Gold prices break key technical level indicating a big move is on the way.

Gold Prices Fall Below Support

The price of gold began to correct in early June, in tandem with the ECB policy meeting, and has been falling ever since. Gold prices have fallen below a key support level and are in danger of falling further. Before getting into where gold is going it is important to understand where it was and why. Leading into the ECB meeting gold prices were supported by a perfect storm of market moving events. On the one hand there was shifting ECB and FOMC outlook undermining fundamental reality, on the other fear and flight-to-safety driven by a whirlwind of global politics.

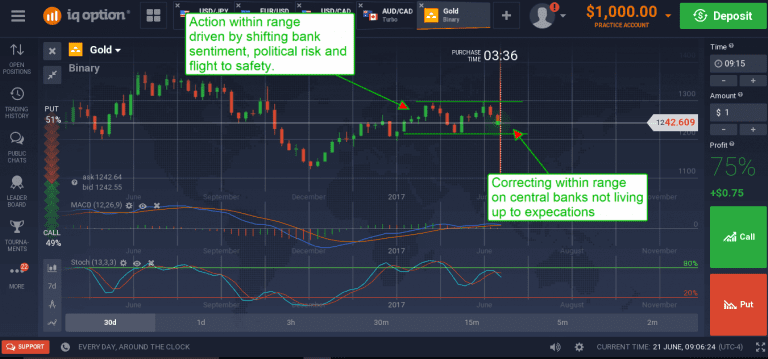

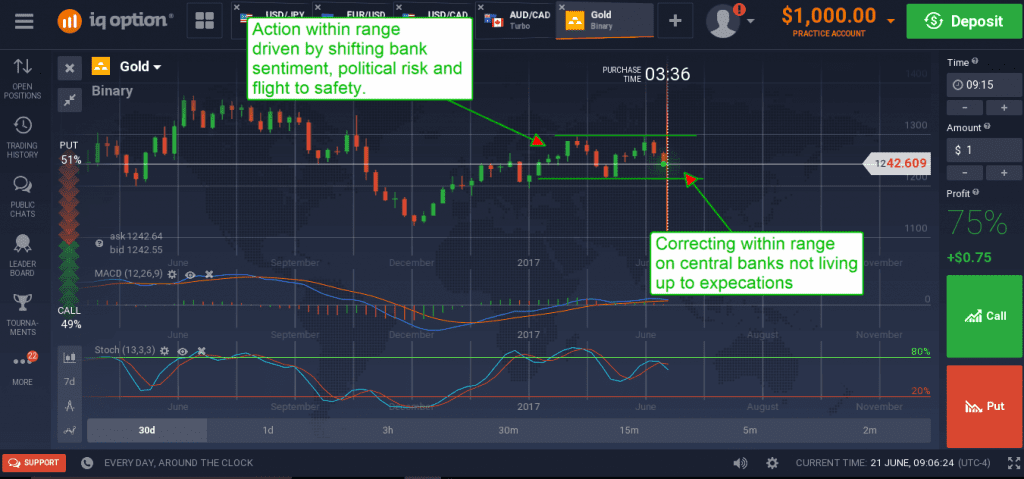

Over the past 3 to 4 months gold prices have been trapped in a trading range between $1,200/$1,220 and $1,300, and well off the lows set last December. December’s low came on aggressively bullish FOMC outlook, hopes for the Trump Agenda and a strong dollar. Price action within the range was driven by political fears and uncertain economic data. Leading into June prices were on the move up as tensions with North Korea mounted, Trump rhetoric had the market on edge, political risk in Europe swelled and tepid data weakened the dollar.

The June Central Bank Cycle

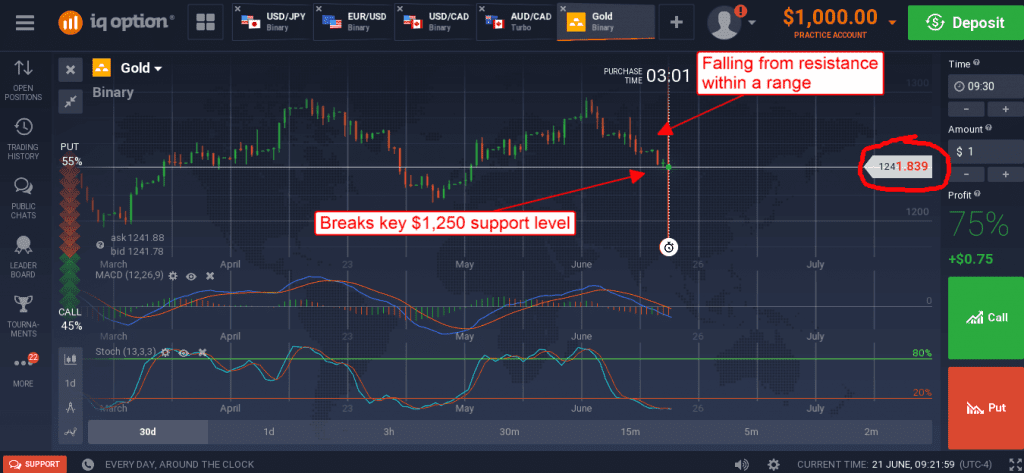

In terms of central bank activity gold was expected to keep moving higher on a weakening dollar. Then came June and what happened? The ECB did not live up to expectations, the FOMC did not live up to expectations, the dollar got its bid back, gold prices fell sharply from resistance and have now broken the key technical support level of $1,250. The $1,250 level has been an important level for gold on both the way up and the way down since the beginning of the year and has been crossed, touched and tested more than 20 times since then. What’s important for traders to note is that each time has resulted in a move up or down to the next target area.

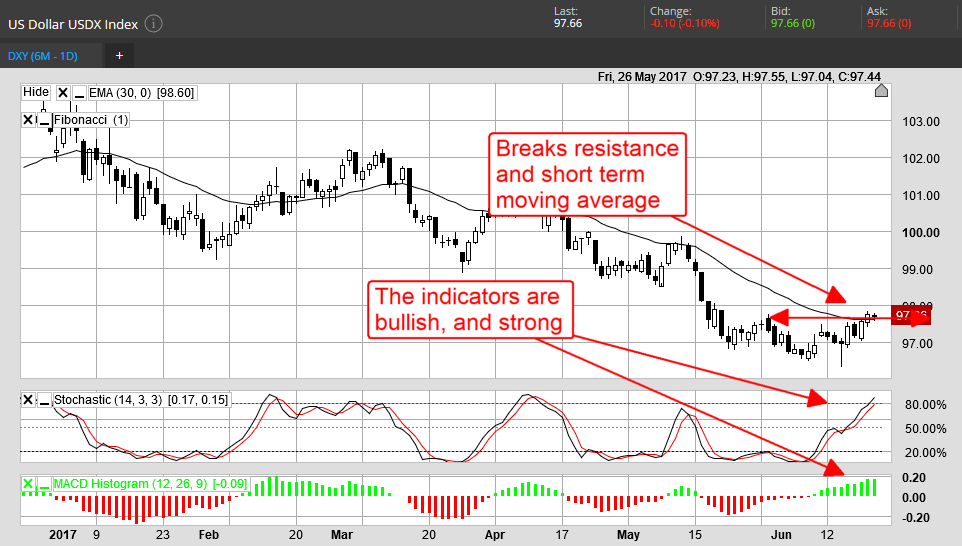

When the central banks were expected to be hawkish (the ECB) and dovish (the FOMC) it created a push/pull effect on the dollar and by extension gold. The euro had been up on hawkishness and was now falling, the dollar had been down on dovishness but was now rising. With this in mind it is a little surprising the Dollar Index didn’t move higher, faster than it did. However, what is important to note hear is that the Dollar Index has broken above a resistance level and appears to be confirming reversal, a move that is also supported by the indicators. So long as the dollar gains strength gold will be under pressure, it may not move lower but it is not likely to move higher either.

Where Will Gold Go Now?

The near term outlook for gold is bearish. On a technical basis prices are set to move lower with only political risk and safety seekers to support them. With elections in the EU largely over, tensions with North Korea and China easing and Trump getting along with the world that support is dubious. Downside targets are in the range of $1,235 to $1,220 over the next two weeks with a move below that possible provided the US data remains consistent with long term economic growth. This week and next are largely void of economic data for the US or the EU, the following week will bring the NFP report.