Fastenal (FAST) Stock Company is a Minnesota-based distributor of industrial, safety, and construction supplies. The company offers a whole range of business services, among which are inventory management, manufacturing, and tool repair. The corporation has over 2600 branches and 13 distribution centers throughout the US, Canada, Mexico and Europe.

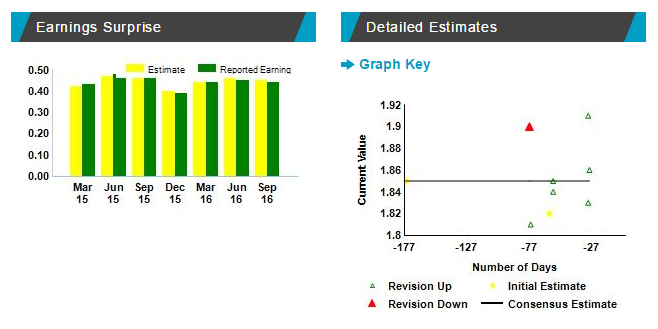

Fastenal is expected to report earnings on 12 April 2017 before the opening bell. The consensus EPS forecast for the quarter is $0.46. The reported EPS for the same quarter last year was $0.44. Investors can capitalize on this event with the help of classic options.

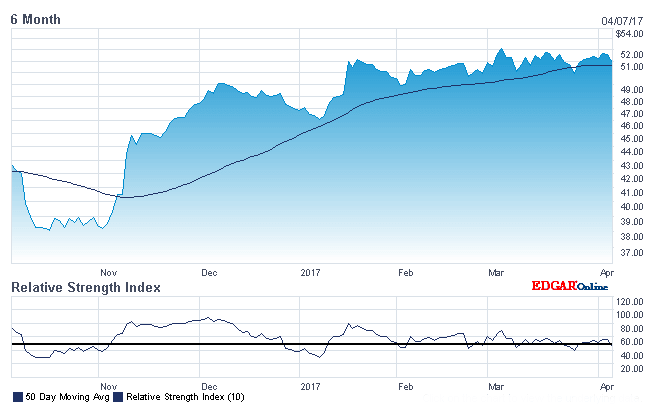

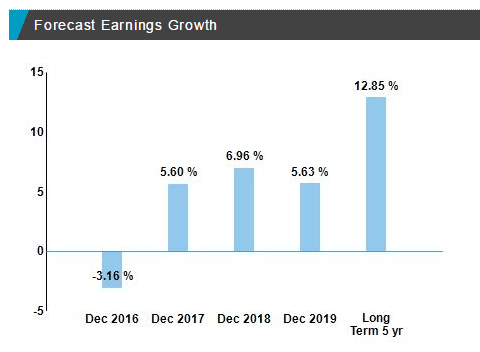

In the past six-month period, Fastenal outperformed the Building Products — Retail/Wholesale industry. C-level management believes that the company has all the chances of increasing margins in the upcoming periods with the help of cost-saving initiatives, Pathway-to-Profit program and sales of executive brands.

We will know whether the stock prices are expected to go up or down after taking a closer look at company’s performance and recent news.

Reasons to invest in Fastenal

Despite volatility spikes and controversial stock price movements in December 2016 — January 2017 Fastenal’s shares gained 27.7% in the last six months. By comparison, the Building Products — Retail/Wholesale industry witnessed much more modest 8.7% growth. Estimates of the company’s profitability for the current quarter moved up during the last 60 days. Stock performance is stimulated by installations of numerous vending machines and Pathway-to-Profit initiative. According to the management, the company is in “a stable margin environment”. If the company is able to defend its margins, price action will respond with positive dynamics.

Born as a fastener producer, the company has grown over time to become a full-scale industrial supplier. Diversification itself does not always mean growth. However, it is usually connected with new opportunities, that can be turned into profit. Another good reason to diversify operations and assets is reduced risks as the company relies on one narrow source of income no more. In case of Fastenal not only the product range is being diversified. The company is constantly working on adapting its corporate structure to the ever-changing business needs. Thus, national account, government sales, and internet sales teams have been introduced.

Those who believe that industrial supply industry is rusty and old-fashioned will be proved wrong. In 2007 Fastenal has adopted the so-called FAST Solutions, a revolutionary vending process with a potential to change the industry and provide the company with additional profits. Instead of attracting additional customers to their brick-and-mortar stores Fastenal installs vending machines at clients’ facilities and keeps them filled with essential products. Vending machines provide customers with in-depth statistics on their consumption, helping analyze and reduce inventory and administrative costs. Thanks to the program sales of non-fasteners grew 5% in the first three quarters of 2016 and almost 6% during the last quarter of the same year. Safety supplies sales are growing, systematically increasing their share in the company’s top line by one percentage point for three consecutive years (equal to 15.3% of total sales in the fourth quarter of 2016).

Introduced in 2007, the Pathway-to-Profit cost-cutting campaign emphasizes increased average store size, that increases company’s pre-tax margins.

Warning signs

Several headwinds have to be considered before investing in Fastenal. First of all, the top line of the company remained soft since 2015. One of the possible reasons for this is volatile oil and gas industry. The latter accounts for 20–25% of Fastenal’s overall sales and therefore can seriously hamper company’s revenue.

The company has been making an emphasis on low margin products lately, which negatively affects the gross margin. In 2013, the indicator was equal to 51.7% but dropped to 49.3% by the third quarter of 2016. This issue clearly has to be addressed by the company’s management.

Daily growth rate of fastener products sales have declined. Fasteners tend to possess higher margin than non-fastener products, offered by the company. This fact, in turn, makes the product mix unfavorable and, as stated above, diminished the gross margin.

What can we expect?

The biggest concern for potential investors should be optimal entry points due to high stock volatility during the previous quarter. A patient investor might want to choose the moment when the price reaches a local minimum and then enter the market. Increased volatility before the report publication poses a threat even in case of a successful forecast.

Overall the outlook is moderate to positive for Fastenal shares as the company continues to grow steadily and introduce innovative decisions to the industry. Most experts believe that unless any negative news comes out, FAST shares can appreciate in the very beginning of the trading session on 12 April 2017.