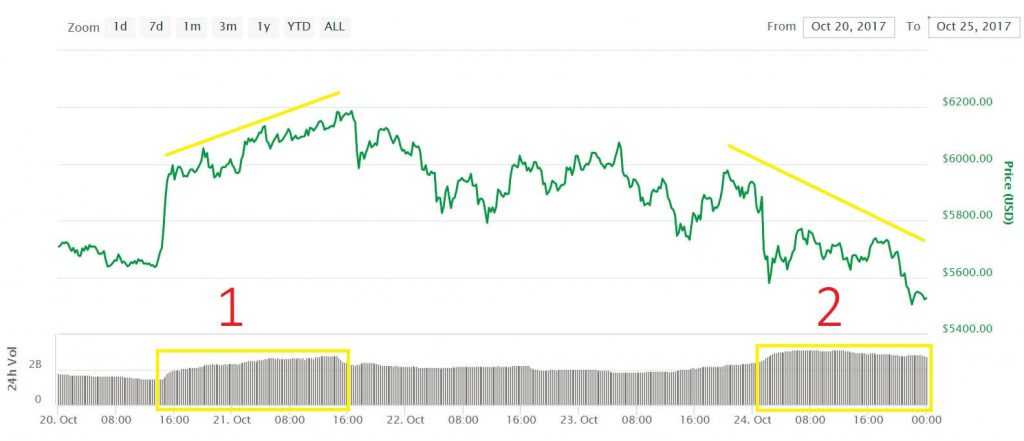

On October 20th, five days before the most recent fork, the price of Bitcoin has reached $6,000 for the first time in history, eventually climbing to $6,200. Suchlike behavior can easily be explained by technical peculiarities of the hard fork. After the split, holders of the original cryptocurrency get an equal number of newly created coins, which can later be sold for an additional profit. A lot of investors, therefore, want to lay their hands on Bitcoin right before the split. The buying pressure, sustained by an upcoming opportunity to capitalize on the post-fork altcoin, drives the price of BTC up.

Alternative blockchains, being the product of the hard fork, can’t usually boast long-term growth potential. They, therefore, are being dumped almost instantly and depreciate in price rapidly due to the sell-off. It applies to Bitcoin Cash and Bitcoin Gold. Demand for Bitcoin, artificially pumped by speculators before the split, goes down as opportunities associated with the hard fork diminish. In the result, the BTC price action returns to the ‘normal’ level.

Those professionally engaged in cryptocurrency activities follow the above-mentioned patterns and don’t miss their chance to profit from this simple, yet highly effective move. Due to the enormous market cap, the price of Bitcoin is hard to shake, still the crypto lost over 3% of its value in a short period after the fork. Presumably, due to whales.

Many investors have accumulated impressive positions in Bitcoin before the most recent fork in order to reap massive capital gains. Due to their coordinated activities, the BTC price action first demonstrated first an increase and then a plunge. Though not 100% accurate, this patter can be used in the future to predict the price of Bitcoin, as well as other major cryptocurrencies before and after the forks.