The Euro (EUR) extended downside movement against the US Dollar (USD) on Thursday, dragging the price of EUR/USD to less than 1.0550 ahead of the ECB’s monetary policy announcement. The technical bias remains bearish because of a lower high in the recent upside rally.

![]()

How to Trade today’s ECB Monetary Policy?

- Buying EUR/USD put options above the aforementioned support levels can be a good strategy if Draghi paints unfavorable picture about the Eurozone’s economy.

- Alternatively, buying EUR/USD call options above the aforementioned resistance levels can be a good strategy if he hints at potential rate hike in coming months.

Technical Analysis

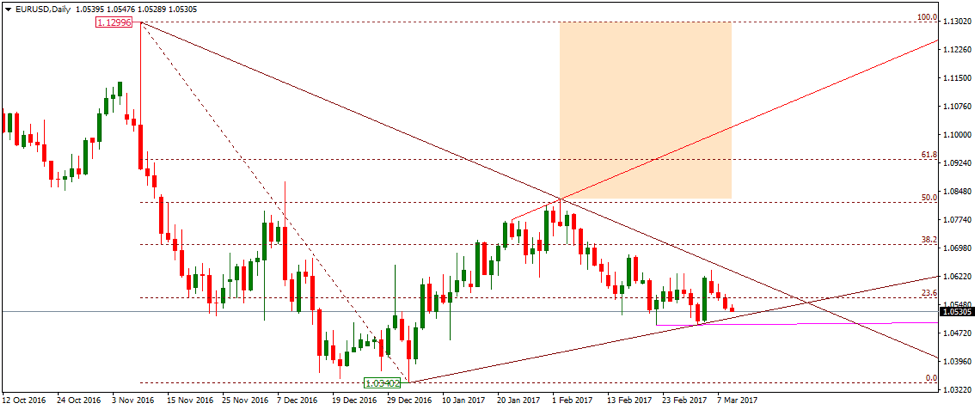

As of this writing, the pair is being traded around 1.0530. A support may be seen near 1.0514, the trendline support area as demonstrated in the given below daily chart with brown color. A break and daily closing below the 1.0514 trendline support shall incite renewed selling interest, validating a move towards the 1.0400 support zone which is a psychological number.

On the upside, the pair is expected to face a hurdle near 1.0630, the trendline resistance area ahead of 1.0819, the 50% fib level and then 1.0990, the upper trendline resistance as marked with red color in the above chart. The technical bias shall remain bearish as long as the 1.0819 resistance zone is intact.

ECB Monetary Policy

The European Central Bank (ECB) is due to announce its monetary policy today. According to the average forecast of different economists, the central bank is expected to keep its benchmark interest rate unchanged at 0%. The deposit rate is also likely to be unchanged at -0.4%, the forecast says. The interest rate decision will be followed by the monetary policy press conference. Investors will monitor the press conference very closely to gauge the future policy decisions about the ECB’s quantitative easing program.

How EUR/USD Reacted to ECB Monetary Policies In Past?

ECB has been maintaining its benchmark interest rate at 0.0% since March, 2016. Same is the case with the deposit rate. So the EUR/USD pair didn’t show any extreme volatility after the release of last few monetary policies. The pair however does show moderate level volatility after the ECB press conference. Mario Draghi’s remarks about the current economic outlook always incite sharp price movement in the pair.