The last trading session for this week has important economic data related to the Euro, with the release of the Inflation Rate in Italy and in the Eurozone, and several economic releases related to the US economy. Moderate to high volatility is expected for the Euro and the US Dollar, and most probably the EUR/USD currency pair.

These are the main economic events for today to focus on today in the forex market:

European Session

- Italy Inflation Rate, Eurozone Inflation Rate

Time: 09:00 GMT, 10:00 GMT

The Inflation Rate in Italy is expected to decline on a monthly basis, with an anticipated figure of 0.1%, less than the previous figure of 0.3%. Also on a yearly basis the inflation rate for Italy is expected to decline with a figure of 0.6%, lower than the previous figure of 0.9%. This trend is expected also for the Inflation Rate in the Eurozone with a decline on a yearly basis having a figure of 1.2%, lower than the previous figure of 1.3%, but an increase monthly with a figure of 0.2%, higher than the previous figure of -0.9%.

Most importantly the Core Inflation in the Eurozone on a yearly basis is expected to remain stable at 1%. As the Core Inflation is a more conservative measure of Inflation Rate, excluding the volatile prices of food and energy, this indicates that there are not any significant inflationary pressures in the Eurozone for now.

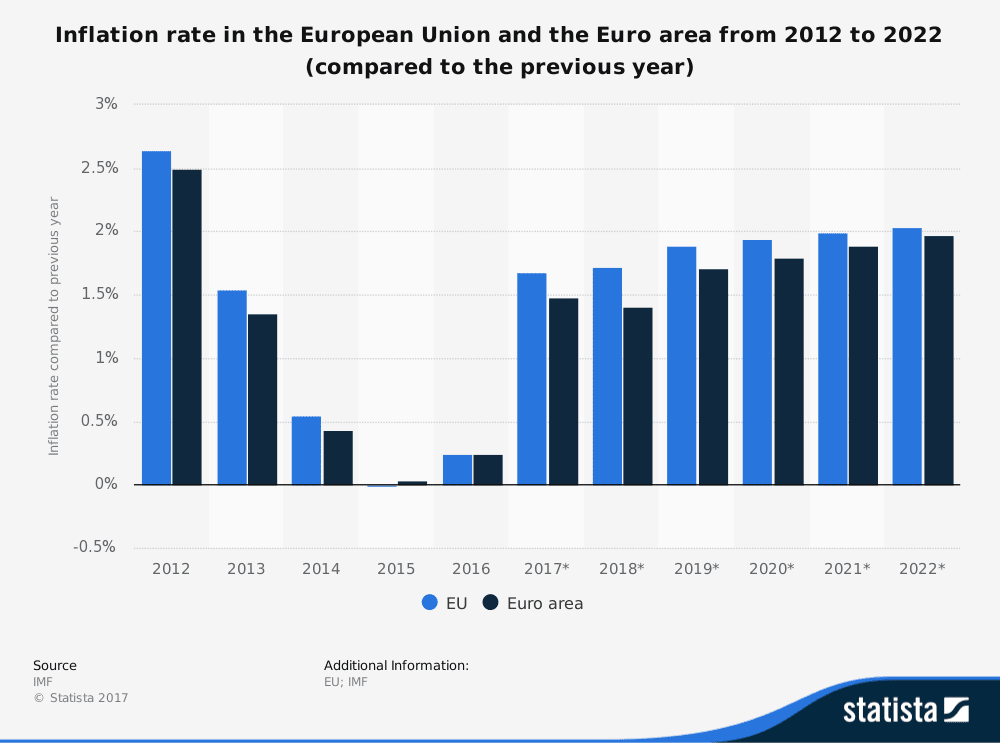

The ECB has mentioned that interest rate increases for 2018 are most probably not an option, so this actually means that the ECB will have not pressure to increase the key interest rate any time soon, which could be considered negative for the Euro. The key driver for the Euro may be the economic growth in the Eurozone. As seen from the chart, the Inflation Rate is expected to increase gradually and reach the level of 1.97% in 2018.

The statistic shows the inflation rate in the European Union and the Euro area from 2012 to 2016, with projections up until 2022. The term inflation, also known as currency devaluation (drop in the value of money), is characterized by a steady rise in prices for finished products (consumer goods, capital goods). The consumer price index tracks price trends of private consumption expenditure, and shows an increase in the index’s current level of inflation. In 2016, the inflation rate in the EU was about 0.24 percent compared to the previous year.

American Session

- Canada Manufacturing Sales, US Building Permits, Housing Starts, Industrial Production, Michigan Consumer Sentiment, JOLTS Job Openings

Time: 12:30 GMT, 13:15 GMT, 14:00 GMT

Higher than expected or rising figures for US Consumer Sentiment, Industrial Production, Housing Starts, Building Permits and Job Openings will be positive for the US Dollar, while increased readings for Manufacturing Sales will be positive for the Canadian Dollar as well, reflecting a strong Manufacturing Sector.

A strong housing market is correlated with a strong economy, so increased readings of Housing Starts and Building Permits are supportive for a strong housing market. The forecasts are for declines for both of the expected figures, but at the same time the Industrial Production is expected to increase both on a monthly and a yearly basis. A mixed economic data for the US Dollar.

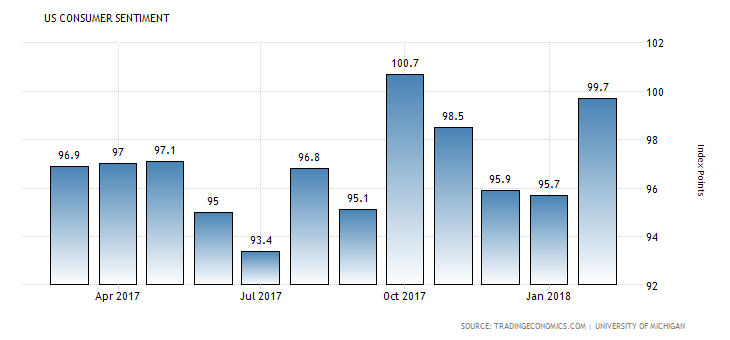

Later on, the University of Michigan’s consumer sentiment figure is expected to decline marginally at the level of 99.3, lower than the previous level of 99.7. Increased figures of consumer sentiment lead to higher consumer spending and higher economic growth. As seen from the chart the Consumer Sentiment figures are volatile, with an undefined trend.

Higher Job Openings will also be supportive and positive for the US Dollar, reflecting a robust labor market, which can lower the Unemployment Rate and contribute positively to economic growth. The forecast if for a figure of 5.8 Million, a marginal decline with the previous reading of 5.811 Million.