A financial year is a 12-month period a business uses for its accounting and tax reporting. It does not have to match the calendar year. Within that time, companies break things down into four three-month blocks called fiscal quarters, often labeled Q1, Q2, Q3, and Q4. These periods act as “checkpoints” for investors and regulators to see how much money a company is making, spending, and keeping as profit.

I spent years working in the fintech sector where regulations are incredibly strict. In that world, making quarterly financial reports was not just a side task. It was a mandatory, high-stakes process that dictated how the entire company operated. I am sharing this experience because understanding these cycles is the best way to see how the global economy actually breathes.

What exactly is a financial year?

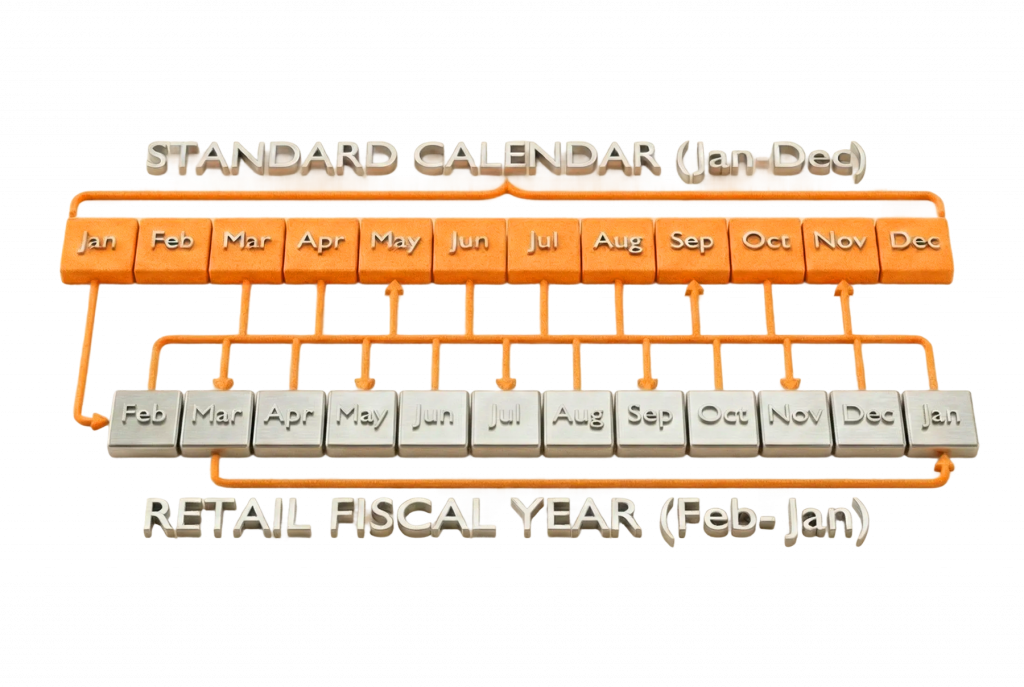

A financial year (often called a fiscal year) is the official “calendar” a company uses to track its money. While most of us think of a year as January to December, many businesses choose a different start date to fit their natural sales cycle. This 12-month stretch is the window used to calculate profits and losses for яtax purposes.

A retail shop might end its year in January. This lets them finish the holiday rush and handle all the gift returns before they have to count their final profits. It is much easier to close the books when the store is quiet rather than in the middle of a Christmas sale.

How do financial quarters work?

Quarters are exactly what they sound like. They are the four “report cards” a company gets every year. Each quarter lasts three months. If a company follows the standard calendar year, the breakdown looks like this:

- Q1: January, February, and March.

- Q2: April, May, and June.

- Q3: July, August, and September.

- Q4: October, November, and December.

In the fintech company where I worked, the end of each quarter was an “all hands on deck” period. We had to verify every single transaction to ensure the reports were perfectly accurate for the regulators. It is a time of high pressure but also great clarity, as you finally see if your hard work actually translated into revenue.

The Strategic Choice: Why companies pick “weird” start dates

Most companies pick a financial year that matches the busiest and slowest times of their business. If you run a company that makes most of its money in the summer, you might want your year to end in the autumn. This allows you to report your biggest wins all at once.

The Apple Example

Apple is a famous example. Their financial year ends in late September. Because of this, their “First Quarter” (Q1) is actually October, November, and December. Since that includes the holiday shopping season, their Q1 is almost always their biggest report of the year.

Educational Institutions

Many universities use a fiscal year that starts in July and ends in June. This aligns with the academic school year. It allows them to keep all tuition and expenses for a single school year within one single financial report.

Agricultural Businesses

Farmers often end their year after the harvest is finished. This makes sense because it’s when they finally have the cash from selling their crops to pay off the debts they took out for seeds and equipment earlier in the year.

Understanding “Earnings Season”

About two to three weeks after a quarter ends, a phenomenon called “Earnings Season” begins. This is when the majority of public companies release their results to the public. During this time, the market becomes very volatile. If a company reports a profit that is even 1% lower than what analysts expected, the stock price can drop significantly.

The Earnings Call

Along with the numbers, companies hold an “Earnings Call”. This is a live conference call where the CEO and CFO talk to investors. In my experience, what they say on these calls is sometimes more important than the numbers. If a company has a bad quarter but explains a brilliant plan for the future, the stock might actually go up.

Global differences in financial years

Not every country or industry follows the same schedule. This can be confusing if you are looking at international companies. Here is a quick look at how different countries typically handle their financial years:

| Country | Typical Financial Year |

| United States | Mostly Jan 1 – Dec 31 (but companies can choose) |

| United Kingdom | April 1 – March 31 (for corporations) |

| Australia | July 1 – June 30 |

| India | April 1 – March 31 |

Note: The UK also has a “tax year” for individuals that starts on April 6th. It is an old tradition that has stuck around for centuries!

How these cycles affect your daily life

You do not have to be an investor for these dates to impact your life. They change how businesses behave.

1. The “End of Quarter” push

If you work in a corporate job, you probably notice the “End of Quarter” stress. Sales teams often offer their best discounts in the last week of a quarter just to hit their numbers. If you are looking to buy a car or software for your business, buying on the last day of a quarter (March 31, June 30, etc.) often gives you the best leverage for a discount.

2. Hiring and Budgeting

Companies often freeze hiring in Q4 if they realize they have spent too much of their budget earlier in the year. Conversely, if a department has a “use it or lose it” budget, you might see them spending a lot of money in the final month of the year to ensure their budget isn’t cut for the following year.

3. Personal Finance and Taxes

Knowing your own country’s tax year helps you plan when to sell stocks or make charitable donations to maximize your tax deductions.

Key Documents: 10-K vs 10-Q

If you want to be a serious investor, you need to know the names of the documents companies file with the government.

- 10-Q: This is the quarterly report. It is less detailed than the annual one and usually isn’t audited by an outside firm. It gives a “snapshot” of the company’s health.

- 10-K: This is the big annual report. It is highly detailed and must be audited by an independent accounting firm to prove the numbers are real. It includes the company’s history, organizational structure, and a deep dive into any risks they face.

The 4-4-5 Calendar: A Retail Secret

Some companies use a very specific accounting trick called the 4-4-5 calendar. Instead of standard months, they break their quarters into two 4-week months and one 5-week month.

Why do they do this? Because it ensures that every quarter has exactly 13 weeks and always ends on the same day of the week (like a Saturday). This makes it much easier to compare “this year’s sales” to “last year’s sales” because the number of weekends in the period is exactly the same. In the world of retail, where Saturday is the biggest sales day, this accuracy is vital.

Conclusion

Understanding financial years and quarters is like learning the rules of a game. Once you know them, the business world starts to make a lot more sense. You’ll understand why your company is acting a certain way in March, or why a certain stock suddenly became a hot topic in October.

The next time you hear an “earnings report” on the news, don’t just tune it out. Remember that those numbers represent three months of hard work, stress, and strategy from thousands of people.